As a seasoned analyst with over two decades of experience in both traditional finance and the burgeoning crypto market, I’ve seen my fair share of bull runs and bear markets. The recent surge and subsequent retracement of Virtuals Protocol (VIRTUAL) has caught my attention, not just because of its meteoric rise, but also due to the factors that seem to be driving this rollercoaster ride.

The rapid increase in VIRTUAL’s market cap and price was indeed impressive, but the sudden drop seems to be a classic case of profit-taking among early investors. This phenomenon is as old as Wall Street itself – buy low, sell high, rinse and repeat. The double-digit decrease could be a precursor to further declines if the altcoin’s value continues to drop, as indicated by its overbought status on the Relative Strength Index (RSI).

However, as with any investment, the future is uncertain. If bulls manage to push the price past the overhead resistance at $5.15, we might see VIRTUAL’s market cap soar beyond $6 billion and the price inch closer to $7. But remember, investing in cryptocurrencies is akin to navigating a minefield – it’s risky, but potentially very rewarding if you know where to step!

As for my joke, here it goes: Why don’t we let computers trade stocks? Because they always go for the shortest path to failure! But remember, even with AI agents like VIRTUAL in the picture, human intuition and experience still play a crucial role in navigating the complex world of finance.

On January 2nd, the digital currency, Virtuals Protocol (VIRTUAL), momentarily crossed a market value of 5 billion dollars. Remarkably, this wasn’t the only record VIRTUAL set that day; its price also reached an unprecedented peak, soaring above $5 at around the same time.

Nevertheless, the latest surge didn’t last long as the virtual token experienced a decline of approximately 15.20% over the previous day. Let’s delve into the reasons behind this swift drop and speculate on possible future developments for VIRTUAL.

Virtuals Protocol Selling Pressure Stops the Upswing

As of January 1st, the market capitalization of Virtuals Protocol stood at approximately $3.87 billion. Yesterday, it surged up to a peak of around $5.05 billion. At the moment I’m writing this, however, the market cap has decreased and now stands at $4.28 billion.

As a researcher examining the world of cryptocurrencies, I’ve found that a currency’s market cap is simply the result of multiplying its circulating supply by its current price. Consequently, any fluctuations in either the circulating supply or price can significantly impact a cryptocurrency’s market capitalization. In the case of VIRTUAL, all 1 billion of its tokens are currently in circulation, making it essential to monitor changes in both its supply and price for accurate assessment of its market cap.

Based on my extensive experience in the cryptocurrency market, it appears that the recent decline in the metric could be primarily due to the price drop of the altcoin from $5.05 to $4.28 over the past 24 hours. This trend has been observed numerous times before, and I’ve learned that such a significant drop can potentially signal further decreases. If this altcoin’s value continues on its current trajectory, it could negatively impact the protocol’s market cap, mirroring a similar downward trend. As someone who has navigated through various market fluctuations, I strongly advise keeping a close eye on this situation and considering diversifying your portfolio to mitigate risk.

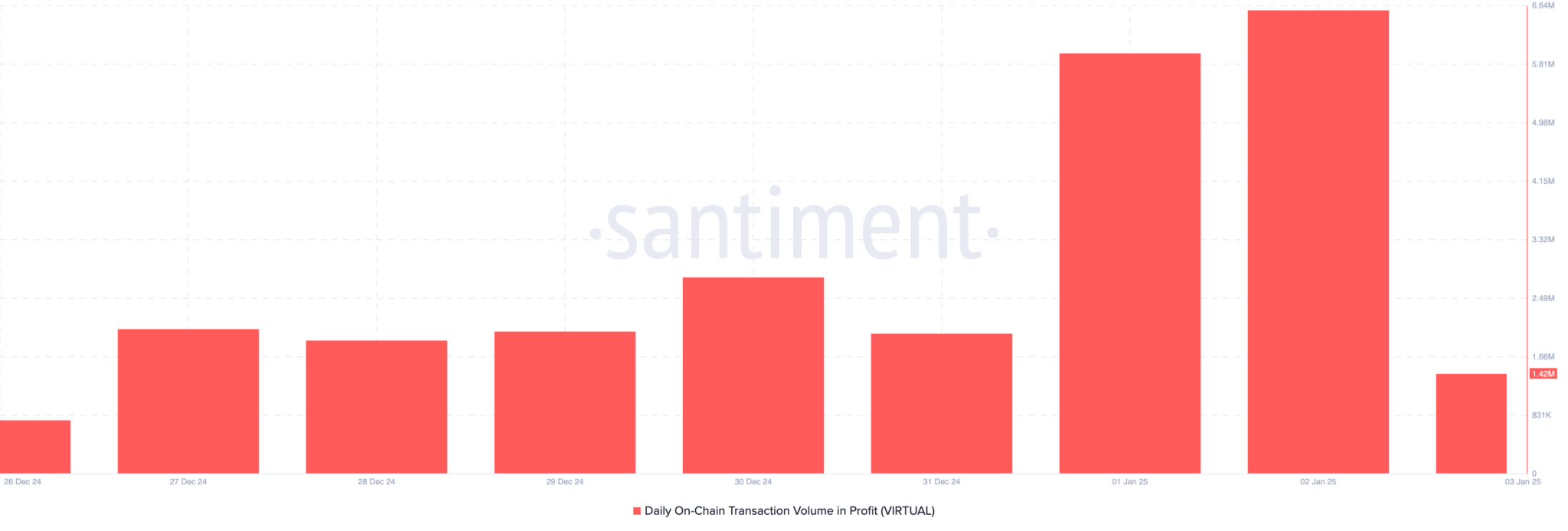

Based on BeInCrypto’s analysis, this substantial drop might be connected to a significant amount of holders cashing out their profits. According to Santiment’s data, the amount of realized profits on January 1 was approximately 5.95 million. This figure represents the level of profits accumulated over a specific time frame. However, on January 2, despite reaching a new all-time high, VIRTUAL saw an increase in the profit volume to around 6.56 million.

In its current pricing, VIRTUAL holders realized profits exceeding $28 million. Although we haven’t seen such levels of profit-taking recently, any additional increase might trigger a prolonged drop in both the market capitalization and price for VIRTUAL.

VIRTUAL Price Prediction: Extended Decline Before Rebound

Based on the Relative Strength Index (RSI), which monitors an asset’s momentum and determines whether it’s overbought or oversold, VIRTUAL experienced a pullback on the 4-hour chart because it had been overbought.

Readings exceeding 70 suggest an overbought condition, whereas readings below 30 indicate an oversold state. On January 2nd, the Relative Strength Index (RSI) on the VIRTUAL/USD chart peaked at 79.87, which triggered a price correction.

As a seasoned trader with years of experience under my belt, I’ve learned to pay close attention to technical indicators when making investment decisions. One such tool that has proven to be particularly useful in my journey is the Supertrend indicator. Recently, while analyzing VIRTUAL, the Supertrend flashed an overhead resistance at $5.15. This is a signal I can’t ignore, as it often indicates a potential resistance level where buyers may struggle to push the price higher. If the red segment of the Supertrend remains above VIRTUAL’s current price, then I believe we could see a decline towards the support level of $3.85. While past performance is not always indicative of future results, my personal experience has shown that this indicator can be quite reliable in predicting market trends. Therefore, I would recommend exercising caution when investing in VIRTUAL at current levels and potentially considering entering a short position if the Supertrend stays above the price.

However, should the bulls manage to push the price beyond the $5.15 barrier (which currently serves as resistance), the current trend may shift. In such a case, the market capitalization of VIRTUAL could potentially exceed $6 billion, with the price moving towards $7.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-03 12:42