In the fevered heart of modern finance, ten names have risen-not as mere corporations, but as titans, their colossal market caps casting shadows over the S&P 500’s once-diverse landscape. Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, Broadcom, Tesla, Oracle, and Netflix: these names, etched into the ledger of capital like apostles of a new gospel, now command 38% of the index’s soul. What has this concentration wrought? A paradox: the S&P 500, once a mosaic of American enterprise, has become a stage for a handful of players, their triumphs and follies dictating the fates of millions.

The Vanguard S&P 500 ETF (VOO), with its meager 0.03% fee, offers a path to this altar of growth stocks. Yet herein lies the rub: for every investor who sees in VOO a vessel of simplicity, there lurks a heretic questioning whether this “diversification” is not a mirage. The fund’s low cost is a siren’s song, luring the unwary with the promise of passive wealth, while the Ten Titans’ dominance whispers of hubris. Is this not the eternal dance of human folly-the belief that one can harness chaos, that the market’s fickle heart can be tamed by a ticker symbol?

The Tyranny of the Ten

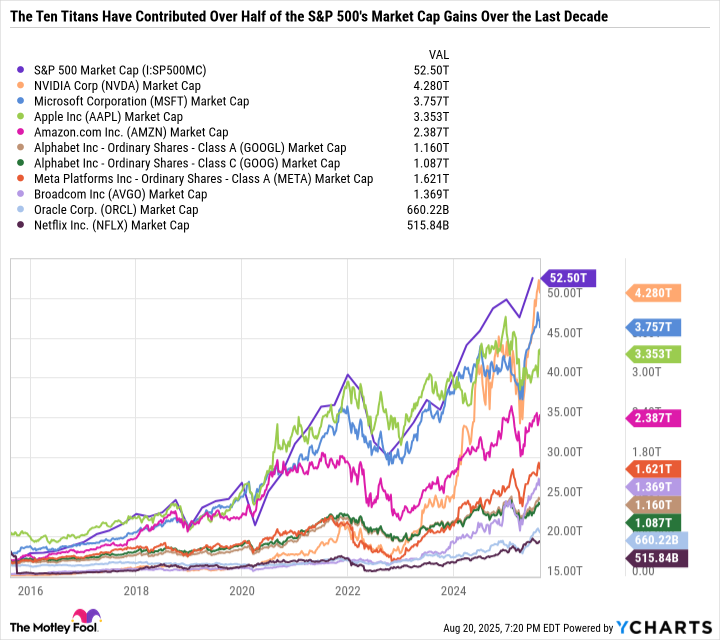

Over decades, the S&P 500 has delivered its annualized 9%-10% returns, a sabbath of compounding for the patient and the pious. Yet the index’s “simplicity” is a cruel jest. The Ten Titans, having grown from $2.5 trillion to $20.2 trillion in a decade, have turned the S&P into a theater of extremes. Consider Nvidia: a mere shadow a decade ago, now a colossus whose $4 trillion valuation dwarfs entire nations. This is not growth-it is ascension. And what of the rest of the market? A chorus of murmurs, drowned by the roar of the titans.

Let us not mince words: the S&P 500’s $34.3 trillion gain over the past decade is a testament to the Ten Titans’ dominance. Without them, the index would be a relic, its gains as unremarkable as a candle in a storm. But what price this brilliance? The very concentration that fuels extraordinary returns also births fragility. For if the titans falter-even slightly-the S&P 500 may find itself adrift, its lesser constituents needing miracles to offset the titans’ missteps.

The Illusion of Balance

The S&P 500’s transformation into a growth-centric beast is both a boon and a curse. For those who seek to double down on the Ten Titans, VOO is a convenient proxy. Yet this convenience is a double-edged sword. The fund’s 1.2% yield and premium valuation speak to a market addicted to growth, its veins clogged with the elixir of innovation. Dividend-seekers and value investors, take heed: the S&P 500 is no longer your ally. It is a tempest, and you are but a leaf in its path.

What, then, is the portfolio manager’s role in this drama? To navigate the tension between simplicity and complexity, between the allure of the titans and the necessity of balance. VOO may serve as a cornerstone, but it must be tempered-complemented by dividend stocks, high-yield ETFs, or the austere discipline of cash reserves. The investor, after all, is not merely a spectator but a participant in this existential ballet, where the stakes are not just capital, but the soul’s equilibrium.

In the end, the Vanguard S&P 500 ETF is what we make of it. A tool for the bold, a trap for the complacent. The Ten Titans, for all their might, are but reflections of human ambition-a mirror held up to our endless hunger for growth, our refusal to acknowledge the abyss. Let us invest with clarity, not delusion, and remember: the market’s greatest irony is that it rewards those who understand its madness. 🌀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-24 21:54