On January 2nd, the digital currency known as VIRTUAL, which is part of the Virtuals Protocol, reached an unprecedented peak of $5.25. Yet, it has since experienced a significant drop, shedding approximately 35% of its value over the last week.

During this timeframe, VIRTUAL has emerged as the poorest performer among the leading 100 cryptocurrencies, consistently hitting fresh lows in price every day since it peaked.

Low Demand for VIRTUAL Pushes Price to New Lows

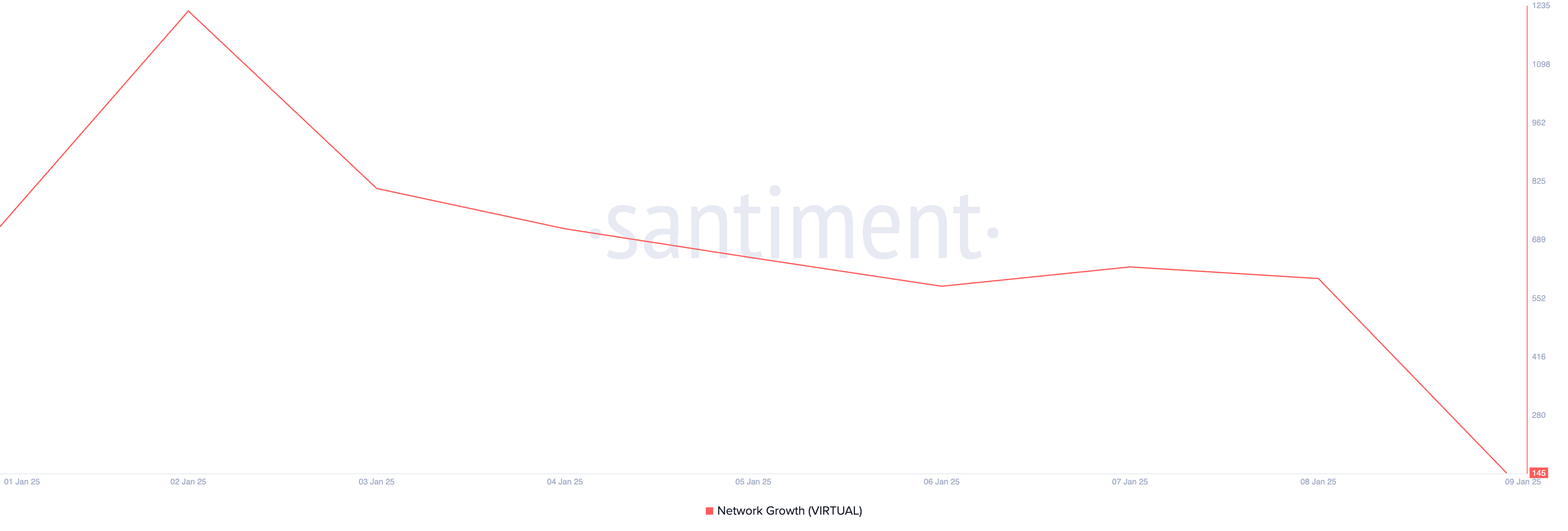

As a researcher, I’ve noticed that while the broader market has experienced consolidation, the significant double-digit decline in VIRTUAL’s value seems to be partly attributed to a decrease in new demand for the token. Since it peaked at $5.25, there’s been an 88% drop in the daily count of new addresses engaging in trades related to VIRTUAL, as indicated by on-chain data from Santiment, starting from January 2.

When the desire for a particular asset lessens among potential buyers, it indicates that fewer individuals are participating in the market. As a result, the overall demand decreases, which may cause a prolonged drop in the value of a VIRTUAL token as sellers exert more pressure than demand does.

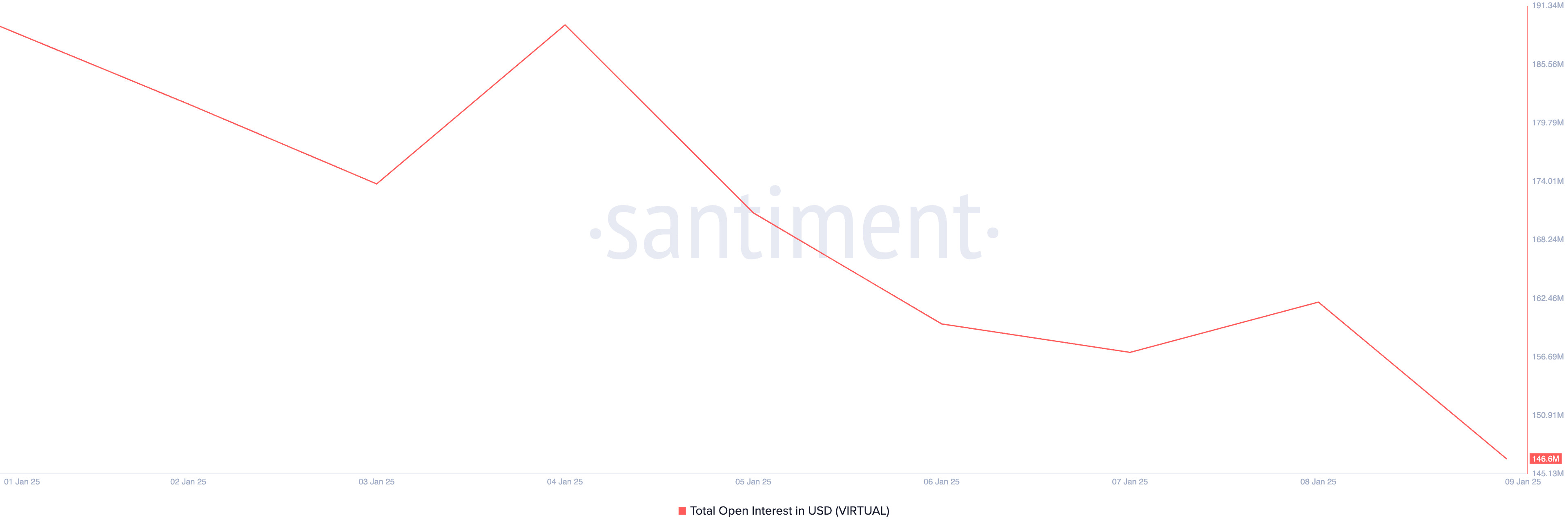

Significantly, the decrease in open interest for this altcoin suggests a drop in demand. Currently, it’s valued at approximately $146 million, which represents a 23% decline over the last week.

The term “open interest” denotes the current count of unsettled derivative agreements, like futures or options. A decrease in open interest during a price drop suggests that traders are liquidating their positions. This could indicate less confidence among traders and fewer newcomers joining the market.

VIRTUAL Price Prediction: Selloffs Could Worsen the Dip

Looking at the daily graph, it appears that VIRTUAL’s Relative Strength Index (RSI) is about to fall beneath the 50-neutral threshold, which suggests an increase in selling activity.

This indicator tracks the asset’s market conditions for being overbought or oversold. When configured in this manner, it shows an escalating bearish trend, which traders take as a sign that the asset’s decline may persist. If VIRTUAL’s buying activity decreases more, its price might drop to $1.31.

Conversely, if investor sentiment improves and turns optimistic, the VIRTUAL token’s price might bounce back and strive to regain its record peak value.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2025-01-09 19:21