There I was, trying to parse the name of this ETF-Vanguard Dividend Appreciation. It sounds like a midlife crisis manifesto, doesn’t it? “Dividend” implies a steady paycheck, while “appreciation” suggests something… more ambitious. Like a retirement plan that also happens to be a yoga instructor. But here’s the thing: it’s neither. Or maybe it’s both, depending on how you squint at the numbers. Either way, it’s the financial equivalent of a well-meaning but slightly clueless friend who insists on giving you a plant for your birthday. You know it’s supposed to be thoughtful, but you’re not sure it’ll survive the winter.

What does the Vanguard Dividend Appreciation ETF do?

It tracks an index that’s like a high school reunion for companies: only those with at least a decade of dividend hikes are invited. Then, it kicks out the top 25% of the most generous yielders-because apparently, the wealthiest people at a party are always the least interesting. What’s left? A group of companies that are more about growth than glamour. It’s like a book club where everyone reads the same novel but refuses to discuss the ending. You get the sense they’re all in it for the long game, even if the plot is a bit meandering.

Here’s where it gets weird: by excluding the highest-yielding stocks, the ETF is basically saying, “We don’t want the flashy ones. We want the ones who’ve been quietly building their empire.” Which is fine, but also makes me wonder if the index is just a bunch of introverts in a corporate suit. They’re not here for the spotlight; they’re here to compound their wealth like it’s a secret handshake.

The result? A portfolio that’s less about immediate rewards and more about… well, patience. It’s the financial version of planting a tree and refusing to check on it for 20 years. You might not get a shade to sit under, but the future is looking lush.

And let’s not forget the expense ratio. A mere 0.05%? That’s like paying a toll booth attendant to let you through. It’s so low, I half-expect the fund to start giving me money just to keep me from complaining.

What are you really getting with the Vanguard Dividend Appreciation ETF?

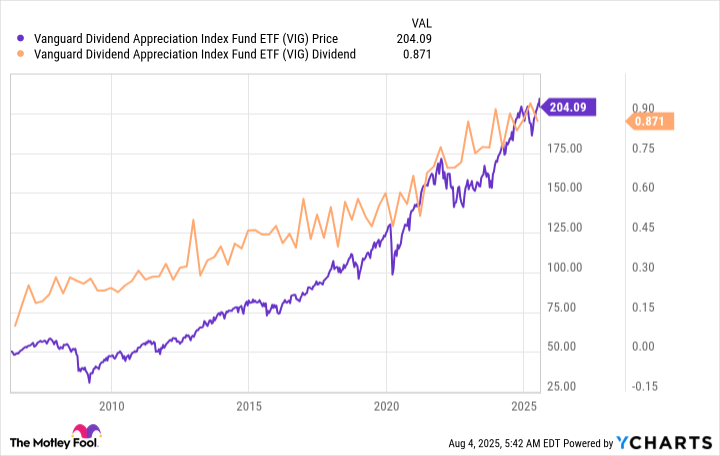

Income growth? Sure. Capital appreciation? Absolutely. But it’s like ordering a salad and getting a side of existential dread. The dividend yield is 1.7%, which is slightly better than the S&P 500’s 1.2%, but if you’re looking for a financial windfall, you might as well invest in a lottery ticket. At least the lottery has a 1 in 300 million chance of making you rich. This ETF’s chances are… well, they’re not bad, but they’re not exactly thrilling.

Still, there’s a certain charm to it. It’s the kind of investment that whispers, “Trust me, I’ll be here when you’re ready.” Which is nice, if you’re the type of person who enjoys watching paint dry. Or, more accurately, watching your portfolio slowly gain value while you’re busy worrying about whether your neighbor’s cat is plotting against you.

The real kicker? This ETF isn’t trying to be a quick fix. It’s a slow burn, like a poorly written novel that keeps dragging on because the author forgot to end it. If you’re young and have decades to wait, it’s a solid bet. But if you’re like me-always eager for immediate gratification-it’s the financial equivalent of a 10-year-old’s promise to clean their room. You know it’ll happen eventually, but you’re not holding your breath.

The Vanguard Dividend Appreciation ETF does what it sets out to do

It’s not perfect. It’s not even particularly exciting. But it’s reliable, like a broken toaster that still manages to toast your bread. If you’re the type of investor who prefers steady, predictable growth over flashy, high-risk bets, this might be your cup of tea. Or your tea of choice, if you’re into that sort of thing.

So, to answer the question: Could buying this ETF set you up for life? Probably not in the way you’re imagining. But if “life” means a slow, steady climb toward financial stability while avoiding the chaos of the stock market, then yes. Just don’t expect a party. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-11 05:19