The Vanguard S&P 500 ETF (VOO +0.06%). It’s a name that rolls off the tongue like a particularly smooth dwarfish ale. And, like a well-made ale, it’s generally a good thing. It’s been accumulating wealth for folks for quite some time, a steady drip-drip-drip of returns that, frankly, many investment schemes can only dream of. But, as any seasoned gambler – or, indeed, any wizard dealing with probability – knows, even the most reliable spell can occasionally fizzle. And right now, there’s a little fizzing going on.

We’re told it’s a ‘safe’ investment. Safe is a relative term. Compared to, say, investing in trained carrier pigeons delivering miniature scrolls containing stock tips? Yes, considerably safer. But the market, bless its chaotic heart, is rarely predictable. It’s more like a particularly opinionated dragon; you can think you understand its patterns, but it’ll happily incinerate your assumptions just to prove a point.

Why It Still Isn’t Entirely Rubbish

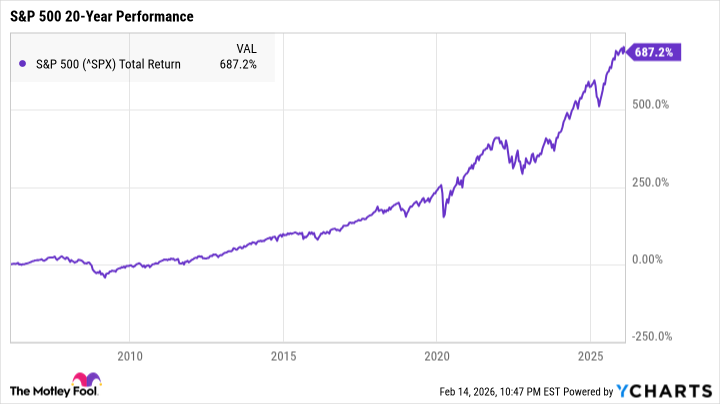

The S&P 500, the thing VOO diligently shadows, has a history. A long history. A history of not entirely collapsing, even when faced with things designed to make it collapse. Recessions, bear markets, the occasional rogue comet… it’s shrugged them all off. It’s not immune, mind you. Just… remarkably resilient. Analysts at Crestmont Research – a guild of number-crunchers I suspect uses enchanted abacuses – have discovered that even over twenty-year stretches, it’s managed to deliver positive returns. Every single one. Which, when you consider the sheer randomness of existence, is frankly astonishing.

The reason? It’s built on solid foundations. Five hundred of the largest, most established companies in the United States. These aren’t fly-by-night operations run by goblins with get-rich-quick schemes. They’re companies that have, for the most part, figured out how to stay in business for a considerable period. A high bar to entry, indeed. And, historically, a fairly reliable indicator of future success. Though, one must always remember that history is written by the survivors.1

And the potential rewards? Not insignificant. Since 1957, the S&P 500 has averaged around 10% per year. Put in $200 a month, and after thirty years, you could find yourself with around $395,000. Which, depending on your local currency and the price of dragon scales, is a substantial sum.

The Slightly Uneasy Bit

Now, here’s where things get a little… asymmetrical. VOO, like most index funds, is ‘market-cap weighted’. Meaning, the bigger the company, the more of it you own. Seems sensible enough. Except, in recent years, a few companies have grown… rather large. Specifically, technology companies. And they’re not just large; they’re becoming disproportionately dominant.

Currently, tech stocks account for over 34% of VOO. Nvidia alone makes up nearly 8%. Apple and Microsoft aren’t far behind. It’s like building a castle on the back of a particularly enthusiastic unicorn.2 It might work beautifully… or the unicorn might decide to take a stroll. And when it does, your castle goes with it.

Tech stocks can be lucrative. They’ve been a major driver of VOO’s recent performance. But if you’re choosing this investment because you’re seeking ‘safety and stability’, you might be in for a bit of a jolt if the tech sector hits a rough patch. It’s a concentration of risk, a precarious balancing act. A perfectly good index, mostly. But one that requires a little… awareness.

Over the long haul, VOO is likely to deliver positive returns. It has a strong track record, and the underlying companies are, for the most part, solid. But that heavy tech focus introduces a degree of volatility that investors should be aware of. It’s a little like expecting a calm sea voyage on a ship powered by a very enthusiastic, and occasionally unpredictable, magical engine.

- Historians, naturally, are the ones doing the surviving. A point often overlooked.

- Unicorns, while majestic, are notoriously fickle creatures. Best not to rely on them for structural support.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 11:32