The price of Virtuals Protocol (VIRTUAL) has soared by an astounding 133% over the last month due to the escalating hype around AI-based cryptocurrencies. However, it’s worth noting that VIRTUAL experienced a slight downturn of 6% in the last day, indicating a possible slowdown in its price surge.

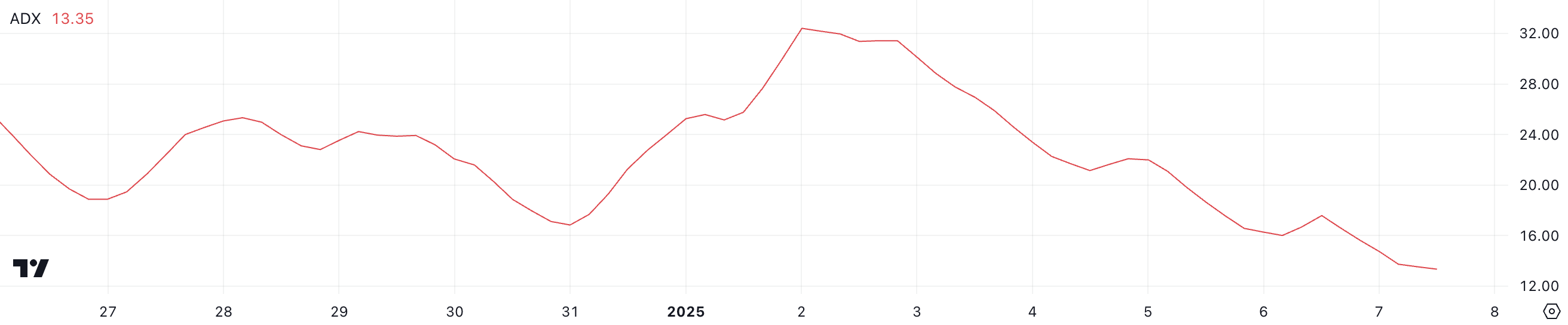

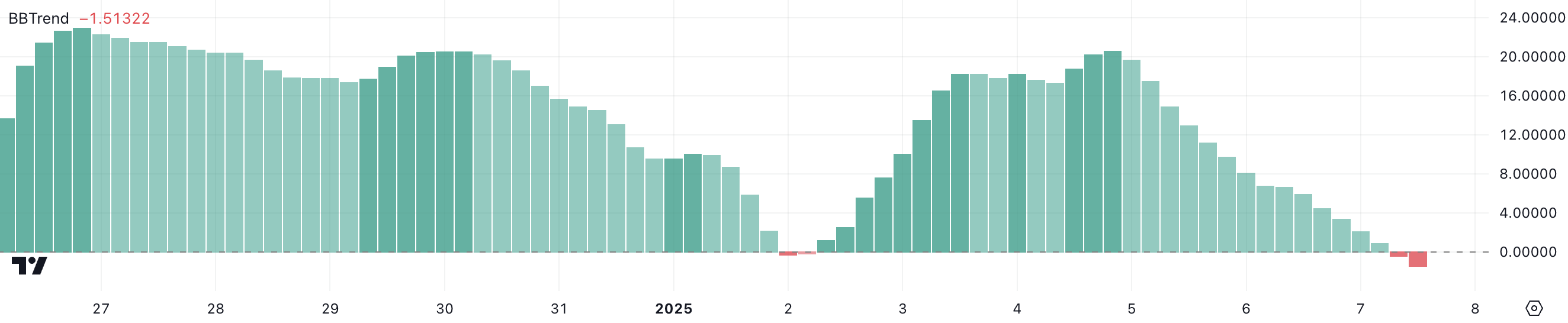

At present, VIRTUAL holds a market capitalization of $4 billion, making it the third-largest AI coin in circulation, following RENDER and TA technologically advanced currencies (TAO). Its ADX stands at 13.3, suggesting a weaker trend strength, while its BBTrend has flipped to -1.51, hinting at a potential consolidation period. This leaves investors wondering about VIRTUAL’s future strategic maneuvers.

VIRTUAL Lacks Clear Direction

As a researcher, I’ve noticed that the Virtual Average Directional Index (ADX) has been gradually decreasing, now standing at 13.3, compared to its previous level of 32.4 on January 2. ADX is a significant technical indicator I use, which assesses the strength of any trend, regardless of its direction, on a scale ranging from 0 to 100. When ADX values exceed 25, it suggests a robust trend, while values below 20 hint at weak or non-existent momentum.

A Virtual’s ADX reading under 20 suggests that the momentum of its earlier trend is weakening, potentially indicating a shift towards a period of stabilization or consolidation.

13.3 is a time when the Average Directional Index (ADX) indicates a weak trend momentum, mirroring the price action’s pattern, which suggests less price fluctuation and predictable movement.

A low ADX reading suggests that Virtuals Protocol’s price might stay within its current range for some time unless there’s a substantial increase in either buying or selling pressure. This could be seen as a stage of uncertainty in the market, with the coin’s future trajectory being influenced by whether bullish or bearish momentum regains strength.

VIRTUAL BBTrend Turned Negative After 5 Days

The Virtual BBTrend, which is an indicator based on Bollinger Bands, has shifted into negative territory, currently reading -1.51. Previously, it had been positive between January 2nd and early January 7th. This technical tool helps analyze the power and direction of price fluctuations.

In simpler terms, when numbers are positive, it’s a sign of optimism or bullishness. On the other hand, negative figures can indicate pessimism or bearishness. The Virtuals Protocol moving towards negative BBTrend levels indicates a change in public opinion, potentially suggesting an increase in downward pressure.

Following a peak of 20.5 for VIRTUAL’s BBTrend on January 4, which indicated a maximum level of bullish energy, the trend surrounding crypto AI agents has been growing steadily over the past few weeks. The present negative value implies that selling forces are stronger than buying forces at the moment, aligning with indications of a possible price drop or additional consolidation.

To get back on an upward trajectory, Virtual’s BBTrend must move into positive territory again, which suggests that investors are regaining confidence and there’s more buying activity. As long as this isn’t the case, the market might stay wary, focusing primarily on preserving crucial support levels.

VIRTUAL Price Prediction: Can AI Coin Go Below $3?

In recent times, the VIRTUAL’s value has been repeatedly setting record highs. Even though it dropped by 6% in the last day, its market worth remains around $4 billion. Yet, given the price seems to be slowing down, we can’t rule out a potential decline.

If VIRTUAL’s value continues to decrease significantly, it might encounter resistance at the $3.73 level. Dropping below this point could lead to additional falls, potentially reaching $3.27 and $2.81, which would signify a substantial drop of approximately 29%. However, the persisting excitement around artificial intelligence coins indicates that VIRTUAL’s appeal might remain robust.

If an upward trend develops, the price of VIRTUAL might strive to surpass the resistance level at $4.59. A successful breakout could possibly propel its value beyond $5, signaling yet another significant achievement.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-01-08 04:55