Alright, settle down, everybody! Eighty percent of Americans are worried about a recession? Eighty percent! That’s practically a national pastime at this point. Honestly, if you aren’t slightly anxious about the economy, you’re either a trust fund baby or you’ve been living under a rock… a very comfortable, financially-insulated rock. But here’s the deal: downturns happen. It’s like taxes and bad reality TV – inevitable. And when the market decides to do its impression of a plummeting pigeon, I’ve got two Vanguard ETFs I’ll be loading up on. Consider it my personal “get out of jail free” card… except the jail is your portfolio, and the fee is opportunity.

1. Vanguard Total Stock Market ETF

Diversification. It’s a fancy word for “don’t put all your eggs in one basket,” which, frankly, is solid advice. Unless you’re a professional basket weaver, in which case, carry on. But seriously, when the market gets the hiccups, having a broad portfolio is key. The Vanguard Total Stock Market ETF (VTI +0.61%) is my go-to. It’s like throwing a massive party for your portfolio – 3,512 stocks, to be exact! Everybody’s invited, from the tech giants to the… well, the slightly less giant companies.

Now, it is a bit tech-heavy, reflecting the market’s current obsession with all things digital. But it also has a nice mix of established companies – the ones that have been around since before smartphones were a twinkle in Steve Jobs’ eye. These are the dependable types, the ones that can weather a storm. The market has survived worse – the roaring twenties, the great depression, disco… and this ETF is built to mirror that resilience.

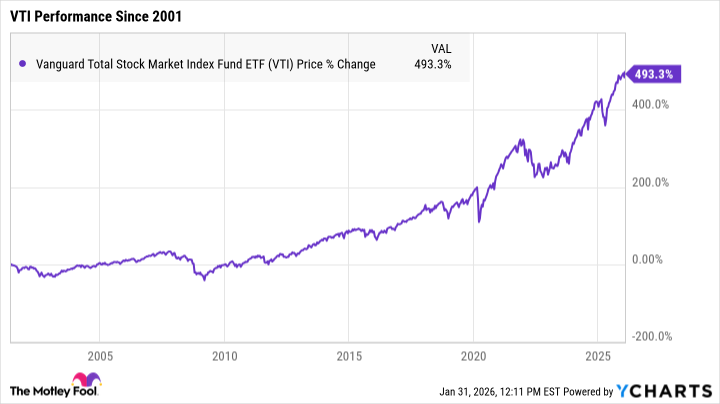

Since 2001, this ETF has delivered nearly 500% total returns. That’s right, folks, a 500% return! If you’d thrown ten grand at it back then, you’d have nearly sixty grand now. Think of the possibilities! You could buy a small island, a lifetime supply of rubber chickens, or, you know, responsibly invest for your future. The choice is yours.

2. Vanguard Information Technology ETF

Alright, now for something a little spicier. The Vanguard Information Technology ETF (VGT +0.86%) holds 320 tech stocks. Now, some people might say, “Tech stocks? During a downturn? Are you crazy?” And to that I say, “Possibly! But also, strategically brilliant!” When the market goes south, tech stocks often lead the charge… downwards. But that means they’re also the ones with the biggest potential for a rebound. It’s like a slingshot effect.

Many tech stocks are currently priced like they’re made of unicorn tears. A downturn offers a chance to snag these gems at a discount. It’s a bit like waiting for the designer clothes to go on sale… except instead of a new wardrobe, you’re building wealth. This ETF adds diversification within the tech sector. Some tech companies might not make it, but with 320 stocks, you’re increasing your chances of finding the winners. It’s a numbers game, folks!

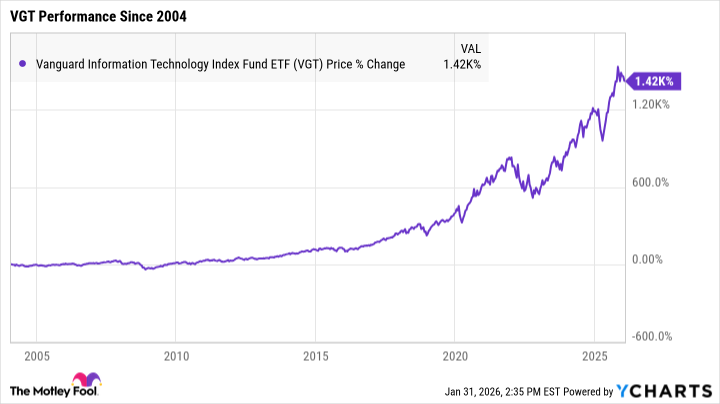

Since 2004, this ETF has soared by nearly 1,500%. That’s not a typo. 1,500%! Past performance, of course, is not a guarantee of future results. But the rise of artificial intelligence (AI) could position the tech industry for even more growth. Think of the robots! They’ll be doing all the work, and we’ll be… well, enjoying the fruits of their labor.

Nobody knows what the coming months hold for the stock market. But the right investments are key to building long-term wealth. So, buckle up, folks. It’s going to be a wild ride… but with these two ETFs, you might just come out ahead. And remember, if all else fails, you can always blame the robots.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 23:32