As a seasoned researcher with a knack for deciphering the intricacies of financial markets and blockchain technology, I find VanEck’s proposal for a Strategic Bitcoin Reserve both compelling and thought-provoking. Having witnessed the meteoric rise of Bitcoin since its inception and observed its potential to disrupt traditional finance, I can see the merit in their argument.

A prominent investment company, VanEck, has recently proposed an idea that the U.S. could potentially reduce its national debt by up to 36% by 2050 by implementing a Strategic Bitcoin Reserves policy.

Under this plan, the strategy aligns with Senator Cynthia Lummis’s Bitcoin Act proposal, which suggests the United States should own approximately 1 million Bitcoins within the next five years. The legislator believes that such a crypto-reserve could provide future generations with greater financial stability by reducing the burden of debts they did not incur or reap benefits from.

How a Bitcoin Reserve Could Transform US Debt Management by 2050

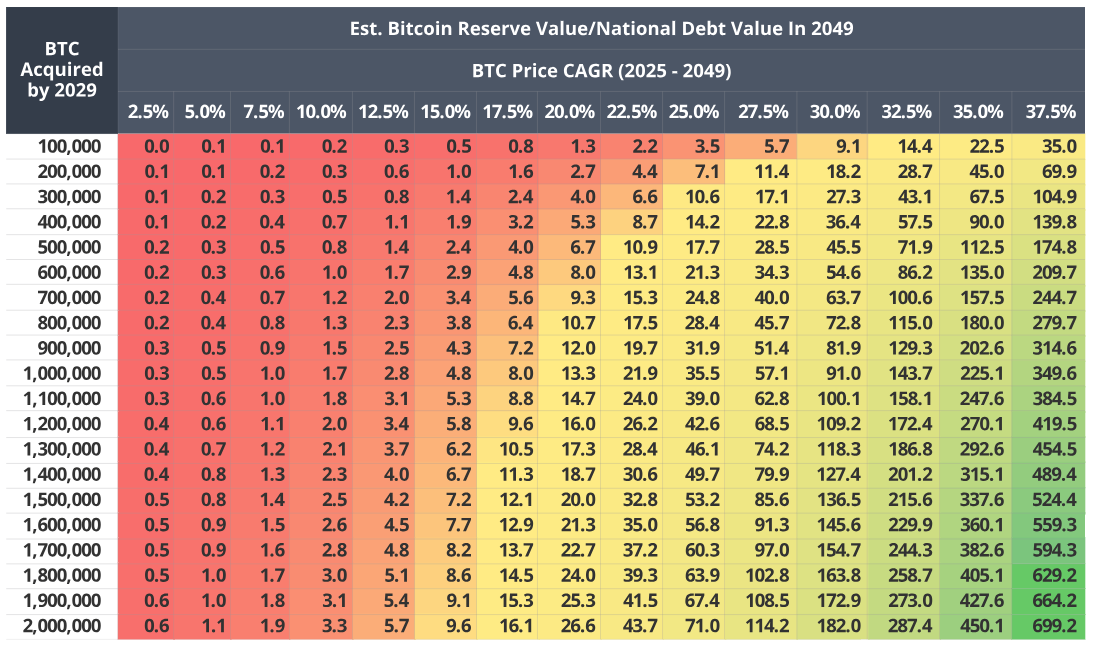

According to VanEck’s analysis, this strategy could potentially reduce national debts by approximately $42 trillion by the year 2049. This forecast is based on a constant 5% growth in debt and a yearly increase in Bitcoin value by 25%.

If Bitcoin’s value continues to rise as projected, it could soar above $42 million by the year 2049, positioning it as a significant force in the international financial marketplace.

Given that the entire world’s financial assets currently stand at around $900 trillion and grow at a rate of 7.0% between 2025 and 2049, our analysis suggests that Bitcoin would make up approximately 18% of these global assets under this specific growth scenario.

Matthew Sigel, the head of research at VanEck, underscored Bitcoin’s possible impact on transforming the worldwide financial structure. He proposed that Bitcoin could emerge as the primary medium for settling global trades – offering a substitute to the U.S. dollar – particularly beneficial for nations aiming to bypass U.S. sanctions.

Sigel suggested that it’s quite plausible that Bitcoin may become a popular medium for international trade transactions among nations aiming to bypass the escalating US dollar sanctions.

To kickstart this ambitious project, VanEck recommends several preliminary measures, including stopping the sale of Bitcoin from US asset forfeiture reserves.

Additionally, it’s proposed that changes might occur under the new administration of President Donald Trump, including reassessing gold certificates based on their present market values and employing the Exchange Stabilization Fund for an initial investment in Bitcoins.

Certainly, following these steps can expedite the process of setting up the reserve, as it may not require a long wait for comprehensive legal authorization.

Nevertheless, the idea has faced some criticism. Venture Capitalist Nic Carter expresses doubt that creating a Bitcoin reserve would actually strengthen the U.S. dollar. In contrast, Peter Schiff advocates for the development of a new digital currency called the USAcoin as an alternative solution.

Schiff proposed a concept where the U.S. might significantly cut costs by introducing USAcoin, a digital currency resembling Bitcoin. The production of USAcoin could be limited to 21 million units, similar to Bitcoin, but with improvements to its blockchain system, making it practical for everyday transactions.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-22 21:50