In the grand theater of capitalism, where fortunes are won and lost like dice in a devil’s hand, exchange-traded funds (ETFs) emerge as chameleons of the financial realm. These paper beasts, with their velvet tongues and iron claws, promise wealth through diversification, risk mitigation, and the sweet, sweet alchemy of passive income. As 2026 looms-a year marked by the scent of burnt toast and the whispers of market volatility-three Vanguard funds stand poised to swallow the cautious investor whole.

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO), a creature of legend among the common folk, tracks the S&P 500 index like a hound chasing a phantom. It hoards 500 stocks from America’s most venerable corporations, a collection so vast it could rival the Library of Alexandria-if books were replaced with balance sheets. To invest in VOO is to sign a contract with the devil himself, who, for a fee, promises survival through any storm. Crestmont Research, that oracle of numbers, claims the index has never failed to recover in 20 years-a feat that would make even Job weep.

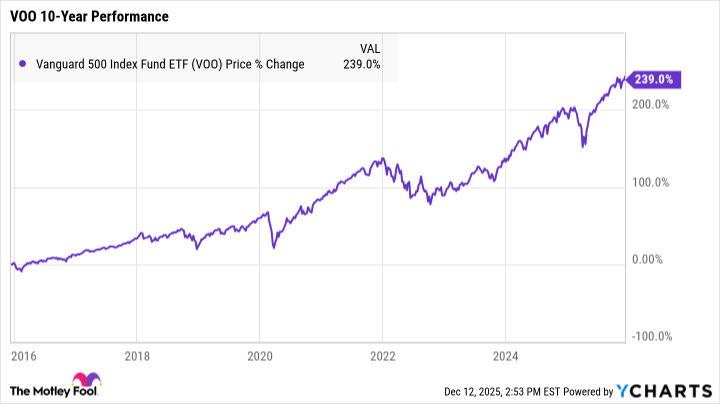

Yet, let us not delude ourselves. Short-term volatility is the market’s favorite parlor trick, a game of hot potato with shares. But given time-a decade, two-the S&P 500 ETF will rise like Lazarus from the grave of recession. Consider this: $5,000 buried in 2016 now sprouts into $17,000, a miracle of compound interest. But what is wealth if not the illusion of control?

2. Vanguard Total Stock Market ETF

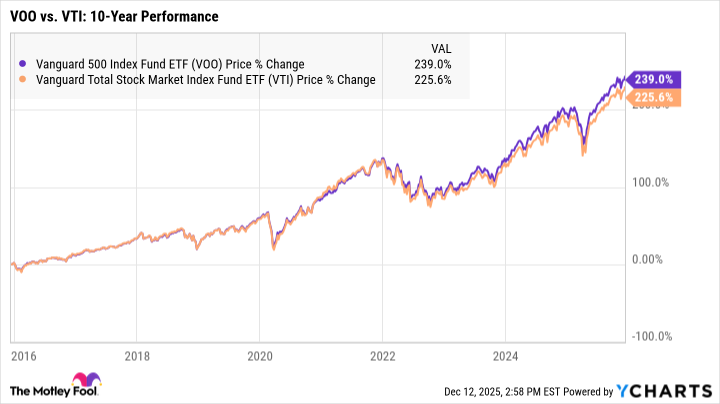

The Vanguard Total Stock Market ETF (VTI), a more voracious beast, swallows 3,531 stocks in one bite. It is the S&P 500’s gluttonous cousin, feasting on small-cap and mid-cap stocks while the aristocrats of Wall Street sip their tea. To own VTI is to claim a sliver of the entire stock market-a mosaic of chaos and order, where the fate of a single grain of sand mirrors the collapse of empires. Like its cousin, VTI boasts a history of resurrection, though its path is slower, more meandering. A severe recession may test its patience, but the market, that fickle lover, will return to its embrace.

Over the past decade, VTI has lagged behind the S&P 500, a victim of the latter’s obsession with large-cap titans like Nvidia and Apple. Yet, in the realm of small-cap stocks, there lies a spark of rebellion. A single phoenix rising from the ashes of obscurity could ignite the entire ETF, a firework in a night sky of mediocrity.

3. Vanguard High Dividend Yield ETF

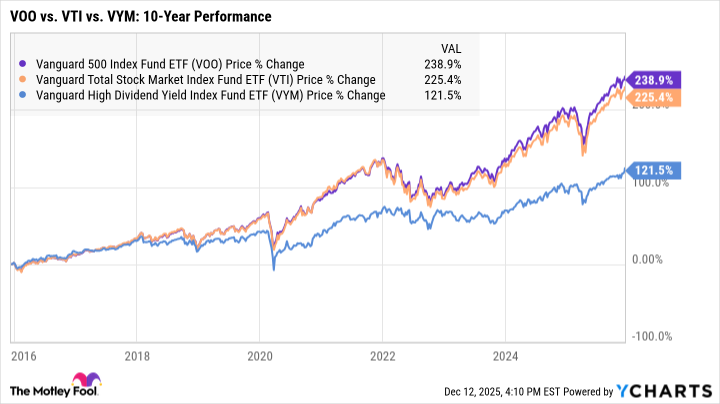

The Vanguard High Dividend Yield ETF (VYM), a miserly nobleman in a world of spendthrifts, offers a different kind of alchemy. It hoards 566 dividend-paying stocks, each a silver coin dropped in the shadow of Wall Street. Its quarterly distributions-$0.84 per share-may seem modest, but they are the breadcrumbs leading to a feast. Reinvest them, and the snowball grows, rolling toward a sumptuous winter of passive income. Yet, this fund is no paragon of returns; its strength lies in its dividends, a shield against the whims of the market’s capricious mistress.

Over the past decade, VYM has trailed its peers, a testament to the cost of caution. But in the long game, dividends are the quiet architects of wealth. They whisper, “Wait,” while the market shouts, “Gamble.”

ETFs, these financial chameleons, offer a path to wealth-or ruin-for those with the patience of Job and the stomach of a sailor. In the end, the market is a beast of contradictions: a savior and a scoundrel, a prophet and a jester. Choose your companion wisely, lest you find yourself dancing with the devil in a hall of mirrors. 👻

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2025-12-15 03:52