The year 2025 witnessed a peculiar efflorescence in the fortunes of Vertiv, a purveyor of power and cooling technologies, and a favored associate of Nvidia. The stock ascended, a 42.6% gain amidst the escalating demands of the data centers – a modern iteration of the gulag, perhaps, where information, rather than men, is confined and processed. Yet, this ascent was not without its tremors, a mid-year decline suggesting the inherent instability of systems built upon fleeting enthusiasms. We must examine not merely the numerical rise, but the underlying conditions that permitted it, and the vulnerabilities that remain.

The Current of Artificial Intelligence

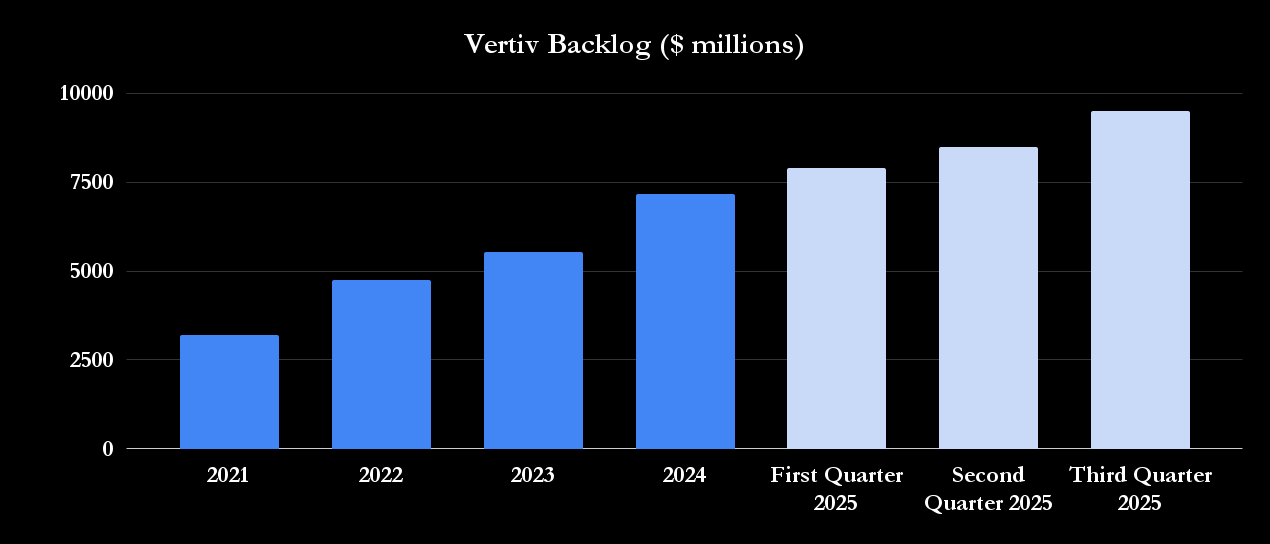

It is no secret, and indeed, openly proclaimed, that Vertiv’s infrastructure is integral to the burgeoning realm of artificial intelligence. This is not innovation, but rather a necessary support system – a network of conduits and regulators enabling the flow of data, the very lifeblood of this new, often opaque, power. The reported $9.5 billion backlog at the close of the third quarter – a figure likely underestimated, as such pronouncements always are – dwarfs the stated Wall Street consensus of $12.4 billion in projected sales for 2026. This discrepancy, this predictable overestimation of future capacity, is a symptom of a larger affliction: the relentless pressure for exponential growth, divorced from any genuine need or sustainable foundation.

Alliances Forged in the Machine Age

Vertiv’s management, led by the seasoned David Cote, a veteran of Honeywell, and Giovanni Albertazzi, a long-standing operative from the Emerson Electric lineage, displays a pragmatism bordering on calculation. They understand that survival in this climate demands not merely competence, but strategic alignment. The partnership with Nvidia, a titan in the realm of processing power, is not altruistic, but a necessary symbiosis. The forthcoming data center power system, designed for Nvidia’s 800-V high-voltage direct current architecture – slated for 2027 – is a testament to this calculated interdependence.

Beyond Nvidia, Vertiv extends its reach. The collaboration with Oklo, to develop power and thermal management for data centers fueled by nuclear fission – a technology fraught with its own complex moral and logistical burdens – is a further indication of this relentless pursuit of scalability. And the alliance with Caterpillar, integrating power and cooling with their industrial gas turbines – a rapidly expanding revenue stream for the latter – reveals the seamless integration of disparate industries, all serving the insatiable appetite of the data centers. It is a system of interlocking dependencies, each component reliant on the others, and vulnerable to the failure of any single part.

A Stock’s Valuation: A Glimpse into the Abyss

The year 2025 brought with it the unwelcome intrusion of tariffs, a crude instrument of economic control that hampered profit growth. These costs, though temporary, serve as a reminder of the external forces that can disrupt even the most carefully constructed systems. Wall Street anticipates revenue growth in the high teens and a 25% increase in free cash flow over the coming years – optimistic projections, perhaps, fueled by the prevailing euphoria. The current valuation – 43.5 times expected free cash flow for 2026 – is a clear indication of the speculative fervor surrounding the AI sector. It is a valuation built on faith, not fundamentals.

Vertiv’s consistent upward revision of revenue guidance throughout 2025 is noteworthy. If this momentum persists, supported by its strategic alliances, the company may indeed enjoy another prosperous year. But we must remember that prosperity, in this context, is not an end in itself. It is merely a measure of the system’s efficiency – its ability to extract value from the world around us. And that value, ultimately, is finite.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

2026-01-15 13:52