So, you’re looking for somewhere to put a thousand dollars, are you? A perfectly sensible thing to do, provided you have a thousand dollars. Most investments at the moment seem to be priced as if they’ve already accounted for the heat death of the universe (a distinct possibility, statistically speaking). Finding something reasonably priced feels a bit like searching for a sensible politician – theoretically possible, but requiring an improbable alignment of cosmic forces.

The so-called “Magnificent Seven” stocks, for example, are currently valued as if they hold the patents to gravity itself. At a combined price-to-earnings ratio hovering around 28, they seem to be betting heavily on humanity’s continued ability to ignore basic economic principles. As the late, great Warren Buffett (a man who clearly understood the universe’s inherent unfairness) observed, popularity and sensible investment rarely coincide. The truly productive positions, as a general rule, are the ones everyone else has forgotten about, or, preferably, never even considered. (This is largely because the universe is a profoundly illogical place, and things only become valuable when someone decides they are. It’s a system fraught with peril, frankly.)

With that unsettling truth established, if you have a thousand dollars burning a hole in your pocket and a tolerance for the mildly improbable, Vertiv (VRT 0.38%) might just be worth a look. It’s not going to set the world on fire, or even provide a particularly dazzling light show, but it might just quietly accumulate value while everyone else is chasing the next shiny object.

What is Vertiv, and why should you care?

Vertiv isn’t a household name, and that’s precisely the point. Its market capitalization is, shall we say, modest compared to the trillion-dollar behemoths currently dominating the headlines. It doesn’t manufacture anything you’d find in your living room (unless your living room is a server farm, in which case, congratulations on your excellent life choices). However, there’s a good chance you’re indirectly benefiting from its services right now. (Consider this a philosophical exercise. Are you reading this on a device powered by electricity? There you go.)

In essence, Vertiv helps companies build and maintain the data centers that power the digital world. It’s a surprisingly vital component of modern infrastructure. In the early days of computing, electricity consumption and cooling weren’t major concerns. But as data centers have grown exponentially, these factors have become… significant. S&P Global’s 451 Research estimates that data centers’ electricity consumption grew 22% last year, and is projected to triple by 2030. (Which is, frankly, a terrifying statistic. It’s like feeding a digital monster, and we’re all contributing to its insatiable appetite.) The utility companies and data center operators are scrambling to secure enough power, which is proving… challenging.

The low-hanging fruit, as it were, is better power-management technology. Vertiv’s recently unveiled EnergyCore Grid, a battery-based energy storage system, is a step in that direction. It can deliver over 200 megawatts of power, and optimize peak demand, provide black-start capabilities, and perform other equally impressive feats of engineering. (It’s essentially a very large, very sophisticated battery. Don’t overthink it.) Their power management solutions boast an efficiency of around 98%, which is… good. Very good, actually.

But perhaps the company’s most interesting offering is data center cooling. This seems to have caught the industry a little off guard. Operators always knew processors and connectivity equipment generated heat. What they didn’t fully anticipate was the sheer volume of heat. Unmanaged, it can cripple performance, or even permanently damage hardware. (Think of it as a digital fever. Not good.)

Global Market Insights expects the data center cooling market to grow at an average rate of over 10% per year through 2034. Vertiv is well-positioned to capture a significant share of this growth, offering everything from liquid cooling solutions to chillers that function like oversized refrigerators, to systems that simply vent heat outdoors. (It’s all rather ingenious, when you think about it. Taking the heat and throwing it away. A surprisingly effective strategy.)

None of this is particularly complicated, but few companies are doing it as well as Vertiv. Credit their data-center-customized solutions. (Which is a fancy way of saying they’ve figured out what data centers need, and built it.)

The Bull Case for VRT Stock

But what makes this name a potentially interesting growth stock right now? It’s not just in the right place at the right time with the right products. Its potential isn’t fully reflected in the current stock price. On the surface, it might not seem that way. Shares are currently valued at over 40 times trailing earnings, and over 30 times this year’s projected per-share profit of $5.33. That’s not outrageously overvalued, but it’s certainly more than some of the more fashionable stocks.

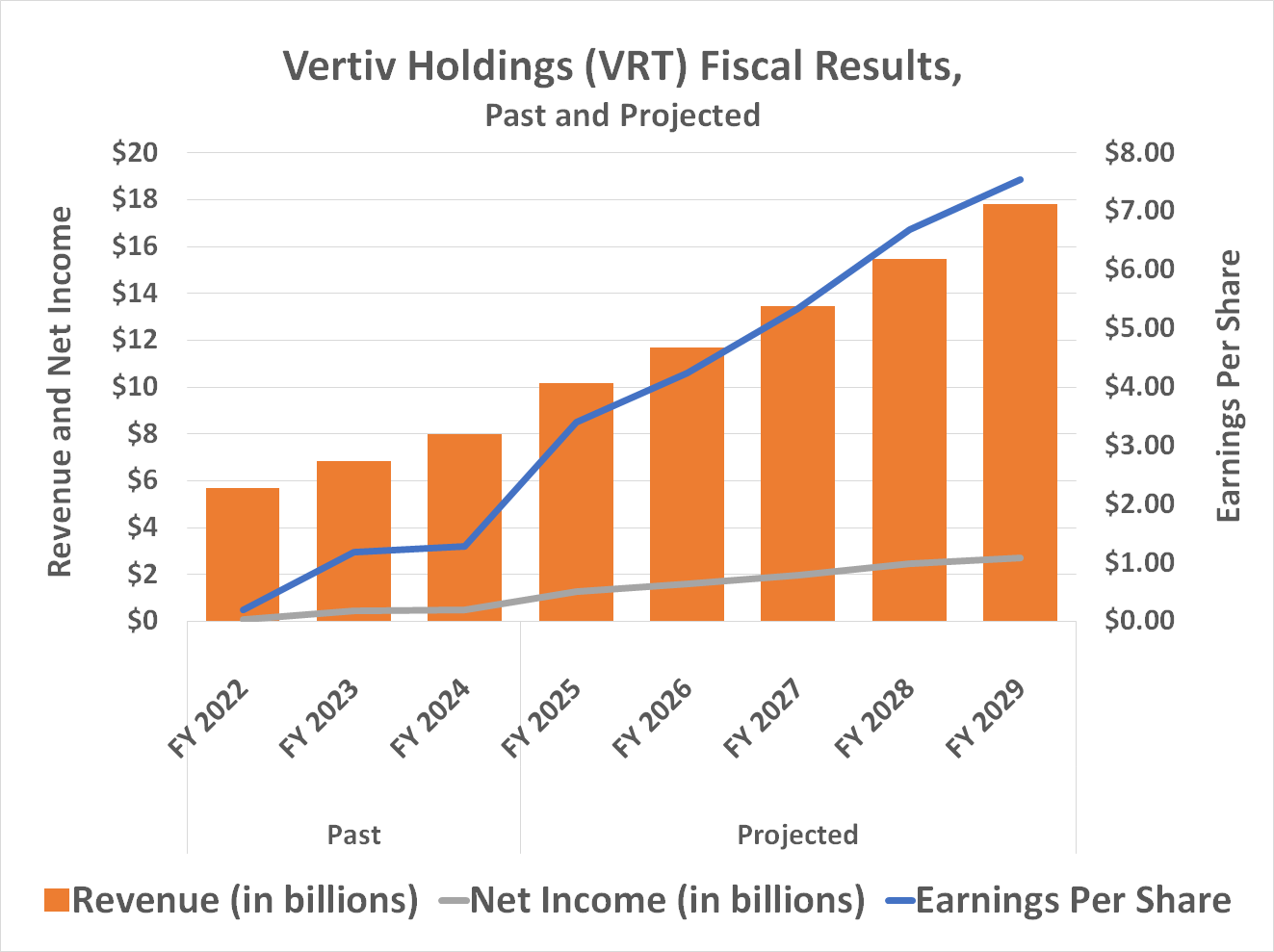

What’s missing from the discussion is just how quickly this company is ramping up its top and bottom lines, and how long it’s expected to continue growing at this pace. Analysts at Morningstar (and others) predict Vertiv’s top line will grow from just over $10 billion last year to nearly $18 billion in 2029. (That’s a lot of data centers. A lot.)

Vertiv’s current backlog of business grew to a hefty $9.5 billion in the three months ending September, and the company reported year-over-year revenue growth of 29% to nearly $2.7 billion. Moreover, this long-term growth forecast aligns with Global Market Insights’ forecast for the worldwide data center cooling market, and with Straits Research’s belief that the global data center power system business is poised to grow from just over $10 billion in 2025 to $17.5 billion by 2033. (It’s a confluence of factors, really. A perfect storm of data, power, and cooling.)

Well-Balanced

Is Vertiv the safest growth stock you can buy right now? Probably not. It’s not the cheapest, and it’s not growing as fast as some other growth names. You could certainly find a reason to choose another stock.

On balance, however, there’s a whole lot to like about Vertiv Holdings, and very little not to like. The entire package is very attractive, particularly in light of the stock’s stagnation since October. It wouldn’t take much to rekindle the rally, especially if the economy eases its way back into stable growth mode, which is looking increasingly likely following the third quarter’s surprisingly solid GDP growth rate of 4.3% and other positive economic indicators. (The universe, it seems, occasionally throws us a bone.)

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 17:52