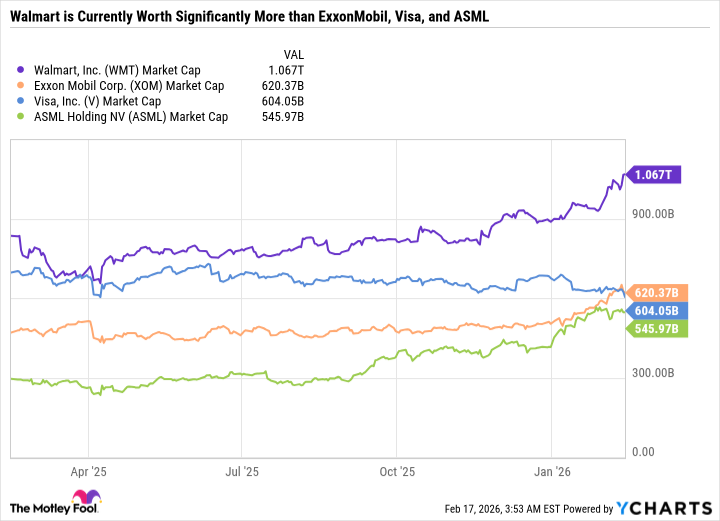

Walmart (WMT 1.52%) recently exceeded a $1 trillion market capitalization, joining an exclusive cohort of U.S. corporations. While this achievement is noteworthy, a comparative assessment of valuation multiples and growth trajectories suggests potential for relative underperformance over the next five years. This analysis identifies ExxonMobil (XOM 2.58%), Visa (V +0.76%), and ASML (ASML +0.77%) as exhibiting characteristics conducive to outpacing Walmart in total shareholder return.

Walmart: Elevated Valuation and Constrained Growth

Walmart’s resilience in the face of sector-wide headwinds affecting consumer staples is acknowledged. However, the current forward price-to-earnings (P/E) ratio of 45.2 appears extended, particularly when juxtaposed with the S&P 500 average of 23.6. The premium assigned to Walmart exceeds that of the so-called “Magnificent Seven,” with the notable exception of Tesla. This suggests the market has already priced in a substantial degree of future growth, leaving limited margin for positive surprise.

Consequently, a scenario of relative underperformance is anticipated, with ExxonMobil, Visa, and ASML representing potentially more compelling investment opportunities.

1. ExxonMobil: A Resurgent Energy Value Proposition

ExxonMobil has demonstrated robust performance in recent periods, aligning with broader strength in the energy sector. Despite this appreciation, the equity continues to present a compelling value proposition. The company’s expectations of double-digit earnings and cash flow growth, even at moderate oil prices, are underpinned by a high-quality production portfolio and anticipated increases in global energy demand.

A consistent program of share repurchases and dividend increases, spanning 43 consecutive years, further enhances shareholder returns and provides a measure of downside protection. ExxonMobil’s higher dividend yield and favorable valuation metrics, coupled with its potential for accelerated earnings growth, position it as a potentially superior investment to Walmart.

2. Visa: Capitalizing on the Secular Growth of Digital Payments

While investor attention has focused on defensive equities like Walmart amidst market volatility, Visa presents a compelling alternative. The company operates a high-margin business model characterized by consistent earnings growth and a robust competitive position. Unlike Walmart, which relies on volume to drive revenue, Visa benefits from a fee structure that leverages both transaction volume and frequency.

Critically, Visa does not bear credit risk, mitigating potential losses and allowing for consistent capital allocation towards share repurchases and dividend increases. The current valuation, at 24.4 times forward earnings and a price-to-free-cash-flow ratio of 26.8, appears reasonable for a company with Visa’s characteristics and growth prospects.

3. ASML: A Key Enabler of Artificial Intelligence Infrastructure

Despite recent volatility in the technology sector, ASML has demonstrated resilience, posting substantial year-to-date gains. The company’s leadership position in lithography, a critical step in the manufacturing of advanced semiconductors, is underpinned by secular demand for artificial intelligence (AI) infrastructure.

While the current valuation of 40.2 times forward earnings may appear elevated, it remains comparable to, and arguably justified relative to, Walmart’s multiple. ASML’s superior growth prospects, driven by the increasing demand for AI chips, position it as a potentially superior investment over the next five years. The company offers investors a direct exposure to the growth of AI without the need to select a specific chip manufacturer or cloud computing provider.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Wuchang Fallen Feathers Save File Location on PC

- 9 Video Games That Reshaped Our Moral Lens

2026-02-22 23:12