This ruling concludes a heated court case and stirs debate over its effects on the digital currency sector. The financial community shows signs of unease, as if the transaction proceeds, it might lead to a significant drop in Bitcoin‘s value.

Federal Approval and Legal Context

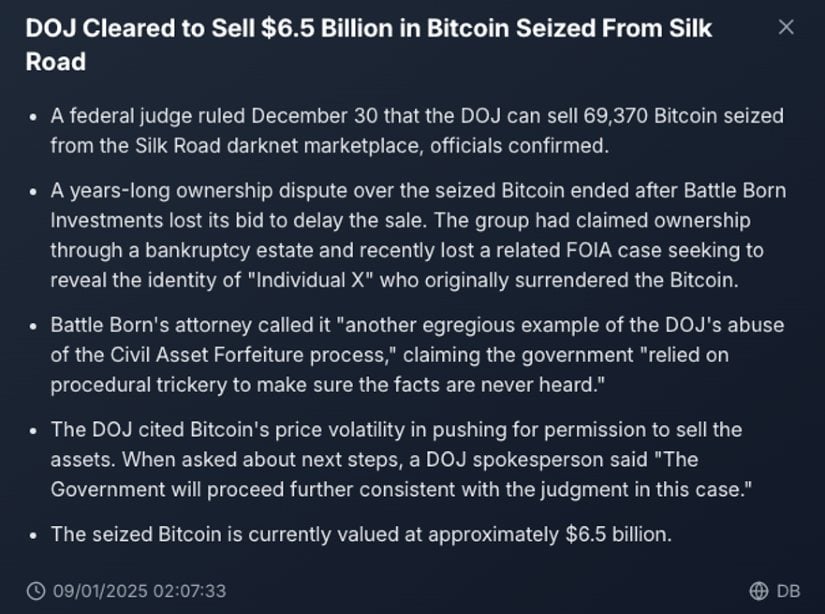

On December 30, 2024, a federal judge allowed the Department of Justice to move forward with selling the confiscated assets, as reported by DB News. This judgment brings an end to a lengthy legal battle between Battle Born Investments, who asserted ownership of the Bitcoin via a bankruptcy estate. Battle Born had maintained that they held legitimate claims due to their connection to an individual suspected of misusing funds from Silk Road.

After taking the case to various courts up to the U.S. Supreme Court, Battle Born’s arguments ended up being rejected. Their legal representative expressed dissatisfaction with the Department of Justice’s management of the situation, accusing them of improper procedures.

Strategic Implications and Market Impact

The liquidation coincides with the changeover to a new government. President-elect Donald Trump has suggested creating a “Strategic Bitcoin Reserve,” much like the Strategic Petroleum Reserve, as a means to control digital assets seized and reduce potential economic risks. This policy suggests a possible change in how confiscated cryptocurrencies might be managed in the future; however, it is unclear whether the existing Bitcoin holdings will be incorporated into this reserve.

Concerns have arisen regarding the impact on Bitcoin market prices following the choice to offload a substantial amount of this cryptocurrency. Previously, major Bitcoin sales carried out by government bodies were executed incrementally, aiming to reduce any potential disturbance in the market.

Ki Young Ju, the CEO of CryptoQuant, calmly informed investors that the $6.5 billion sale could comfortably be handled by the market within a week due to its robust capacity. He explained, “Last year, approximately $1 billion worth of funds entered the market daily based on realized capitalization—equivalent to $379 billion in total. This means the U.S. government’s $6.5 billion sale could be easily absorbed in just a week.

Bitcoin Price Retreats Below Six Figures

Although it’s officially acknowledged that the Department of Justice (DOJ) can sell its Bitcoin holdings, various contradictory reports have surfaced. Analysis of the blockchain indicates no transfer of funds from the related Bitcoin wallet, which continues to possess 69,370 BTC. On the other hand, some alternative sources, including crypto influencer @trading_axe, assert that the Bitcoin has already been dispersed via Coinbase. These contentions are yet to be substantiated.

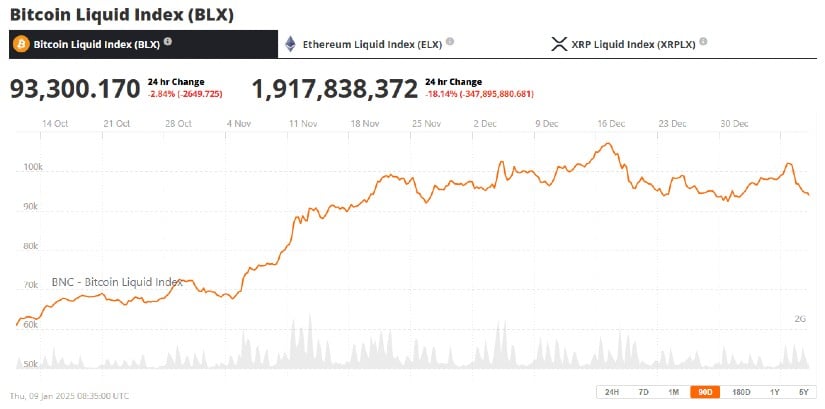

Currently, Bitcoin’s value is hovering near $93,300 after briefly reaching over six figures on January 7th. However, it has since experienced a drop, decreasing by about 2% for the day. Some analysts are predicting that if the price falls below $90,000, which currently serves as its lower boundary within the consolidation channel, there might be an increase in selling due to panic.

Bottom Line

The Department of Justice’s decision to allow the sale of Bitcoin from the Silk Road case demonstrates the growing relationship between cryptocurrencies and law enforcement. This move emphasizes the difficulties involved in managing seized digital assets within a fluctuating market. Although the market seems unfazed by this news, how these assets are eventually sold or held will continue to spark interest among investors, policymakers, and industry participants. These discussions about regulatory strategies and market stability could dominate conversations in the cryptocurrency world for several months ahead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-10 13:10