As a seasoned crypto investor with over a decade of experience navigating the volatile waters of the digital asset market, I find myself intrigued by the latest developments concerning Bitcoin and its potential role in government reserves. The US government’s current stance on Bitcoin is reminiscent of a cat that has caught the proverbial mouse but isn’t quite sure what to do next.

The possibility of an expanded Bitcoin reserve policy is indeed interesting, and it would be fascinating to see how this unfolds. I’m particularly intrigued by Wyoming Senator Cynthia Lummis’ ambitious plan to accumulate a million BTC over five years. While I don’t believe this will materialize in 2025, it does underscore the growing recognition of Bitcoin’s potential role in national economies.

It’s worth noting that while the federal government is treading cautiously, several US states are showing a more proactive approach towards embracing digital assets. The Texas Strategic Bitcoin Reserve Act and Pennsylvania’s proposed legislation to invest in Bitcoin as a hedge against economic uncertainty are clear indicators of this trend.

If implemented, these state-level initiatives could have profound implications for the market and the wider economy. A commitment from the US government to purchase Bitcoin could drive up demand and prices, setting a global precedent for other nations to follow suit. This could lead to a digital gold rush, with countries vying to establish their digital reserves before the next big thing comes along – perhaps Dogecoin or Shiba Inu.

From a geopolitical perspective, a strategic Bitcoin reserve could strengthen the US’s position in the global digital economy and provide a counterbalance to the increasing exploration of central bank digital currencies by other countries. It’s a bit like the old Cold War days, but now it’s about who controls the digital realm rather than nuclear arsenals.

In conclusion, while the US government may not be buying more Bitcoin in 2025, their ongoing discussions and potential future policies highlight the growing importance of cryptocurrencies in national economic strategies. This evolving landscape signals a more significant institutional adoption of Bitcoin, with state governments and corporations likely to take the lead as they explore the strategic value of digital assets in a rapidly changing financial environment.

And on a lighter note, who knows? Maybe one day we’ll see Bitcoin listed as a reserve asset next to gold and US dollars – but for now, I’m just holding onto my meme coins and hoping for the best!

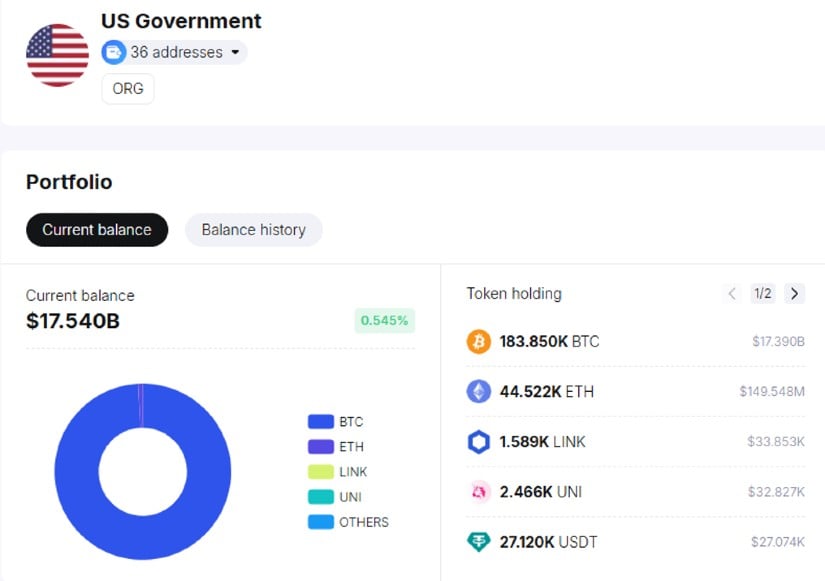

Based on recent studies, it’s been found that the U.S. government presently owns around 183,850 Bitcoins, which equates to roughly $17.36 billion. This wealth was mainly amassed through confiscations from cases like Silk Road. These Bitcoin holdings are kept in various known wallets. Some people have suggested that the government might augment its Bitcoin reserves, but according to Alex Thorn, head of research at Galaxy Digital, no additional Bitcoin purchases are anticipated within the next year.

Bitcoin Reserve Policy: A Future Possibility

Despite the likelihood of no new Bitcoin purchases, the report suggests that government agencies might consider broadening their Bitcoin reserve policy. Thorn hinted at potential internal debates within different departments about finding ways to leverage the government’s current Bitcoin holdings in future plans. These talks could lead to a more structured and formal Bitcoin reserve policy in the future.

A proposed policy, originating from Senator Cynthia Lummis of Wyoming, is the Bitcoin Act 2024, under which the U.S. government would acquire 200,000 Bitcoins annually for five consecutive years, amassing a total of one million Bitcoins as a reserve. However, with the current circumstances, it appears unlikely that this far-reaching plan will be implemented in 2025.

The cautious approach taken by the U.S. government regarding Bitcoin could potentially influence the global acceptance of Bitcoin. Japanese Prime Minister Shigeru Ishiba has expressed that Japan will hold off on making a firm decision about Bitcoin assets until they have a clearer understanding of the U.S.’s plans. Changpeng Zhao, former CEO of Binance, suggests that smaller countries may be the first to embrace Bitcoin reserves, with China eventually following suit over time.

State-Level Bitcoin Adoption Gaining Momentum

As the federal government adopts a cautious stance, several U.S. states are more eagerly exploring the idea of incorporating Bitcoin into their financial reserves. States like Ohio, Texas, and Pennsylvania have either proposed or initiated legislation that enables state treasuries to invest a portion of their reserves in Bitcoin. This increasing curiosity at the state level suggests a potential pathway for Bitcoin’s integration into formal financial systems.

As a crypto investor, I’m following the recent developments regarding the integration of Bitcoin into state reserves. For instance, the Texas Strategic Bitcoin Reserve Act proposes that the state should hold Bitcoin for at least five years as part of its reserve assets. Similarly, a bill in Pennsylvania is considering allowing their treasury to allocate up to 10% of its balance sheet towards Bitcoin, viewing it as a potential safeguard against economic volatility.

Impacts of a Bitcoin Reserve Policy

The possibility of establishing a formal Bitcoin reserve policy, either at the state or national level, could bring about substantial changes in both the market and the broader economy. If the U.S. government were to declare its intention to buy Bitcoins, this could boost demand, leading to higher prices. Such a move might also establish a global trend, prompting other countries, especially those with vast sovereign wealth funds or those aiming to diversify their financial holdings, to adopt similar policies.

Having a strategic reserve might significantly impact international politics as well, bolstering the United States’ influence within the worldwide digital economy. It also serves as a balancing force against the rising adoption of central bank digital currencies (CBDCs) by various nations.

Shaping the Future of Bitcoin in the National Economy

In 2025, it’s not expected that the U.S. government will buy more Bitcoins, but their ongoing conversations about Bitcoin reserves and the possibility of a future policy suggest that cryptocurrencies are becoming increasingly significant in national financial plans. They might choose to maximize the impact of their current holdings or even establish a systematic purchasing strategy. The U.S.’s position on Bitcoin will have a profound effect on global market trends, ultimately shaping the destiny of digital currencies.

The shifting terrain indicates a larger embrace of Bitcoin by institutions, with governments and major companies expected to spearhead this adoption due to their exploration of the potential strategic benefits of digital currencies in an ever-evolving monetary landscape.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-29 12:36