The Vanguard Dividend Appreciation ETF (VIG), that most peculiar of financial bureaucrats, masquerades as a dividend monarch while quietly orchestrating a coup of growth over income. Its name, like a poorly translated decree, hints at generosity but delivers a ledger of arithmetic precision. For the trader with eyes for the long game, it is a paradoxical treasure; for the impatient, a labyrinth of delayed gratification. Herein lies the tale of why this ETF might be your most cunning stratagem-or your costliest folly.

A Curious Creature of the Market

Technically speaking, the Vanguard Dividend Appreciation ETF is but a scribe, copying the S&P U.S. Dividend Growers Index with the diligence of a 19th-century clerk. Yet in its copying lies a cunning: it plucks only those companies that have raised dividends for a decade or more, then casts aside the top 25% like an overzealous accountant shredding receipts. The remaining 75% are then weighted by market cap, a grotesque hierarchy where giants loom over dwarfs, their influence proportional to their girth. This is no income fund, but a slow-burning alchemy of growth and deferred reward.

The ETF’s 1.7% yield, meager as a beggar’s alms, is no accident. It is the byproduct of a bureaucratic purge-those with fatter dividends were exiled to the outer dark. Yet this is no oversight but a calculated absurdity: the true prize lies not in today’s payout but in tomorrow’s. For the trader who understands that dividends are not coins but seeds, VIG is a garden of compounding, where patience turns lead into gold.

The Why of VIG: A Traders’ Paradox

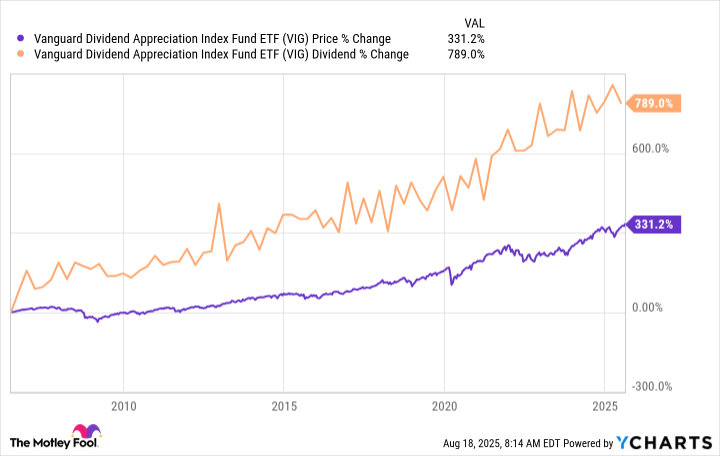

Observe the chart above: price and dividend rise in a duet of slow, grinding ascent. Here, the trader sees not two streams but one-a river of capital growth and a tributary of income, both feeding the same floodplain. For those with decades until retirement, this is a masterstroke. You pay 0.05% in fees to outsource the labor of curating 300+ stocks, a task that would leave even the most disciplined investor with a head full of numbers and a soul full of regret.

Yet there is a nuance, as delicate as a bureaucrat’s smile. The dividend, though modest now, grows like ivy on a crumbling wall. Reinvest it, and let time work its magic; by the day you retire, it may be a torrent, not a trickle. The trader who buys and holds is not merely investing but playing a game of chess with time, where each move is a dividend reinvestment and the checkmate is a yield so fat it makes today’s 1.7% look like a joke.

Consider the absurdity: since 2006, the dividend has grown 750%. This is not alchemy but arithmetic, yet it reads like a fairy tale. For the trader with a horizon of 30 years, VIG is not an ETF but a promise-a promise that the future will be kinder to your portfolio than the present.

The VIG Verdict: A Tale of Two Investors

If you hunger for income today, VIG is a ghost at the feast. But if you are a trader with a telescope trained on the distant future, it is a celestial map. For the former, it is a bureaucratic red tape; for the latter, a golden thread through the labyrinth. The key lies in the absurdity of time: what is a pittance now may be a fortune later, and the trader who knows this is the true master of the game.

In the end, VIG is not for the faint of heart or the short of patience. It is for those who can see beyond the numbers, who understand that markets are not just machines but stories-stories of growth, of compounding, of dividends that rise like phantoms from the earth. And if you are such a trader, then VIG is not just an ETF. It is a prophecy. 🐞

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-21 13:26