As a seasoned crypto investor with a knack for spotting trends and navigating regulatory landscapes, I can confidently say that the surge in funding for crypto startups since Trump’s election victory is not just a blip on the radar. It’s a clear indication of a growing acceptance and recognition of the potential of blockchain technology by traditional financial institutions.

Investments in the cryptocurrency sector have seen a significant increase, as startups have managed to gather more than a billion dollars from Venture Capital (VC) firms following Donald Trump’s presidential election win.

The increase in funds indicates a rising sense of confidence about a potentially friendlier legal climate with the new government in office.

Crypto Startups Attract Over $1 Billion in Funding

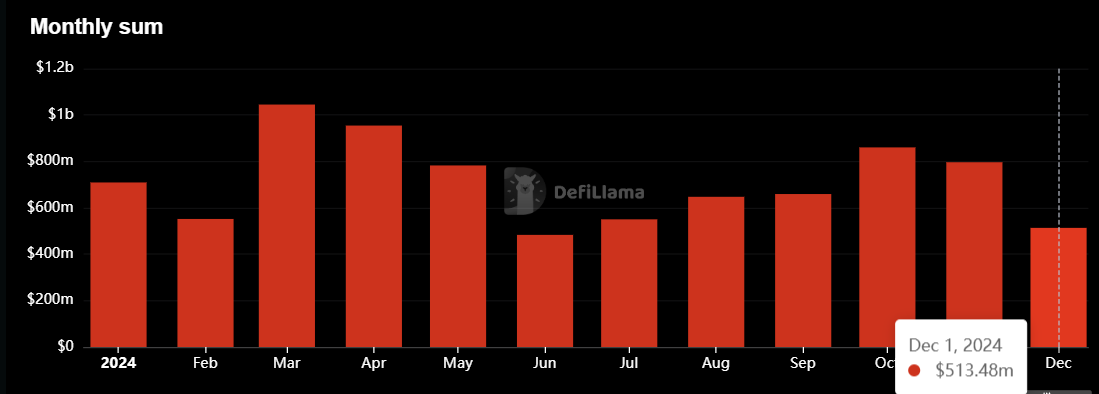

Ever since Donald Trump’s win on November 6, 2016, cryptocurrency startups have received around $1.3 billion in funding. According to DefiLlama, venture capitalists invested approximately $796 million in November and an additional $511 million in December.

During this timeframe, The Avalanche Foundation stood out as the leading fundraiser, amassing a total of $250 million via a private token sale. This financial backing coincides with the upcoming Avalanche9000 network upgrade, slated for December 16. This update is anticipated to boost blockchain scalability and minimize costs by enhancing its efficiency.

It’s been noticed that venture capitalists have shown a marked increase in their curiosity about crypto infrastructure ventures. These financiers have collectively poured over half a billion dollars into the development of this infrastructure, with Zero Gravity Labs and Bitcoin miner Canaan Creative being two prominent recipients, having raised $40 million and $30 million respectively, in significant funding rounds.

At the same time, the Decentralized Finance (DeFi) industry experienced growth, receiving over $150 million in investments. Significant investments were made, such as $45 million for USDX Money and $30 million for World Liberty Financial. This surge in funding is a continuation of the recovery in the DeFi market, now drawing attention from both individual and institutional investors.

The increase in funding is associated with expectations that the incoming government will be favorable towards cryptocurrencies. Previously, Donald Trump has shown significant backing for the crypto sector, promising to provide much-needed regulatory guidance and create a National Bitcoin Reserve (NBR) within the U.S.

After securing his victory, Donald Trump has made a series of appointments that lean in favor of cryptocurrencies. Among these choices are Paul Atkins, who is proposed to lead the Securities and Exchange Commission (SEC), and David Sachs, who will serve as the White House’s inaugural crypto advisor.

It’s thought that these appointments may bring regulatory certainty, eliminate obstacles for institutional involvement, and encourage more financial backing in this field.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-15 13:27