As a seasoned researcher with over two decades of experience in the financial markets, I find Strive’s Bitcoin Bond ETF proposal intriguing and potentially game-changing for retail investors seeking indirect exposure to Bitcoin. The strategy is reminiscent of MicroStrategy’s approach, which has yielded impressive returns for its shareholders.

Vivek Ramaswamy’s company, Strive Asset Management, is planning to introduce an Exchange Traded Fund (ETF) designed to purchase convertible bonds from MicroStrategy and other businesses that own Bitcoin.

The firm has filed an application with the SEC on December 26.

Bitcoin’s Demand Continues to Grow Among Retail Investors

As per the documents, the ETF intends to provide investors with access to “Bitcoin-backed Securities,” these being debt instruments issued by firms such as MicroStrategy, which utilize the funds for purchasing Bitcoin.

Strive will actively manage the ETF, investing directly in these bonds or using financial products like swaps and options. The asset management firm was founded by republican politician Vivek Ramaswamy back in 2022.

In November, he collaborated with Elon Musk on Tesla founder’s project, the Department of Government Efficiency (DOGE), an independent endeavor aimed at decreasing unnecessary government expenditure. Yet, its resemblance to the top meme cryptocurrency DOGE has persistently caused fluctuations in the market.

Vivek’s ETF business has submitted an application for a Bitcoin Bond ETF, which will be linked (via swap agreements) to convertible bonds intended for purchasing Bitcoin. In essence, it functions like a Microstrategy convertible bond ETF until other companies adopt similar strategies, as stated by ETF analyst Eric Balchunas on platform X (previously known as Twitter).

During Trump’s presidency, there is anticipation that additional cryptocurrency ETFs will receive approval from the industry analysts. Just recently, the Securities and Exchange Commission (SEC) gave the green light to two Bitcoin and Ethereum ETFs from Hashdex and Franklin Templeton.

The Bitcoin Bonds ETF proposed by Strive might provide a distinctive financial instrument, allowing individual investors eager to invest in Bitcoin an opportunity to do so.

The Bitcoin Therapist stated that Elon Musk’s lack of comment on Bitcoin since the election, along with news regarding Vivek’s Bitcoin Bond ETF application, has made them almost certain about a strategic US Bitcoin reserve. It seems like the day one scenario is still possible. Events seem to be in motion that cannot be reversed.

MicroStrategy’s Stock Shows Pararrell Demand to Bitcoin

The concept of a Bitcoin Bond ETF is lucrative because it provides indirect exposure to MicroStrategy’s Bitcoin acquisition benefits.

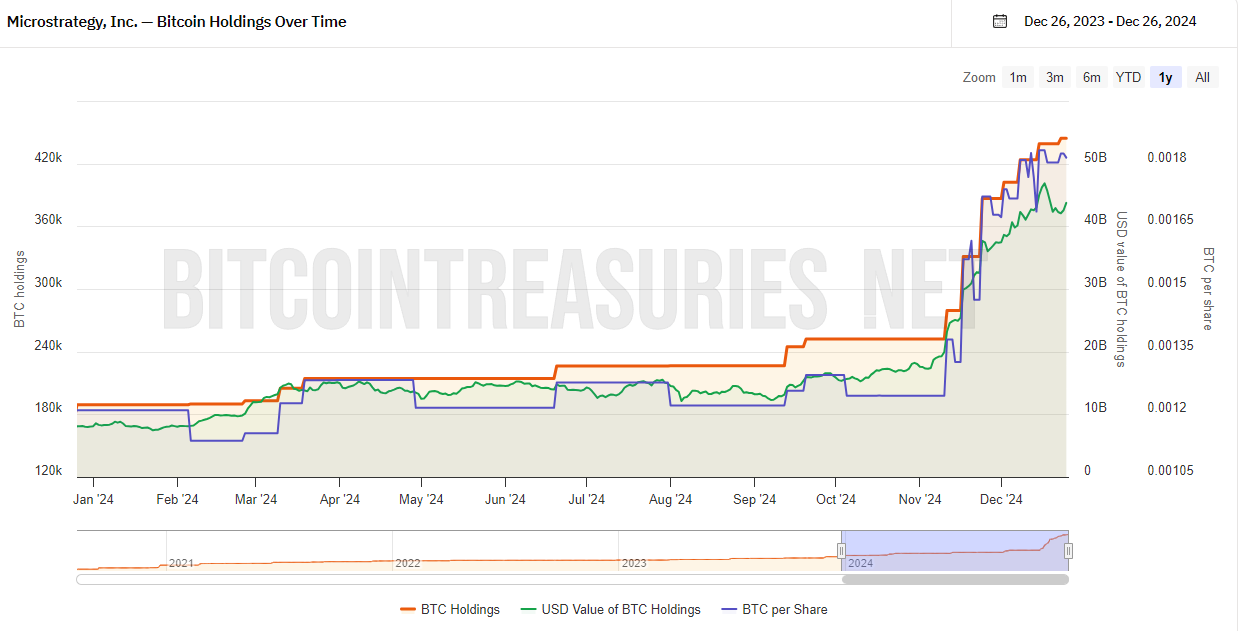

Starting from the year 2020, under the leadership of Michael Saylor, MicroStrategy has invested more than $27 billion in purchasing Bitcoin. As a result, this action has significantly increased their stock price by approximately 2,200%.

Throughout 2024, the company significantly increased its Bitcoin acquisitions. In fact, during December, MicroStrategy purchased more than $4 billion worth of BTC. This buying spree occurred when the cryptocurrency was consistently priced above $95,000.

Furthermore, the robust growth of Bitcoin in 2024 appears to have positively impacted MicroStrategy’s stock price. In fact, the company’s shares skyrocketed by nearly 400% this year, positioning it as one of the top 100 publicly traded companies.

Simultaneously, this achievement paved the way for the stock’s addition to the Nasdaq-100 index. Moreover, there’s a promising prospect for its inclusion in the S&P 500 within the next year.

MicroStrategy finances its Bitcoin acquisitions by selling new company shares and offering convertible bonds. The convertible bonds either carry minimal or no interest, but they can be exchanged for MSTR stocks.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-27 01:56