As a researcher with a background in blockchain technology and digital assets, I am particularly intrigued by VanEck’s announcement regarding the first Solana (SOL) ETF filing in the United States. Matthew Sigel, Head of Digital Assets Research at VanEck, has shared compelling insights into why Solana is an attractive choice for an ETF and why they consider SOL a digital commodity similar to Bitcoin and Ether.

On June 27, Matthew Sigel, VanEck’s Digital Assets Research Head, took to social media platform X (previously known as Twitter), to disclose that VanEck had submitted the first application for a Solana (SOL) exchange-traded fund (ETF) in the US. In this post, Sigel elucidated why VanEck finds Solana an attractive candidate for an ETF and considered SOL akin to digital commodities like Bitcoin and Ether.

Why VanEck Filed for a Spot Solana ETF

Sigel noted that VanEck’s intention to propose a Solana ETF is rooted in the distinctive features of Solana as a blockchain system, according to him. Solana stands out as an open-source platform capable of accommodating various applications such as transactions, trading, gaming, and social networking. Unlike several other blockchains, Solana functions with a unified global state machine without relying on sharding or layer 2 solutions, thus streamlining its design.

VanEck holds the view that Solana’s major advantages include its ability to handle large numbers of transactions swiftly and affordably. According to Sigel, this blockchain can process thousands of transactions each second with very low fees, making it an appealing choice for numerous applications. This impressive performance is reportedly due to a unique security system that combines proof-of-history (PoH) with proof-of-stake (PoS). By utilizing this combination, Solana ensures both strong security and high capacity.

Sigel pointed out that Solana’s features, including high transaction volume, affordable fees, and robust security, along with an active community, make it an enticing choice for an ETF. VanEck believes introducing a Solana-based spot ETF will offer investors access to a diverse and inventive ecosystem that caters well to the expanding needs of decentralized applications.

Why VanEck Considers SOL a Commodity

As an analyst, I’d interpret VanEck’s perspective on Solana’s native token, SOL, by saying: From my perspective as an analyst, VanEck considers Solana’s token, SOL, akin to Bitcoin and Ether in commodity terms. According to Sigel’s assessment, the primary function of SOL is to cover transaction fees and provide computational services on the Solana blockchain, similar to how Ether operates within the Ethereum network. Moreover, its liquidity and utility are showcased through its availability for trading on digital asset platforms and its use in peer-to-peer transactions.

Sigel highlighted that the Solana platform accommodates a wide range of applications and offerings, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which substantially contribute to SOL‘s usefulness and worth. Moreover, he stressed that the Solana network functions without a central authority, upholding the tenet of decentralization. The validation and maintenance of transactions and records are handled by a diverse assortment of independent validators scattered around the world, preventing any single entity from dominating the system.

Sigel underscored that SOL shares key traits with well-known digital assets, including its decentralized structure, broad utility, and economic viability. He argued that these qualities make SOL an attractive investment, development, and entrepreneurial opportunity for those looking to bypass dominant app markets and centralized systems.

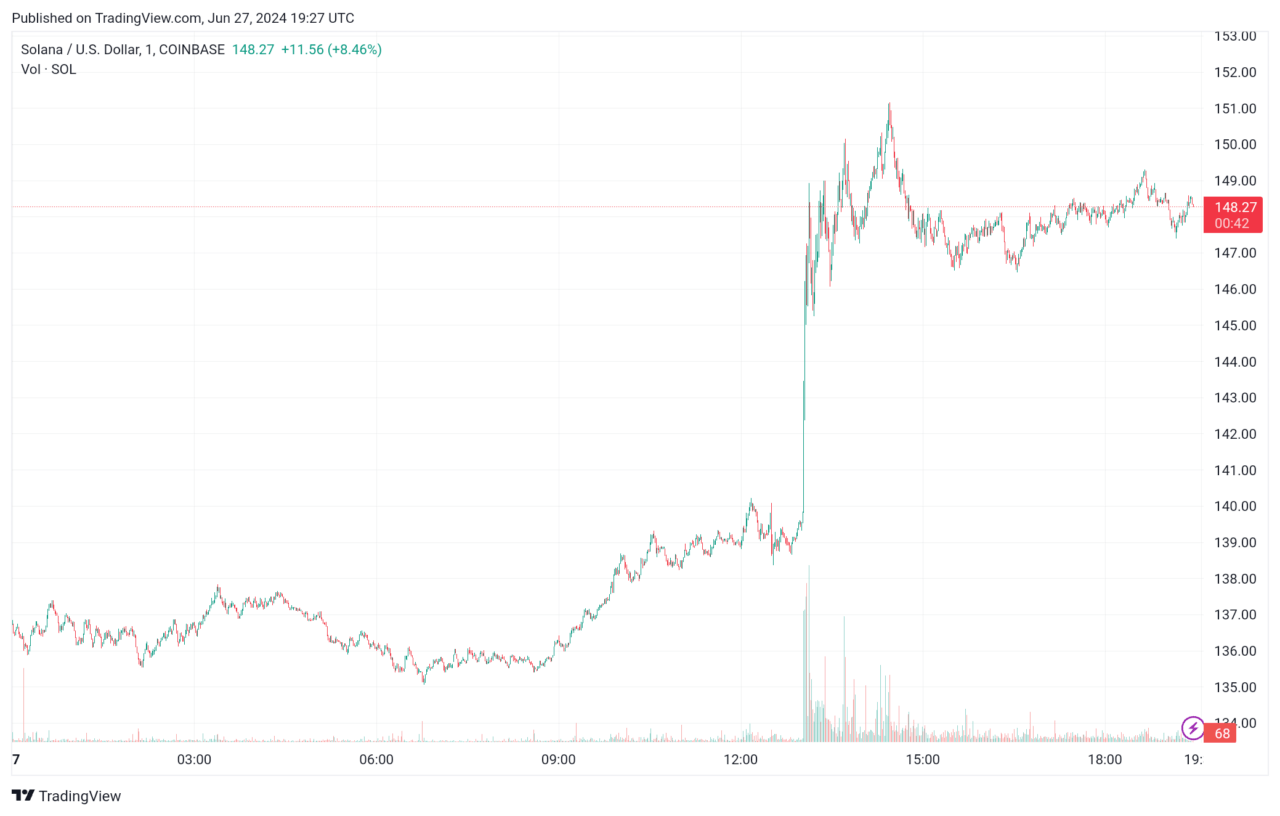

The price of Solana (SOL) experienced a significant increase of almost 9%, as shown in the graph below, following the recent announcement made by VanEck.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-06-27 22:56