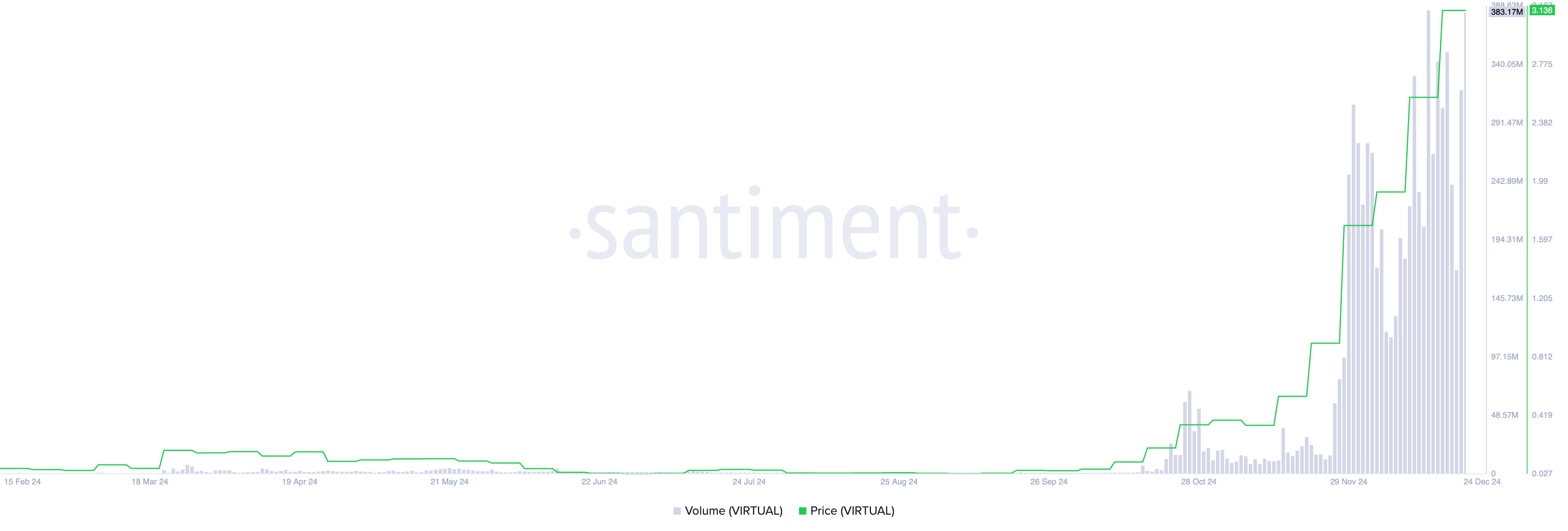

As a seasoned analyst with over two decades of market experience under my belt, I must admit, the 24% surge in VIRTUAL‘s value in just 24 hours has caught my attention. The remarkable rise in its daily trading volume to an impressive $383 million is a clear bullish indicator that this altcoin might be on an upward trajectory.

As an analyst, I’m observing a significant surge in the value of VIRTUAL, the digital token that underpins the decentralized platform for AI agent creation, Virtuals Protocol. In just the past 24 hours, this token has soared by an impressive 24%. This robust rally has catapulted VIRTUAL to the peak of the list of top performers during the analysis period.

The increased activity in VIRTUAL’s virtual trading, marked by a significant boost in daily transactions, points to a growing curiosity and desire for the digital coin. It implies that this upward trend could persist.

VIRTUAL Sees Rise in Demand

The 24% surge in VIRTUAL’s value has been driven by a 109% spike in daily trading volume over the past 24 hours, reaching an impressive $383 million within that timeframe. This is a bullish indicator, signaling that the altcoin is poised to extend its gains.

When an asset’s price rises in tandem with its transactional activity, this typically signifies robust market curiosity and elevated engagement with the asset. This situation implies that a substantial number of buyers are contributing to the price surge, increasing the likelihood that the growth will persist.

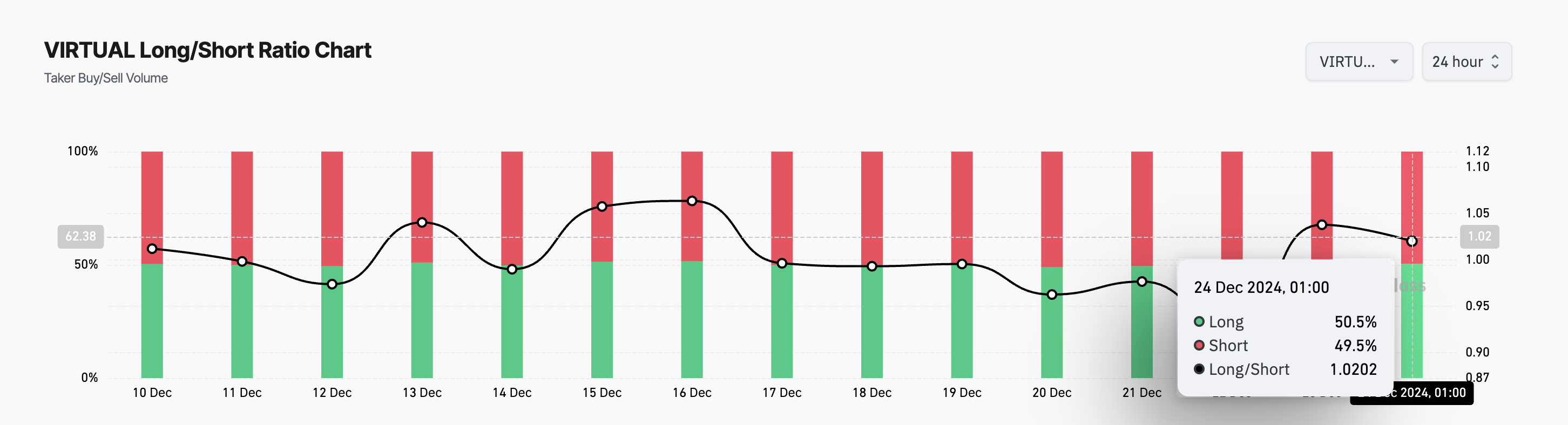

Additionally, the Long/Short Ratio of VIRTUAL, as reported by Coinglass, lends credence to the bullish perspective. Currently, this ratio stands at 1.02, suggesting that there is more interest in long positions compared to short ones, indicating a higher demand for the asset.

In simpler terms, when an asset’s Long/Short Ratio exceeds 1, it means there are more investors betting on the asset’s price increase (long positions) than those betting on a decrease (short positions). This excess demand for long positions suggests that traders have a positive outlook regarding the asset’s future price direction, indicating optimism.

VIRTUAL Price Prediction: The 20-day EMA Is Key

Currently on the daily chart, VIRTUAL’s trades hover slightly below its record peak of $3.32, a level last seen on December 16. This follows a rebound from the support provided by its 20-day Exponential Moving Average (EMA) at $2.31 during yesterday’s trading session.

This key moving average tracks the average price of an asset over the last 20 days, giving more weight to recent prices for better trend analysis. When an asset bounces off the 20-day EMA as support, buyers are defending this level, reinforcing a bullish trend. If this support level continues to hold, VIRTUAL could reclaim its all-time high and rally past it.

If the mood in the market changes and the VIRTUAL token drops beneath its 20-day Exponential Moving Average (EMA), it might potentially decrease towards $1.11.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-24 14:20