With a fresh administration taking over at the White House, there’s growing enthusiasm among industry specialists regarding a potentially favorable stance towards digital assets within the U.S. They anticipate increased regulatory certainty and a nurturing atmosphere for advancements in cryptocurrency technology.

In a conversation with BeInCrypto, Aaron Basi (IoTeX’s head of product) stated that the recent shift in U.S. cryptocurrency policy could inspire other countries to adopt similar strategies and foster growth within their own crypto industries.

Crypto Industry Remains Eager

In preparation for another term as president, Donald Trump has initiated various steps to convince the cryptocurrency sector that under his leadership, the U.S. aims to become the global leader in digital currencies – a promise he made during his election campaign.

Among the steps taken were several crucial personnel decisions. In early December, Trump bestowed the title of “Crypto Czar” upon David Sacks for the White House. David Sacks, a seasoned entrepreneur and investor with more than two decades under his belt in Silicon Valley, is anticipated to contribute a wealth of experience to this position.

Additionally, Trump chose Paul Atkins, who is supportive of cryptocurrencies, to take over from Gary Gensler as the head of the Securities and Exchange Commission (SEC). This decision was met with enthusiasm by crypto supporters, and the market responded promptly with increases in value.

Trump appointed Stephen Miran, a previous Treasury official under his administration, to head the Council of Economic Advisors (CEA). Known as a strong proponent for digital currencies, Miran has advocated for regulatory changes within the U.S. in the past.

Over an extended period, the United States was perceived as a potentially hazardous location for cryptocurrency ventures due to its inconsistent and sometimes conflicting regulations. However, as the regulatory landscape becomes more transparent and consistent, it will convey a strong signal: the US is welcoming innovation within the crypto sector, according to Aaron Basi’s statement to BeInCrypto.

As such, the crypto industry awaits this transition with high expectations.

What a Strategic Bitcoin Reserve Could Mean for the United States

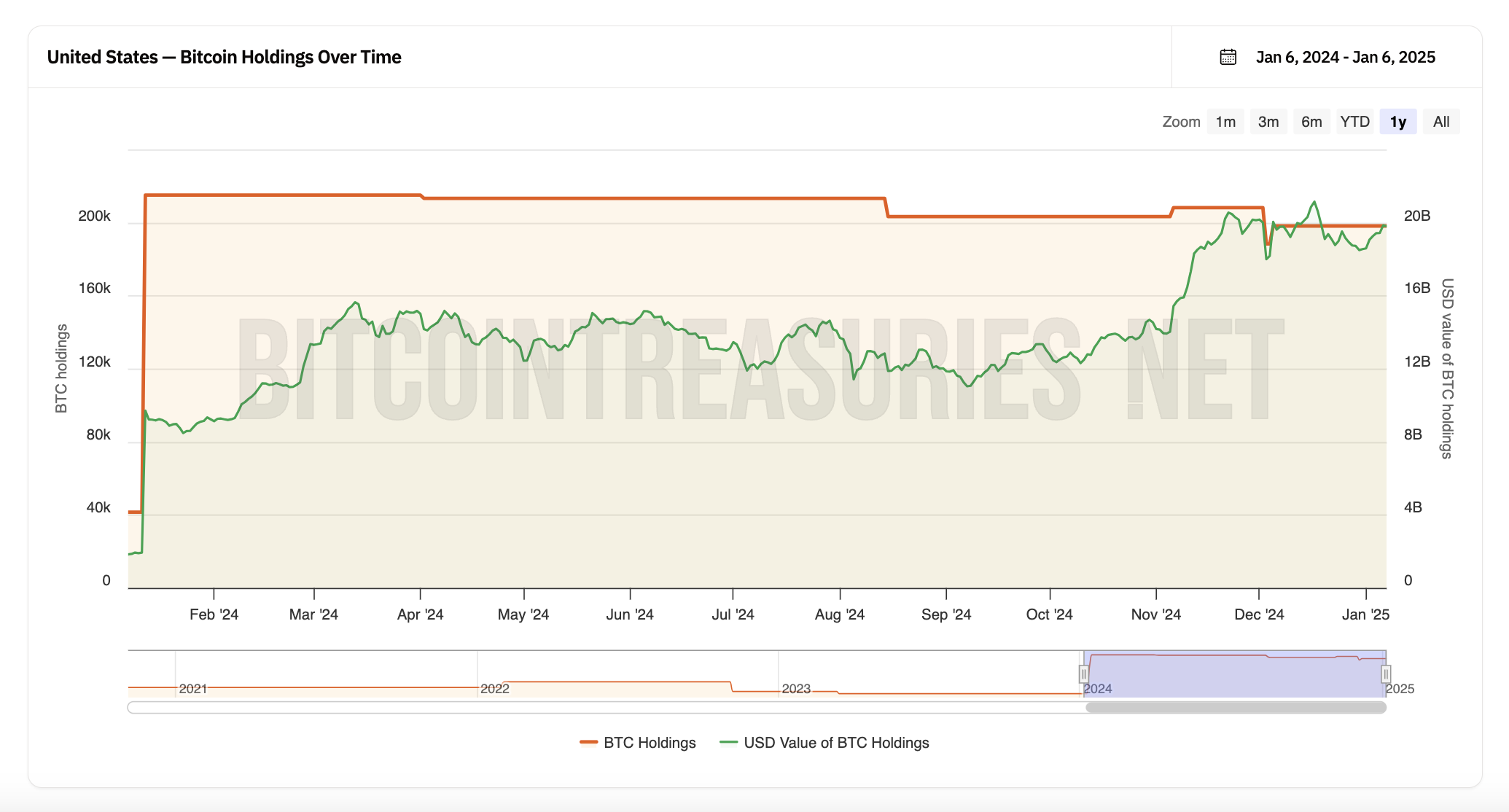

During his campaign, one of Donald Trump’s pledges involved setting up a strategic Bitcoin reserve.

My administration intends to maintain a full ownership of all Bitcoins currently held by the U.S. government, as well as any future acquisitions. This will create a fundamental reserve of Bitcoin, serving as our strategic national stockpile. At the Bitcoin 2024 conference in Nashville, Trump stated, ‘We will ensure that this asset is not taken away from us.’

Supporters of Bitcoin maintain that by controlling this so-called “digital gold,” known as Bitcoin, the U.S. can demonstrate its financial dominance over other nations, holding the most powerful global digital asset.

Supporters believe that Bitcoin could act as a protective measure against rising prices and weakening currencies. However, skeptics warn of potential dangers due to its price fluctuations and complications in regulation.

Under Gary Gensler, the notion of a Bitcoin reserve seemed implausible. However, with a Trump presidency, this idea doesn’t appear quite so outlandish anymore. Yet, it does provoke some worries, according to Basi.

He stated that the effect on the market would be substantial. To begin, it could boost institutional adoption even more as businesses and nations rush to mimic the US’s actions. This action may decrease the supply of Bitcoin available in the open market, which might cause price increases due to heightened scarcity. However, it could also generate worries about government control over Bitcoin and how this aligns with its decentralized ideals. Questions may arise: is Bitcoin still “by the people” if it’s held in government vaults?

Some legislators are currently proposing bills aimed at establishing government-supported Bitcoin reserves. Yet, it’s unclear how swiftly such a change might occur on the federal level under President Trump’s administration.

Concerns over the Centralization of Bitcoin

Discussions about establishing a strategic Bitcoin reserve ignite discussions on whether Bitcoin’s fundamental decentralized essence can coexist with government adoption, stirring debate.

Basi pointed out that while greater institutional adoption can lead to benefits such as increased stability, improved liquidity, and enhanced legitimacy in the market, it also raises questions about centralization. This is because when large institutions or governments control significant amounts of Bitcoin, they have a considerable impact on the market, which could potentially contradict Bitcoin’s decentralized principles.

As a crypto investor, I ponder over the potential implications if a government decides to incorporate Bitcoin into its reserves. Such a move might trigger various outcomes. For instance, the worth of Bitcoin could be stabilized and tied to established assets like the U.S. dollar or gold, thereby influencing its volatility and value in the market.

A possible connection between various factors might restrict Bitcoin from fully functioning as a genuinely autonomous resource. Powerful entities, such as central governments or institutions, could potentially influence Bitcoin by regulating its availability and market trends to reach particular economic goals on a larger scale.

What would remain unmanipulatable, however, is Bitcoin’s network itself.

As a crypto investor, I’ve come to appreciate the design of the Bitcoin protocol, mining distribution, and community governance that ensures no single entity can seize control. However, the potential risk lies not in actual control but perception and accessibility. If large institutions hoard too much Bitcoin, it could limit chances for retail investors and smaller players to actively engage. The task at hand is striking a balance – welcoming institutional involvement while maintaining Bitcoin’s accessibility for all.

As I delve into the realm of Bitcoin, I can’t help but notice the advantages that institutional adoption brings: it fosters stability and legitimacy. However, this very adoption also stirs apprehensions about potential centralization. This realization underscores the importance of a cautious strategy that safeguards the inherently decentralized essence of cryptocurrencies.

Increased Opportunities for Altcoins

As the cryptocurrency sector gears up for a more active involvement with digital currencies, Basi anticipates that institutions will broaden their interest in crypto beyond just Bitcoin, exploring various alternative coins (altcoins) as well.

Since Bitcoin is currently the most well-known digital currency among traditional financial institutions, it often serves as a secure starting point for venturing into the world of cryptocurrencies. However, with increasing adoption, curiosity towards other digital assets is also likely to grow.

For instance, consider Solana. Due to its emphasis on scalability and affordable transaction fees, it’s become popular among decentralized finance (DeFi) initiatives. On the other hand, Ripple (XRP) is addressing the complex issue of international money transfers,” Basi explained.

A significant factor contributing to a digital asset’s strength lies in its ability to offer practical uses, or utility. Numerous cryptocurrency initiatives have demonstrated their usefulness by displaying applications in real-world scenarios. Basi specifically pointed to Decentralized Physical Infrastructure Networks (DePINs) as an illustrative example of this utility in action.

DePINs utilize the power of blockchain technology, with smart contracts for streamlined resource allocation and token systems to motivate engagement. This structure emphasizes decentralization, as it relies on a network that’s shared and managed collectively, with the infrastructure being co-owned and cooperatively run.

A variety of initiatives known as DePin projects can be found both within the U.S. and internationally. These projects tackle challenges across diverse fields, including telecommunications, water resource management, power distribution networks, and wireless communication systems.

As a researcher, I can attest that some of these remarkable applications have left an indelible mark on Capitol Hill. It seems that when people think about crypto, they often associate it with the scams that abound, yet they fail to recognize the legitimate businesses being constructed. Take GEODNET, for instance, a business that is working tirelessly to reduce food prices and improve accessibility, or CUDIS, which strives to enhance health outcomes. My conversation with BeInCrypto has further solidified these insights.

As the understanding of cryptocurrencies expands, more institutions are coming to see their value beyond just speculative purchases. This increasing acknowledgement is likely to lead to a broader range of investment options in the future.

Crypto-Friendly Environment to Attract Foreign Interest

With the U.S. taking a more active stance on cryptocurrencies, it’s expected that international businesses will capitalize on this trend and venture into the market.

As a researcher, I’d express it this way: “I find that international businesses are highly interested in penetrating the U.S. market due to its abundance of prospects. The consumer demographic is vast, venture capital is abundant, and the technological infrastructure is unparalleled – as stated by Basi.

Under President Biden’s leadership, numerous cryptocurrency firms considered broadening their operations globally as a response to the Securities and Exchange Commission enforcing tough regulatory measures domestically.

By September 2023, it was disclosed by Ripple, a fintech company based in San Francisco, that over 80% of their cryptocurrency job recruitment for their cross-border payments sector would occur outside of the United States.

Previously in that year, Coinbase’s CEO, Brian Armstrong, announced that their cryptocurrency platform had obtained a permit to function within Bermuda. Armstrong further emphasized that the U.S. requires clear regulations to avoid businesses moving towards “regulatory sanctuaries” overseas.

In a more welcoming U.S. for cryptocurrencies, these businesses can establish partnerships with established American brands and institutions. With clear regulations, international companies will be more inclined to enter the market, fostering a vibrant and competitive crypto environment, as suggested by Basi.

To establish a dominant position in the cryptocurrency sector, U.S. policymakers should make sure their regulatory stance is clearly communicated.

The Possibility of a Global Domino Effect

As per Basi’s explanation, the U.S.’s decision to establish a welcoming regulatory environment for crypto businesses could spark similar changes in other nations.

In essence, the United States often leads the way in shaping global financial policies, and when it makes a move, other nations tend to pay attention. If the U.S. demonstrates that supportive cryptocurrency regulations can stimulate economic growth, technological advancement, and even enhance national security, it could trigger a chain reaction, with other countries likely adopting similar policies. It’s like a series of falling dominos—when the U.S. takes action, other countries may not want to miss out on the potential economic advantages that cryptocurrencies offer. This is the view he expressed.

Currently, various countries worldwide are actively working to become appealing destinations for cryptocurrency businesses looking to establish overseas operations.

As a researcher, I’ve noticed that regions such as Europe are actively shaping their cryptocurrency regulations to maintain their competitive edge. It’s likely that these efforts will gain momentum. Moreover, up-and-coming markets, particularly in Asia and Latin America, have the opportunity to establish themselves as crypto hotspots by implementing more inviting regulatory frameworks, as suggested by Basi.

On December 30, the European Union set up the Markets in Crypto Assets (MiCA) framework. This legislation functions as a single rulebook for crypto businesses operating within the union. A Crypto Asset Service Provider (CASP) license granted by any EU member state allows companies to expand their services throughout the European bloc.

In December, Argentine President Javier Milei detailed major policy proposals for the year 2025, focusing on unrestricted currency usage and favorable cryptocurrency regulations. Proposed changes being considered would enable Argentines to carry out transactions using their preferred currency, such as Bitcoin.

Besides the United Arab Emirates, South Korea, Brazil, and El Salvador, a number of other nations have established comparable systems.

The Question Surrounding China and Russia

As the U.S. embraces the strategy of asset diversification, there’s a growing curiosity about whether China and Russia might adopt similar practices as well.

In China, cryptocurrencies are perceived as potential risks to the country’s financial security. Time and again, China has grabbed attention with its stringent measures to control crypto-related business activities.

Lately, China’s foreign currency management authority has established new rules that obligate banks to identify potentially hazardous financial activities, such as those associated with digital currencies like cryptocurrencies.

In simpler terms, when it comes to China, things aren’t always clear-cut. Their ban on cryptocurrencies seems more about regulating the market than outright rejection. Despite this, they have significantly invested in blockchain technology and are leading the development of their digital yuan project. This suggests that China isn’t inherently against cryptocurrencies; rather, they seem to be opposed to those they can’t control, as Basi explained to BeInCrypto.

Contrastingly, it appears that Russia is becoming more favorable towards cryptocurrency transactions. Just two weeks ago, Russian businesses commenced utilizing Bitcoin and various other digital currencies for international money transfers, thanks to recently enacted legislation facilitating such activities.

2024 saw Russia recognize Bitcoin as a viable tool for bypassing international sanctions and facilitating instant cross-border transactions. As a result, the government made it legal to use cryptocurrencies in foreign trade, and implemented policies to bolster Bitcoin mining activities within the country.

According to Basi, Russia’s approach to cryptocurrency may also influence China’s outlook.

Should nations such as Russia, traditionally skeptical towards cryptocurrencies, begin to adopt the industry, there might be pressure on China to follow suit. This could lead to a softening of their ban on specific crypto transactions, especially if they perceive strategic advantages like facilitating cross-border trade or lessening dependence on the US dollar. A complete reversal of the ban might not occur, but China may endeavor to assimilate cryptocurrencies into its economy under its own conditions.

Time alone will reveal the response of the two nations as the U.S. embraces a more welcoming approach towards cryptocurrencies.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-01-09 23:11