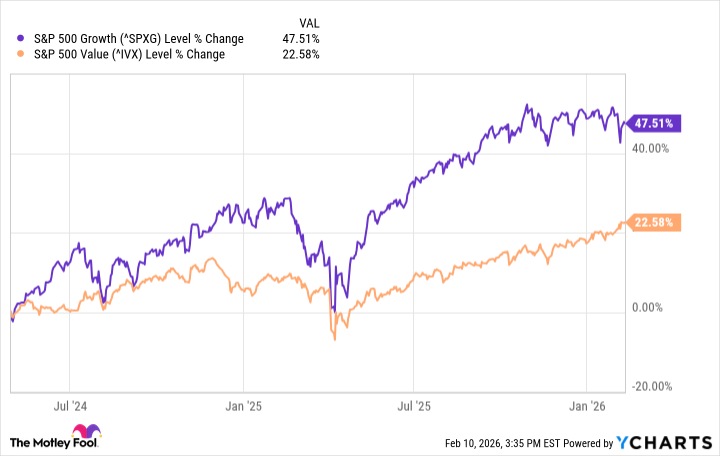

The recent exuberance for growth stocks—a feverish dance around the altar of artificial intelligence—has, predictably, cast a rather long shadow upon the more demure charms of value. Since the vernal equinox of 2024, the S&P 500 Growth Index has rather thoroughly trounced its value counterpart, a performance fueled by the shimmering mirage of algorithmic futures. One suspects, however, that markets, like capricious lepidopterists, are rarely content to pursue a single specimen indefinitely. The pendulum, as it were, begins its inevitable arc.

The self-correcting mechanisms of the market—often as subtle and insidious as the fading of a daguerreotype—are at work. It would not be imprudent, therefore, to consider a re-allocation of capital, a gentle tilting of the portfolio towards those undervalued entities that have been languishing in the periphery. Herewith, a trio of specimens, poised, perhaps, for a decade of subtle bloom.

1. Uber Technologies: The Ride to Respectability

To classify Uber Technologies as a ‘value’ stock feels, at first glance, a touch paradoxical. The company’s top line, after all, continues to exhibit a rather vigorous growth rate, a twenty percent ascent in the most recent quarter. Yet, priced at a mere sixteen times last year’s earnings—and a scarcely more extravagant seventeen times next year’s projected profit of around $4.33—Uber, for the moment, presents a rather intriguing proposition. A temporary dip, a twenty-five percent pullback from September’s peak, has created an opportunity, a momentary lapse in the market’s collective attention. Perhaps the anxieties surrounding slowing growth and the costly ambition of a robotaxi fleet have unduly dampened enthusiasm.

One must, however, maintain a longer perspective. Autonomous transportation is not a fleeting fancy, but a fundamental shift in the industry’s trajectory. Precedence Research forecasts a staggering 52.5% annualized growth rate for the robotaxi market through 2034. Uber, positioned to capture a significant share of this burgeoning market, is, in essence, a rather ordinary vessel containing an extraordinary future. It is a matter of discerning the substance from the shadow.

2. Merck: Beyond the Keytruda Kingdom

Merck, the pharmaceutical behemoth, has allowed itself to become, shall we say, overly reliant on Keytruda, its cancer-fighting flagship. This single drug now accounts for nearly half of the company’s revenue—a rather precarious dependence, particularly as its patent protection wanes in a mere two years. This reality, as it often does, has begun to exert its influence on the ticker’s performance. However, to assume stagnation is to underestimate Merck’s proactive efforts to diversify its portfolio. Through strategic acquisitions—Prometheus in 2023, Cidara more recently—the company is diligently reloading its pipeline, anticipating a $70 billion influx of new yearly revenue by the mid-2030s.

Valued at a modest twelve times next year’s projected earnings, Merck offers ample room for the market to recognize this impending transformation. It is a company, in essence, undergoing a chrysalis stage, poised to emerge with a more resilient and diversified form.

3. Bank of America: A Fortified Bastion

Finally, let us consider Bank of America. Its inclusion on a list of ‘value’ stocks may raise an eyebrow or two. The shares have, admittedly, more than doubled in value since their late-2023 nadir. Yet, the anticipated decline in interest rates—a prevailing narrative for the coming years—presents a headwind for banks, constricting their profit margins. Furthermore, the credit market itself is showing signs of strain, with loan delinquencies reaching near-decade highs.

However, one must remember that economic cycles, like the tides, are predictable in their irregularity. The current headwinds, one suspects, are already largely factored into the stock’s price, while the potential for a rebound remains largely unappreciated. Investors stepping in now will be acquiring a fortified bastion, valued at a mere thirteen times this year’s expected earnings—a rather modest price for a company poised to benefit from the inevitable upswing.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Games That Faced Bans in Countries Over Political Themes

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

- Top 20 Educational Video Games

2026-02-14 13:33