As a seasoned crypto investor with a decade of experience navigating the volatile world of digital assets, I find the projected $18 billion venture capital funding for 2025 incredibly promising. Having weathered market slumps and witnessed the meteoric rise of Bitcoin, I’ve learned that patience is key in this rollercoaster ride.

The optimism surrounding a more favorable regulatory environment under Trump’s successor, coupled with the return of ‘generalist’ investors and the entry of traditional financial institutions, paints an encouraging picture for the crypto space. It’s like watching the sun peek over the horizon after a long, dark night.

However, I can’t help but remember the old saying, “What goes up must come down.” While $18 billion is a significant increase from 2024 levels, it pales in comparison to the $33 billion invested in 2021. But then again, Rome wasn’t built in a day, and neither was the crypto market.

In the end, I’d like to say, “The best time to invest in crypto is when your grandma asks you what Bitcoin is.” So, if you ask me about 2025, I say it’s the year of the grandmas! Let’s hope they have a knack for picking winners.

According to an analyst from PitchBook, it’s anticipated that investments in cryptocurrency ventures will likely total around $18 billion by the year 2025.

After Donald Trump’s election win, venture capitalists are expecting a beneficial regulatory climate ahead.

2025 Crypto Investments Set to Soar

During an interview on CNBC, analyst Robert Le forecasted that there would be approximately $18 billion invested in cryptocurrencies next year. He attributed this prediction to the reemergence of ‘all-purpose’ investors after Bitcoin surged following the election, and this figure represents a 50% increase compared to investment levels in 2024.

According to Robert Le of PitchBook, it’s likely that over $18 billion will be invested in venture capital by the year 2025.

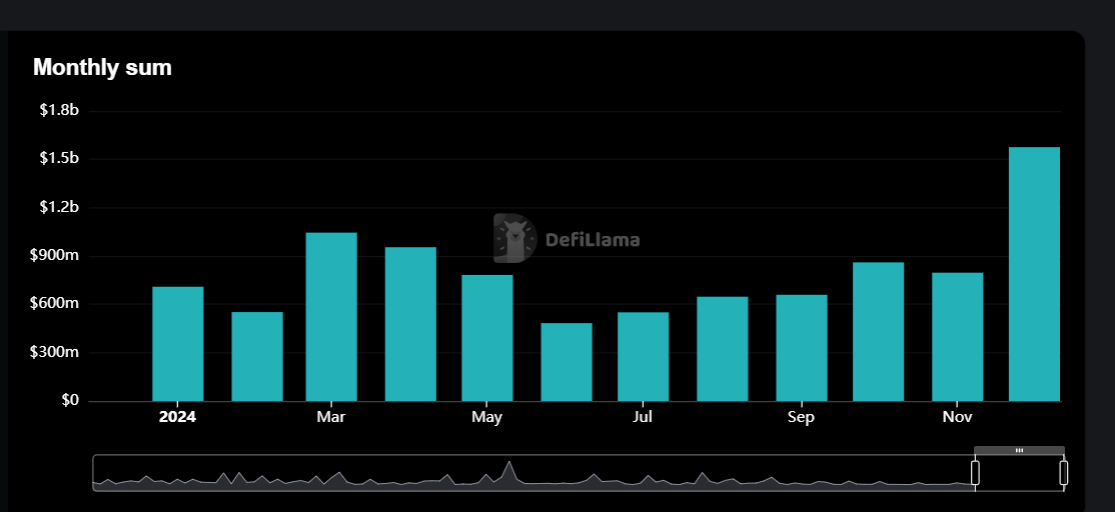

In terms of investment prospects for 2024, Le mentioned that the first quarter experienced a significant influx of funding following the approval of Bitcoin ETFs. This optimistic atmosphere encouraged venture capitalists to enter the market.

However, investments slowed down later as Bitcoin staggered amid a summer slump.

In 2025, it appears that several advantageous circumstances are lining up, making it potentially attractive for investors to re-enter the market, as noted by Robert Le.

Le shared his perspective, stating that the setup seems excellent, implying a positive outlook on regulatory conditions. He also mentioned that the economic climate appears stable and several digital tokens like Solana, Bitcoin have reached or exceeded their all-time highs. His prediction is that venture capital investments in 2025 could surpass $18 billion, marking a 50% increase compared to the previous year.

Contrarily, the reported $18 billion investment in 2022 pales in comparison to the staggering $33 billion invested by venture capitalists in the crypto and blockchain sector in 2021. As per Galaxy Research, a substantial portion of this $33 billion, approximately $22 billion, was directed towards funding rounds for startups in this field in 2021 alone.

Moreover, crypto startups received almost 5% of venture capital distributed in 2021.

During an interview with CNBC, Robert Le expressed his belief that by 2025, conventional financial institutions may start venturing into the cryptocurrency sector. He pointed out that traditional finance (Trafi) enjoys a stronger relationship of trust with regulatory bodies, which could potentially enhance the credibility of the crypto industry.

Le mentioned that we’re currently engaging with several major companies who are showing renewed interest in cryptocurrency. It is expected that these firms will begin investing in crypto next year, which could significantly boost the market. As more traditional financial institutions enter this field, it will likely increase credibility and trust in digital currencies.

A noteworthy shift was mentioned for investment priorities in 2025. Previously, there had been significant investment in infrastructure, but it was suggested that moving forward, efforts would be directed towards bolstering the application layer to attract a greater number of users.

Speaking about regulators, Le mentioned that having the Securities and Exchange Commission (SEC) establish new cryptocurrency regulations could indeed be advantageous. Moreover, Le pointed out that, even if the SEC chooses to take no positive action, it would still be preferable compared to the stringent enforcement measures enforced over the past two years.

Read More

2025-01-01 13:40