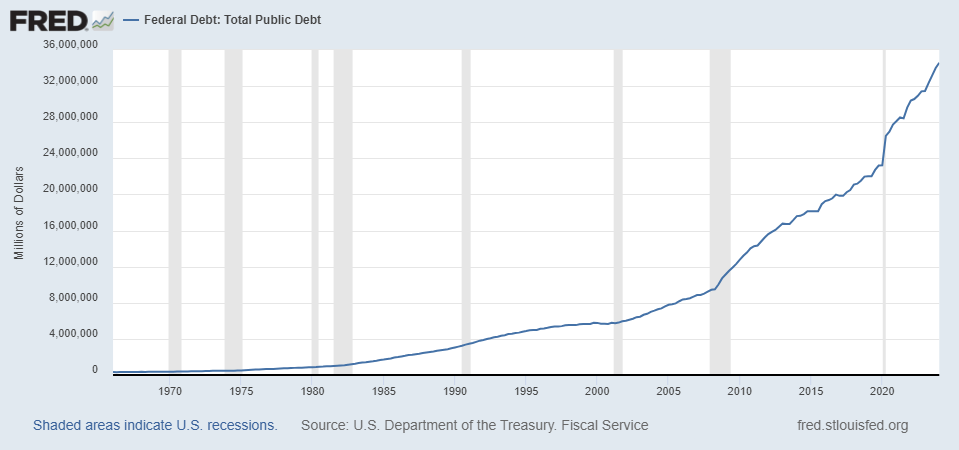

As a seasoned financial analyst with over two decades of experience in the industry, I find myself increasingly alarmed by the latest developments in the US debt and cryptocurrency markets. The fact that the US national debt has surpassed $35 trillion at a time when financial markets are experiencing unprecedented growth and Bitcoin is nearing the $70,000 mark, leaves me with a sense of unease.

The US national debt has reached over $35 trillion for the first time, an achievement that comes as financial markets continue to rise. Meanwhile, Bitcoin is approaching $70,000 following a significant address from ex-US President Donald Trump at the Bitcoin 2024 conference in Nashville.

Based on information from an American debt monitoring resource, the United States owes over $35 trillion, translating to approximately $100,000 for every citizen, and around $267,000 per taxpayer. The country’s debt-to-Gross Domestic Product (GDP) ratio has reached 122.55%, representing a significant increase from 56.8% in the year 2000 and 34.6% in the late 1980s.

Amidst recent market surges, there’s growing unease as the Federal Open Market Committee (FOMC) gathers this week. Investors are particularly focused on Federal Reserve Chair Jerome Powell, whose influential statements can significantly impact both traditional and cryptocurrency markets.

At this monetary policy meeting, the Federal Reserve is not expected to lower interest rates. However, the way Chair Powell speaks during his post-meeting press conference will be closely watched for any hints about future rate adjustments from the central bank. Most market observers are fixated on the September gathering, where rate decreases have already been largely factored in.

Based on data from the CME Group’s FedWatch tool, investors currently predict a high probability, approximately 96%, of an interest rate reduction in September. Such a move often brings about increased liquidity in financial markets, which can be beneficial for assets considered risky, such as cryptocurrencies.

Based on my extensive experience in financial markets and analysis, this week’s economic calendar is particularly noteworthy for its dense array of data points. Many companies within the S&P 500 index will be reporting their earnings during this period. These reports can significantly impact market trends due to the potential volatility they introduce. In my career, I have witnessed firsthand how unexpected earnings results from major corporations can lead to substantial shifts in stock prices and overall market sentiment. Therefore, staying informed and prepared is crucial for anyone involved in investing or financial analysis.

At the Bitcoin 2024 conference, Trump recently delivered a speech in which he outlined his vision for making the US the global leader in cryptocurrency, particularly Bitcoin, declaring that “we will be the crypto hub of the earth and the Bitcoin dominion of the world, and we’ll make it happen.” Since his speech, Bitcoin has experienced a notable increase in value.

If Donald Trump gets elected as the next president, he has promised to put an end to the “anti-crypto campaign” spearheaded by President Joe Biden and Vice President Kamala Harris. He intends to act swiftly, announcing that on his inauguration day, he will fire Gary Gensler, who currently chairs the U.S. Securities and Exchange Commission (SEC).

Important to mention, the President of the United States lacks the power to dismiss commissioners appointed to the Securities and Exchange Commission (SEC). Instead, they can designate a new commissioner for the position.

Trump revealed intentions to set up a “presidential advisory body focused on Bitcoin and cryptocurrencies” and voiced his desire for all remaining Bitcoins to be mined domestically in the US. He also highlighted the significance of preserving the individual right to hold and safeguard their own digital currency assets.

After Trump’s speech, Senator Cynthia Lummis (R-Wy) put forth a legislative plan for the US Federal Reserve to acquire approximately 1 million Bitcoins within the next five years. The Bitcoin would then be kept in reserve for a minimum of 20 years. This proposed action aims to employ the digital currency as a tool to help decrease the national debt.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-07-29 17:58