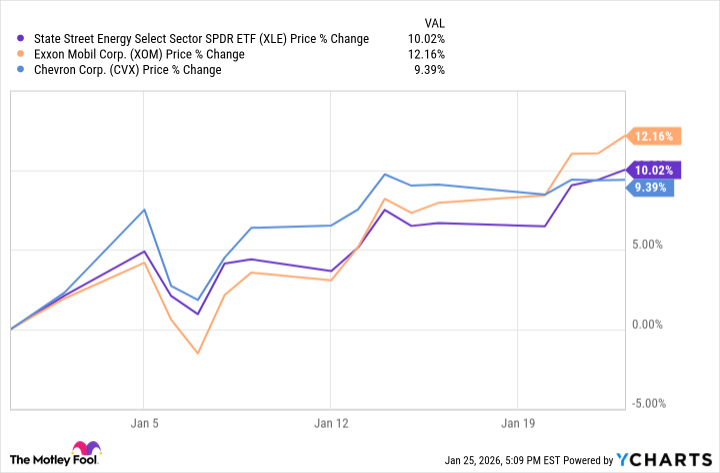

Well, now. A most peculiar thing has happened. It seems someone has finally managed to wrestle old Nicolás Maduro into a bit of a pickle, and the chaps at ExxonMobil are starting to twitch their noses, sniffing for opportunity in Venezuela. It’s a country brimming with the black, gooey stuff – more oil than you can shake a stick at, they say – and the thought of tapping into that has sent a little shiver of excitement through the markets. The State Street Energy Select Sector SPDR ETF (XLE +1.67%) is already doing a jig, up 10% this year, and ExxonMobil (XOM +1.53%) is nipping at its heels, gaining 12.2%. A jolly good show, you might think.

But hold your horses. Before you start picturing mountains of cash and overflowing oil drums, let’s have a proper look at this Venezuelan business. It’s not quite as simple as sticking a straw in the ground and slurping up the profits. Oh no, not at all.

An ExxonMobil/Venezuela Bet: A Rather Slow Cooker

Can Venezuela boost ExxonMobil’s long-term cash flows? Yes, undoubtedly. It would be like finding a secret stash of golden tickets. However, the company has been a bit…under the weather lately, with free cash flow taking a tumble for three years running. A bit of Venezuelan oil could certainly perk things up. But patience, my friends, is a virtue.

You see, ExxonMobil hasn’t exactly been on speaking terms with Venezuela since 2007, when old Hugo Chávez, a rather grumpy fellow, decided to relieve them of their assets. It was the second time such a thing had happened, which, frankly, is a bit rude. Now, the current ExxonMobil chaps aren’t exactly quaking in their boots, mind you. CEO Darren Woods even declared there’s opportunity, which is a bit like a fox admiring the henhouse. But don’t expect oil to be gushing forth overnight. Even if they signed a lease today (which won’t happen in a hurry), it could be years before they’re pumping anything out of the Orinoco Belt.

ExxonMobil Investors Might Prefer a Bit of Peace and Quiet

Let’s be clear: if ExxonMobil does venture into Venezuela, it could be good for their long-term cash flow. But “long-term” is the operative word. Years, possibly. Some investors might be perfectly happy if ExxonMobil steered clear altogether. The country’s value proposition isn’t quite as dazzling as some folks seem to think, even with a new, friendlier government in charge.

Simple sums reveal the truth. In Guyana, ExxonMobil can break even at around $35 a barrel. In Texas’s Midland Permian Basin, $48. But in Venezuela? The break-even price is somewhere between $42 and $56 a barrel. And in the Orinoco Belt, it’s even higher. It’s like comparing a swift, nimble pony to a rather sluggish, swamp-dwelling beast. The math is better elsewhere, and ExxonMobil, being a sensible sort of company, knows this perfectly well. It shouldn’t be lost on investors either. They might find a bit of peace of mind, and a healthier return, by sticking to places where the oil flows a bit more freely, and the politicians aren’t quite so…peculiar.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Single-Player Games Released in 2025

- Where to Change Hair Color in Where Winds Meet

2026-01-29 18:52