The matter of Visa, a name echoing through the corridors of global exchange, has occupied my reflections for some years. Not as a mere instrument of commerce, but as a peculiar instance of recurring value – a labyrinth of transactions yielding, with a predictable inevitability, a certain yield. One accumulates shares, not with the gambler’s hope, but with the cartographer’s steady hand, charting a course through the ever-shifting landscapes of the market. The accumulation is slow, deliberate—a mirroring of the compound interest itself.

The recent fiscal cycle – 2025, as the chronologists insist on labeling it – presented a modest ascent, a mere eleven percent, shadowed by the broader S&P 500’s sixteen and four-tenths. Such fluctuations, however, are the ephemera of the market, the illusory shadows within Plato’s cave. The true measure lies in the underlying architecture, the inherent logic of the system.

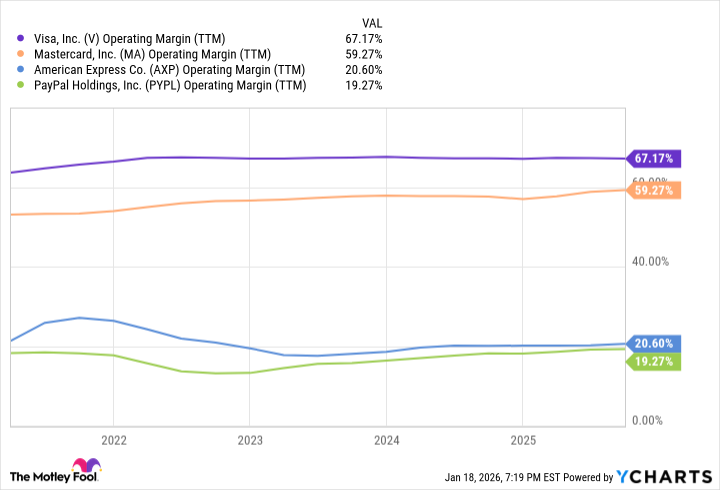

The Geometry of Margins

Visa does not, strictly speaking, issue the cards that populate our wallets. It is the architect of the network, the invisible infrastructure upon which these instruments of exchange operate. This detachment from direct credit risk—the avoidance of lending and the attendant anxieties—is not merely prudent; it is elegant. The network, once established, requires only the maintenance of its boundaries—cybersecurity, a perpetual vigilance against the incursions of the unreal, and the subtle persuasion of marketing—to continue generating value. The resultant margins are, by any measure, exceptional—a testament to the power of indirect influence.

The Perpetual Gift

The operation of Visa resembles a self-perpetuating engine, fueled by what might be termed the “network effect.” The more participants—cardholders and merchants alike—become entangled in its web, the more valuable the network becomes. A merchant, hesitant to accept this particular form of exchange, risks exclusion—a diminishing of potential transactions, a self-imposed exile from the flow of commerce. It is a subtle coercion, yet remarkably effective.

Each new cardholder, each accepting vendor, reinforces the value of the entire system—a virtuous cycle, reminiscent of the infinite reflections within a pair of facing mirrors. The system does not merely grow; it replicates itself, expanding into new territories of exchange.

The Flow of Digital Currents

The increasing prevalence of digital transactions, a phenomenon reshaping the very fabric of commerce, naturally benefits Visa. Each exchange, each digital current flowing through its network, represents a potential revenue stream. And the cross-border transactions—those journeys across national boundaries, requiring the conversion of currencies and the navigation of complex regulations—yield an even greater return. It is as if the network itself possesses a thirst, constantly seeking out new avenues for expansion.

In the aforementioned cycle of 2025, total payment volume experienced a rise of eight percent, while cross-border volume surged by thirteen. Revenue reached forty billion—an increase of eleven percent. The numbers, while impressive, are merely symptoms of a deeper principle—the inexorable flow of value through a well-designed system.

Visa, for some time now, has functioned as a reliable source of income. However, its future prospects appear even more promising—the emergence of Visa Direct, the exploration of B2B payments—all suggest a continued trajectory of growth, even for an entity of its considerable size. It is a system that does not merely adapt to change; it anticipates it, shaping the very landscape of commerce to its advantage.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 22:33