As a seasoned crypto investor with over a decade of experience in this wild and ever-evolving market, I must admit that the current surge in VIRTUAL price has piqued my interest. Having witnessed countless bull runs and bear markets, I’ve learned to read between the lines of technical indicators like RSI and BBTrend.

The RSI reading of 67.7 suggests that while the intense buying pressure might have subsided a bit, the bullish momentum remains strong. It’s akin to a marathon runner who has crossed the halfway point but still needs to conquer the second half. The key here is to stay cautious and keep an eye on the price action for any signs of overbought conditions creeping in.

The BBTrend, on the other hand, indicates a modestly positive but weak trend. It’s like a car that has just left the starting line but hasn’t quite picked up speed yet. The market sentiment isn’t fully bearish, but it’s not strong enough to drive a significant rally either.

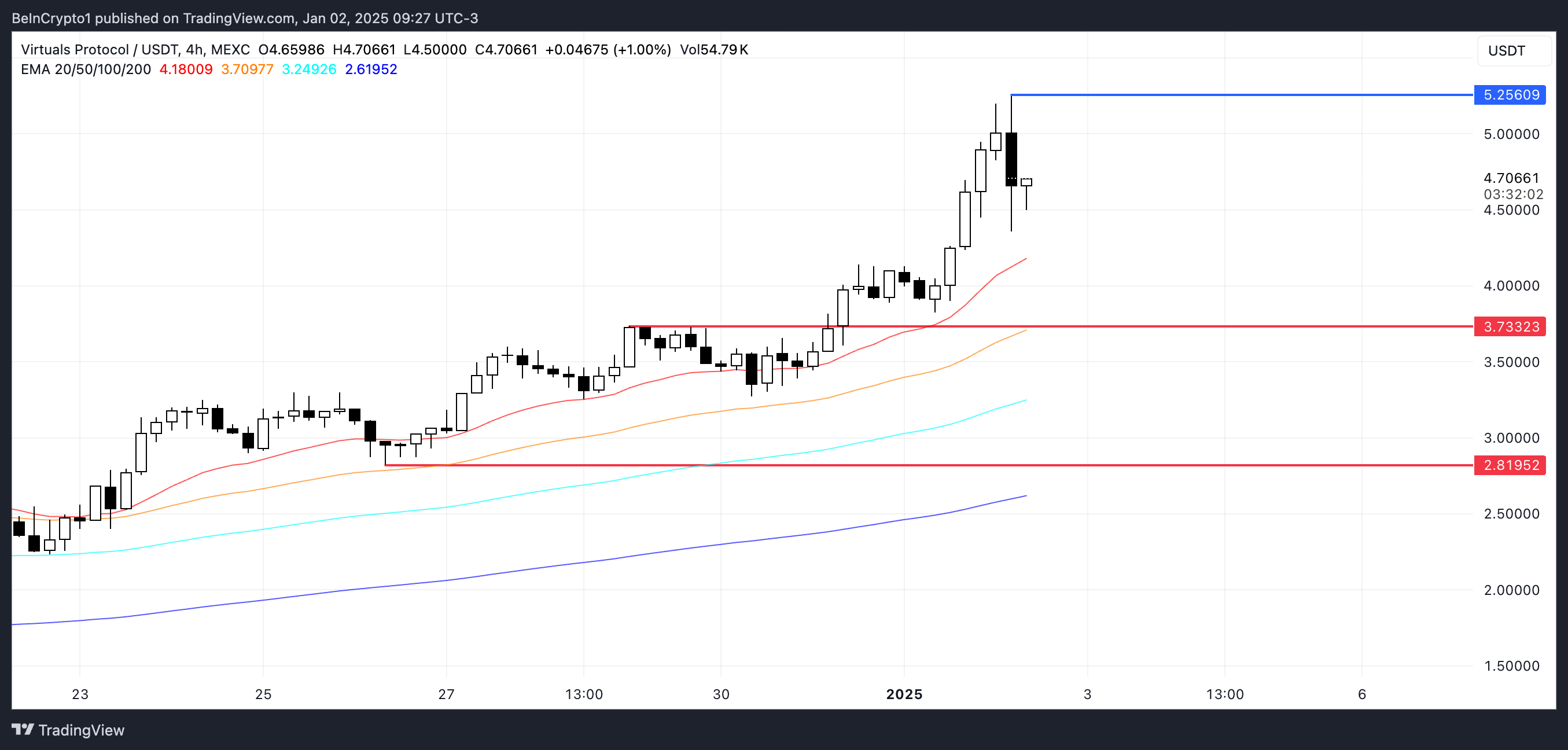

As for the price prediction, I’m cautiously optimistic about VIRTUAL reclaiming the $5 level. If the current uptrend strengthens, we could be looking at higher targets around $5.25. However, if the correction I sense is imminent, we might see a test of the support level at $3.73. As always in crypto, the market can be as unpredictable as a roller coaster ride at an amusement park.

And now, to lighten the mood, let me share a little joke: Why don’t we ever tell secrets on the crypto market? Because it’s full of price action!

As an analyst, I’m observing a significant surge of approximately 15% in the value of the virtual coin over the last 24 hours. The buzz surrounding AI agents seems to be intensifying, fueling this upward trend. Over the past few weeks, this digital asset has been setting new peak prices, with its value exceeding $5 for the first time on January 1, 2025.

Although technical indicators such as RSI and BBTrend indicate that the market is still bullish, some signs hint at potential resistance. The direction of VIRTUAL’s price trend in the near future will decide whether it regains its previous high of $5 or experiences a drop to significant support levels like $3.73.

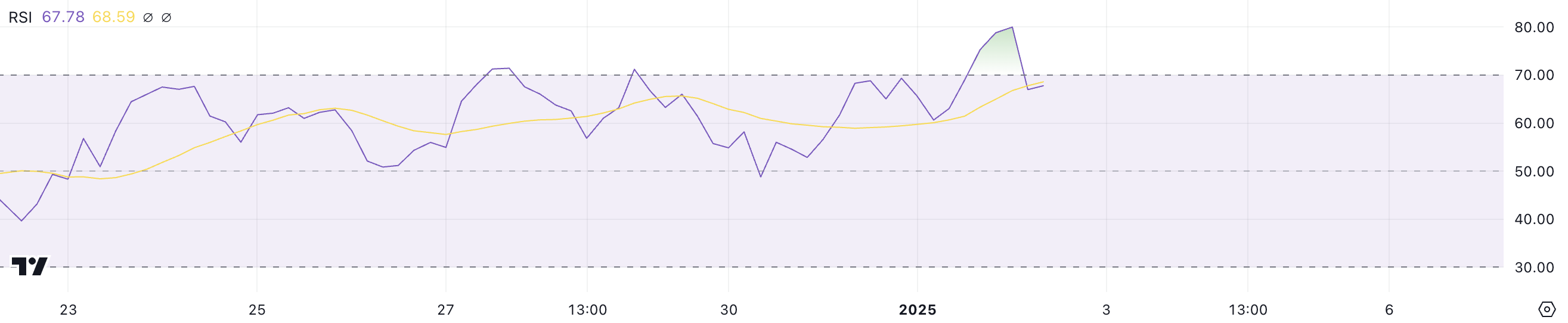

VIRTUAL RSI Is Close to Overbought

As an analyst, I’ve observed a noticeable dip in the Virtual Relative Strength Index (RSI), which has moved from a high of 80 to the current level of 67.7. This downturn suggests a decrease in the extreme buying pressure, yet it doesn’t necessarily mean that the bullish momentum has waned. The persistent hype surrounding artificial intelligence within the crypto market appears to be maintaining its strength, keeping the overall positive trend intact.

In simpler terms, with an RSI (Relative Strength Index) of 67.7, VIRTUAL is nearly reaching the overbought threshold of 70, which indicates that the asset is still in a bullish trend but could soon encounter resistance and require careful monitoring as it gets closer to this point.

The Relative Strength Index (RSI) is a tool that gauges how quickly and powerfully prices are changing, ranging from 0 to 100. Readings exceeding 70 signal overbought situations, which could lead to a price decrease or pullback. On the flip side, readings below 30 indicate an oversold market, potentially indicating a future recovery.

With the Relative Strength Index (RSI) standing at 67.7, this indicates that there might be potential for further short-term growth in the price of VIRTUAL. However, if the RSI rises again and enters the overbought territory, it could lead to an increase in selling activity.

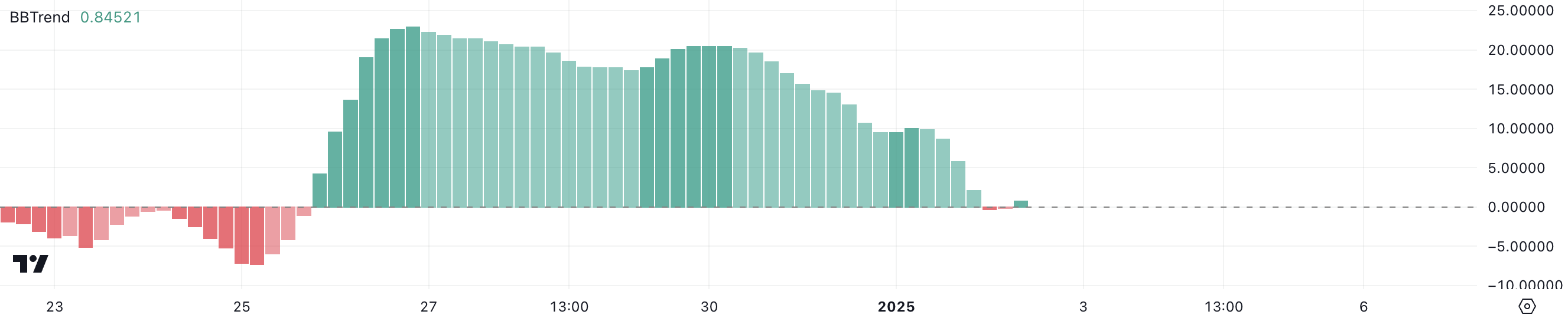

VIRTUAL BBTrend Sits Below Recent Levels

From December 25 through January 1, the VIRTUAL BBTrend showed a robust and favorable trend, peaking at 22.9 on December 26. However, the indicator switched to negative on January 2, falling to -0.34 before experiencing a slight recovery, now sitting at 0.48.

This change implies that although the strong buying activity has lessened, the return to a positive trend could suggest that the intense selling might be slowing down. This could potentially lead to a period of short-term stability.

The BBTrend, which is based on Bollinger Bands, shows the intensity and direction of a market trend. A positive value means an upward trend, while a negative value points to a downward trend. Currently, VIRTUAL’s BBTrend stands at 0.84, indicating a relatively strong but weak uptrend. This suggests that although the market sentiment is not yet fully bearish, it lacks the power to trigger a substantial rally.

Based on my experience as an investor, I’ve noticed that markets can be unpredictable and fickle, especially in the short term. In this particular case, it seems that the price of VIRTUAL might consolidate or see limited growth for now. This is because the momentum isn’t strong enough yet to establish a clear trend direction. However, if stronger momentum develops, I believe we could see a more pronounced upward movement in the future. As always, I recommend conducting thorough research and staying informed about market conditions before making any investment decisions.

VIRTUAL Price Prediction: Will It Recover $5 Levels?

Over the last several days, the price of VIRTUAL has reached unprecedented peaks, breaking through $5 for the initial time on New Year’s Day, 2025.

Should the ongoing upward trend grow stronger, it’s plausible that the value of VIRTUAL could surpass the $5 mark again and even challenge objectives around $5.25, suggesting persisting bullish energy. If this happens, it would solidify VIRTUAL’s status as the leading AI cryptocurrency in the market.

According to BBTrend analysis, the present upward trend appears weaker, suggesting a potential reversal. If such correction occurs, VIRTUAL’s price might dip to test the support at $3.73. If this level is breached, a more pronounced drop toward $2.81 could follow.

Read More

2025-01-03 00:07