Time, that fickle friend of both comedians and investors, has once again proven that the best way to build wealth is to sit back, relax, and let the market do the heavy lifting-preferably while sipping a martini and pretending you’re Cary Grant. Enter exchange-traded funds (ETFs), those magical little financial kazoo instruments that let you play the stock market without needing a music degree or a stock-picking license. Vanguard, that stalwart of stodgy yet stellar investing, has five ETFs that, when combined, form a portfolio so balanced it could make a yoga instructor weep with envy. And for under $2,000? Why, that’s practically a steal-even for a guy who thinks “diversify” is a new dance move.

1. Vanguard S&P 500 ETF

The S&P 500 is the stock market’s answer to a best-of compilation album: 500 of America’s most popular companies, including the “Magnificent Seven,” who are less like Seven Dwarfs and more like Seven Deadly Sins with better stock options. But here’s the rub: You can’t invest in the S&P 500 directly, because it’s not a product-it’s a concept, like a pyramid scheme for capitalism. The workaround? The Vanguard S&P 500 ETF (VOO), which is like buying a ticket to the S&P 500’s party without needing to dress up or remember the password.

Now, the S&P 500 isn’t perfect-it’s had its share of meltdowns, like a toddler at a buffet. But history shows it always bounces back, delivering an 8% annualized return over nearly a century. So, if you want to ride the rollercoaster of capitalism without needing a helmet, this ETF is your golden ticket. Just don’t forget the popcorn.

2. Vanguard Dividend Appreciation ETF

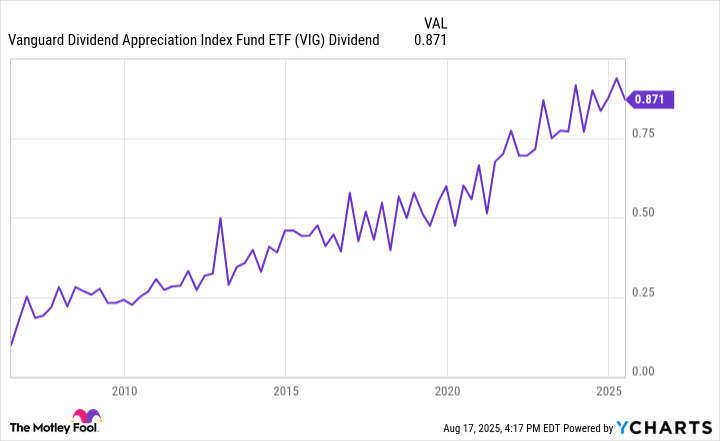

If dividends were a movie, they’d be the kind that wins Oscars for “Best Supporting Role in a Financial Drama.” The Vanguard Dividend Appreciation ETF (VIG) is your front-row seat to companies that hand out dividends like confetti at a Wall Street parade. These are the businesses that say, “Hey, we’re doing so well, we’ll throw you a few bucks just for showing up!”

With a 1.6% yield, VIG isn’t the Hulk Hogan of dividends-it’s more like the guy who wins the lottery and donates half to charity. But here’s the kicker: Those dividends grow over time, like compound interest’s more charismatic cousin. And while it’s got only two “Magnificent Seven” stocks, it’s the perfect sidekick for the rest of this list-because even comedians need a straight man.

3. Vanguard Information Technology ETF

If you want to lean into technology, the Vanguard Information Technology ETF (VGT) is your digital-age circus, complete with clowns like Nvidia, Microsoft, and Apple. This ETF isn’t for the faint of heart-it’s a tech-themed sideshow where the top three holdings make up 40% of the act. So, if you’re comfortable with the idea of “putting all your eggs in one basket,” just make sure the basket is made of semiconductors.

But fear not! After the Big Three, the ETF scatters its bets like a magician’s sleight of hand. And at 0.09% expense ratio, you’re paying less than a cup of overpriced coffee for access to this tech extravaganza. Just don’t ask it to fix your Wi-Fi.

4. Vanguard Real Estate ETF

Diversification isn’t just about companies-it’s about property, baby! The Vanguard Real Estate ETF (VNQ) is the stock market’s answer to a REIT, or Real Estate Investment Trust. It’s like owning a piece of every landlord’s dream, from suburban bungalows to hospitals that charge $500 for a Band-Aid.

With over 150 REITs and a 2.8% yield, this ETF is the financial equivalent of a real estate rumba-smooth, steady, and slightly more profitable than a timeshare in Branson. And if you reinvest those dividends? Well, you’ll be compounding your wealth like a caffeinated squirrel with a calculator.

5. Vanguard Total International Stock ETF

Last but not least, the Vanguard Total International Stock ETF (VXUS) is your passport to the global economy. It’s got 8,600 companies from 190 countries-because if you’re going to diversify, you might as well throw in a few pyramids and kangaroos for good measure.

From Taiwan Semiconductor Manufacturing to Nestlé, this ETF is a global gaggle of goose eggs, each one a potential golden goose. And at 0.05% expense ratio, it’s cheaper than hiring a translator for all those foreign financial reports. You see, dear reader, this is how you make the world your oyster-without needing a passport or a suitcase.

There you have it, folks! Five ETFs to buy, hold forever, and maybe even laugh about while doing it. Just remember: Past performance is no guarantee of future results, but if you invest in Vanguard, at least your portfolio will have style. 😄

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-21 11:39