There’s been a noticeable increase in enthusiasm for cryptocurrencies in the U.S., with some comparing it to the excitement surrounding the space race, due to recent advancements during President Donald Trump’s term.

Pro-Crypto Leadership

In an interview on CNBC’s Squawk Box on January 6th, Redbord highlighted the appointments of Scott Bessent as Treasury Secretary, Paul Atkins as Chair of the Securities and Exchange Commission (SEC), and venture capitalist David Sacks in a role overseeing cryptocurrency as critical decisions. He underscored that these personnel choices demonstrate a firm dedication to nurturing advancements in blockchain technology, artificial intelligence, and digital assets – implying that people are the driving force behind shaping policies in these areas.

Redbord remarked that there’s an electric atmosphere, reminiscent of a space race, since the U.S. is now positioned to match or possibly outdo international peers in the field of blockchain technology.

Strategic Bitcoin Reserve

One intriguing concept under constant debate is the possibility of setting up a strategic reserve for Bitcoin in the United States. Redbord pointed out that such an action might substantially increase Bitcoin’s worth and inspire other countries to follow suit with comparable tactics. As he put it, “This could ignite a worldwide pattern, whereby nations and even US states acknowledge Bitcoin’s expanding influence in national economics,” he elaborated.

Countries like Switzerland and Hong Kong are leading the way in this area, as Switzerland has already decided to include Bitcoin in its national reserves. The CEO of Metaplanet, Simon Georvich, anticipates that if the United States were to establish a Bitcoin reserve, it could trigger a competition among countries to do the same.

Expanding Blockchain Use Cases

In addition to Bitcoin’s function as a means for storing value, Redbord emphasized the growing utilization of blockchain technology in everyday financial transactions. Businesses such as Stripe and Cash App are leveraging stablecoins to facilitate smoother cross-border payments and remittances.

Redbard expressed that nothing thrills him more than witnessing blockchain technology being applied effectively to tackle genuine, everyday challenges.

Bitcoin’s Future Trajectory

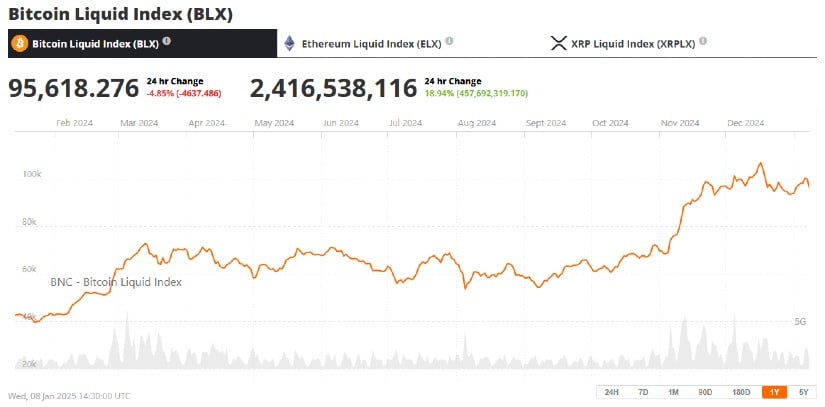

Bitcoin recently surpassed the $100,000 barrier due to optimistic expectations surrounding potential policy changes. While Redbord avoided making exact price forecasts, he remains optimistic about Bitcoin’s future expansion, citing technological innovations and regulatory progress as key drivers.

It seems that many market analysts hold a unified viewpoint. According to Daan Crypto Trades, a dedicated trader, Bitcoin is currently experiencing a period of “finding its value,” indicating there could be more price increases in the future.

Regulatory Challenges Ahead

Although there’s a sense of hope, there are hurdles yet to overcome. Redbord pointed out that some policymakers and prosecutors continue to see digital currencies as tools for illicit activities, which might impede widespread acceptance. He underscored the importance of productive regulatory dialogues to clear up misunderstandings and establish a fair regulatory environment for the industry.

Under the unique blend of favorable leadership and progressive policies at the onset of the Trump administration, there’s a strong potential for rapid expansion in the U.S. cryptocurrency sector. With concepts such as a Bitcoin reserve and expanded blockchain applications, the U.S. seems poised to spearhead the upcoming surge in digital asset development.

Although the future may hold some turbulence, it’s an electrifying era for cryptocurrency investors and Bitcoin enthusiasts. Hang on tight!

Read More

2025-01-09 14:05