As a seasoned analyst with over two decades of experience in the financial sector, I have witnessed the rise and fall of various trends. The current Bitcoin Reserve campaign in the US has certainly piqued my interest, as it represents a unique intersection of technology, finance, and politics.

The movement to accumulate Bitcoin in the U.S. is picking up steam as more entities express their backing. Endorsements from both regional and federal authorities are bolstering optimism that the U.S. hoard of Bitcoins (BTC) could one day surpass the 1 million coin mark.

Nevertheless, skeptics also exist, with some pushing that a Bitcoin reserve would be detrimental to the United States.

VanEck Joins Bitcoin Reserve Campaign

Mathew Sigel, who leads research at VanEck, declared the firm’s complete backing for a tactical Bitcoin reserve, indicating an increasing level of institutional backing for this idea.

NOW AVAILABLE: VanEck Announces Support for a Strategic Bitcoin Reservation Plan. There’s no need to rely on rumors; the information comes directly from us,” Sigel clarified.

The Bitcoin Reserve initiative, which seeks to establish Bitcoin as a nationally or state-held reserve currency, is increasingly being recognized and supported. This movement gained momentum following President-elect Donald Trump’s public endorsement four months ago.

In a speech, Trump suggested that Gary Gensler’s position at the SEC could be replaced, emphasizing the possibility of Bitcoin strengthening national reserves. He declared, “The Bitcoin Reservoir is our future,” which generated curiosity among policy-makers and financial institutions alike.

Distinguished political leaders, such as Senator Cynthia Lummis, are among those expressing their backing. Notably, Lummis has suggested the idea of selling parts of the U.S. gold reserves to purchase Bitcoin. As a long-standing proponent of Bitcoin, Lummis argues that incorporating digital currencies into the nation’s reserve assets could enhance financial stability. This proposition has drawn the interest of both political parties, with ongoing discussions in Congress regarding the feasibility of such an action.

At the same time, various U.S. states are getting involved. Florida’s Chief Financial Officer has publicly supported a strategy that involves holding Bitcoins as reserves. Similarly, legislators in Pennsylvania have proposed a bill advocating for a state-level Bitcoin reserve. These actions hint at a grassroots movement aimed at incorporating Bitcoin into government finances in a decentralized manner.

The campaign has expanded past just the United States. If elected, the libertarian leader of Poland, Sławomir Mentzen, has vowed to adopt a national strategy for a Bitcoin reserve. This promise by Mentzen highlights the global attraction of Bitcoin as a contemporary financial asset that can combat inflation and bolster financial independence.

BlackRock’s Cautious Approach

In light of the increasing popularity of the BTC Reserve initiative, global giant BlackRock, known for managing the world’s largest assets, has chosen to approach with caution. Meanwhile, financial expert VanEck endorses this idea, but according to Eleanor Terret from Fox Business, BlackRock expresses doubts about it.

According to sources familiar with the matter, BlackRock has not endorsed holding a strategic Bitcoin reserve, contrary to some recent news reports. This information was passed on by Terrett to Fox Business.

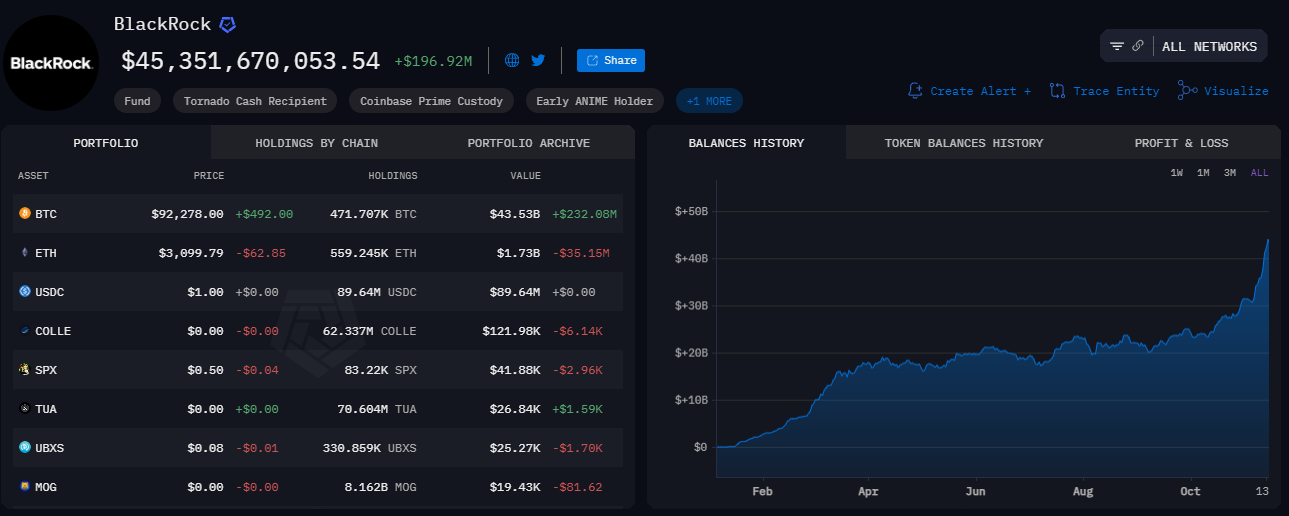

As a crypto investor, it’s clear that BlackRock’s moves in the market are anything but straightforward. The recent explosive growth of their Bitcoin ETF to over $40 billion in assets under management (AUM), breaking industry speed records, is just one example. This giant in asset management has also significantly boosted its Bitcoin presence by heavily investing in MicroStrategy, a company renowned for its massive Bitcoin holdings. They’ve gone even further, purchasing a whopping $680 million worth of Bitcoin through their IBIT ETF and direct investments.

On platform X, a user pointed out that BlackRock seems to be following the strategy of Franklin Templeton by promoting Exchange-Traded Funds (ETFs), but their ultimate goal might be tokenization.

This perspective indicates that BlackRock might be focusing more on the broader utilization of blockchain technology for asset tokenization rather than Bitcoin adoption itself. Interestingly, it’s worth noting that BlackRock now holds approximately 471,707K Bitcoins, currently valued at an impressive $43.53 billion.

Moreover, there has been further questioning regarding the possibility of a U.S. Bitcoin reserve. Financial mogul Mike Novogratz expressed his reservations, suggesting that Bitcoin’s volatility and political divisiveness make it an unlikely choice for a major government asset in the immediate future.

It’s unlikely, given that the Republicans only hold a majority, not 60 seats, in the Senate. Novogratz suggests it would be wise for the U.S. to invest more in Bitcoin, possibly even adding to what they already have. He doesn’t believe the dollar requires anything tangible to support its value.

Regardless of differing opinions, the BTC Reserve campaign has clearly picked up speed and generated interest. This interest is not limited to just policymakers worldwide, but also extends to financial institutions and private investors. We’re seeing this momentum play out through government-backed initiatives, widespread international adoption, and even institutional investments such as BlackRock’s ETF. As a result, Bitcoin’s influence within the global financial landscape is steadily expanding.

Alongside the broader economic landscape, there’s growing optimism that clear regulations for bitcoin and digital assets might be established post the US election. During his campaign, President-elect Donald Trump expressed interest in holding a strategic bitcoin reserve, while politicians favorable towards cryptocurrency won elections at both the House and Senate, from various parties. This positive economic climate coupled with supportive policies could potentially speed up and expand Bitcoin’s acceptance, as suggested by BlackRock.

vanEck’s open support, along with increasing curiosity from individuals such as Senator Lummis and influential global figures, might signal a pivotal moment when digital assets become integral components of conventional investment approaches.

In the heat of ongoing discussions, there’s still uncertainty about whether Bitcoin could eventually be the digital equivalent of gold in the future, or if its instability and doubts from influential figures such as BlackRock might prevent it from being widely accepted as a store of value.

Currently, Bitcoin has experienced a slight increase of 0.59%. According to BeInCrypto’s latest updates, the first cryptocurrency is being traded at approximately $92,207.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-11-20 09:50