Oh, the clever investor with a nose for the gaudy promises of corporate charlatans rarely jumps at the first glittering tech fad. In a world where tech stocks strut about like peacocks in a parade, there lies a hidden gem-a sector that supplies the very lifeblood of modern gadgetry. The Vanguard Utilities Index ETF (VPU), though it might seem as dull as a doormat at first glance, quietly whispers secrets of reliable dividends and a future painted in electric hues.

Even the most cautious souls-be they conservative, income-hungry, or even those chasing a hint of growth-might find themselves drawn to this unassuming fund. After all, isn’t it a peculiar twist that in the boisterous realm of Wall Street, where flamboyant tech titans bask in the limelight, a collection of “widows and orphans” stocks can offer a dividend yield of roughly 2.8%? A sum that’s more than twice that of the vaunted S&P 500 (and let’s not forget the doppelgänger Vanguard 500 ETF that mimics its every move). But as any market skeptic will tell you, even the most reliable dividend can be as fickle as a mischievous imp in a sugar bowl.

Utilities are boring, right?

Once upon a time, utilities were as predictable as a lullaby on a rainy day-dubbed “widows and orphans” stocks because they reliably paid their dividends, much like an old nanny tending to her charges. Yet beneath their placid exteriors lies a hidden truth: the Vanguard Utilities ETF is not merely a relic of yesteryear. Regulated and monopolistic, these companies continue to serve as the backbone of civilization. And now, with the insatiable appetite of technology for electricity, the old adage of “boring” is being challenged by a not-so-subtle undercurrent of growth.

Consider this: electricity demand grew a modest 9% from 2000 to 2020. But as our world becomes ever more tethered to the digital realm-fueled by artificial intelligence, data centers, and electric vehicles-the demand for electricity is expected to balloon by over 50% between 2020 and 2040. Such forecasts aren’t the work of a crystal ball in a dark, candlelit room; they’re born of an insatiable need for power that even the most cunning utility barons cannot ignore. However, as a market skeptic, one must wonder: are these projections a product of wishful thinking, or a forewarning of a tangled web yet to be unraveled?

It might seem like an age-old drama, but the unfolding saga of rising electricity demand is set to span decades. Instead of trying to pick a single star in this utility firmament, one might simply invest in the Vanguard Utilities Index ETF-a smorgasbord of electric, natural gas, water, and independent power companies. After all, why trust one solitary player when a diversified ensemble might offer a more palatable dish for the cautious palate.

What does the Vanguard Utilities Index ETF do?

Let’s be candid: the Vanguard Utilities Index ETF is about as exciting as a soggy biscuit in a teapot. It invests in utilities-those reliable, if somewhat soporific, companies that ensure our lights stay on and our gadgets keep humming. And it’s nothing more than an index fund, faithfully tracking its target with no magical flourishes. But in a world where the unexpected lurks around every corner, sometimes the dullest of investments can be a sanctuary for the wary investor.

Technically, this ETF is a follower of the MSCI US Investable Market Utilities 25/50 Index-a name that might evoke the mystique of an ancient incantation but, in reality, is merely a fancy way of ensuring diversification. With its 25/50 criteria, the fund spreads its bets across a range of electric, natural gas, water, and independent power companies. And while electricity plays the leading role, comprising roughly 90% of the portfolio, one must keep an eye on the supporting cast that could either uplift or upend the performance.

At an expense ratio of around 0.09%, this ETF is as low-cost as it gets in the utilities sector-a veritable bargain for those who favor a conservative, income-oriented approach with a hint of long-term growth potential. A $1,000 investment nets you a modest five shares, but as any market skeptic knows, it’s not just about the number of shares-it’s about the quality of the investment, which can sometimes be as unpredictable as a mischievous pixie on a sugar high.

What if the growth doesn’t play out as expected?

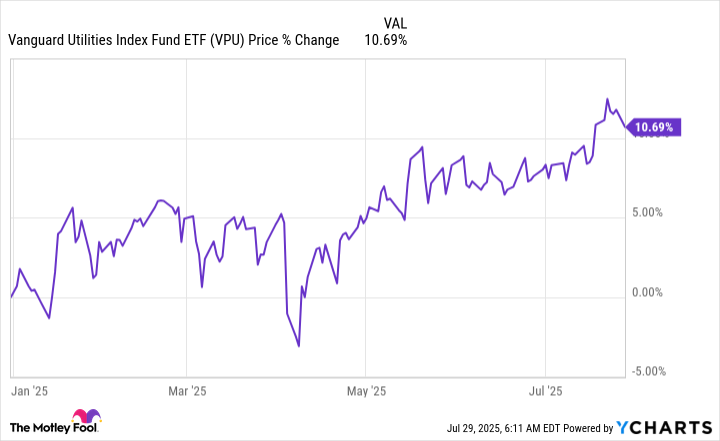

The big risk, as ever, is that the electric future foretold by soothsayers and corporate minstrels might fizzle out like a damp squib. The Vanguard Utilities Index ETF has seen gains of around 10% this year-a commendable feat for a utility fund, but one must remember that even the most reliable of dividends can vanish like a puff of smoke when the winds change. While it’s possible that the anticipated surge in electricity demand could falter, the long-term trends and the unyielding thirst for power by our technology-driven world suggest that a complete reversal is unlikely.

Should the near-term prospects sour, the fund’s generous dividend yield stands ready like a safety net beneath a trapeze artist-a reminder that even if the market wobbles, there remains a lifeline to hold onto. In the grand tapestry of investment, even a market skeptic must admit that sometimes there is a glimmer of hope amidst the gloom. And if the future proves as unpredictable as a grumpy troll under a bridge, you’ll have your dividend to thank for keeping you afloat.

So, as we gaze into the murky waters of financial forecasts and electric dreams, remember that the Vanguard Utilities Index ETF is not a panacea but rather a cautious bet on a world that is both fascinating and fraught with uncertainty. In the end, only time will tell whether this utility play will reward the wary investor or serve as a cautionary tale for those seduced by promises of easy gains. 🔮

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-06 07:15