As a seasoned observer of the digital finance landscape, I find the proposal of a Bitcoin reserve to be an exciting development that could reshape the future of global finance. Having been involved in the tech industry for decades, I’ve seen firsthand how innovative technologies can disrupt established systems and create new opportunities.

There’s been intense discussion among financial analysts, cryptocurrency supporters, and government officials about the Trump administration’s idea of creating a U.S. reserve for Bitcoin.

This action seeks to establish Bitcoin as an officially endorsed reserve asset by the state, which represents a significant change in the U.S. government’s viewpoint towards cryptocurrencies. Previously viewed with suspicion, Bitcoin is now poised on the verge of being broadly accepted as digital gold.

Shifting From Bitcoin Reserve Speculation to Strategy

Should the United States embrace Bitcoin completely, it would assume a leading role in financial technology innovation and respond effectively to the increasing dominance of nationally controlled digital currencies such as China’s digital yuan.

This policy poses significant concerns: Might it ignite a worldwide “cryptocurrency competition”? Will it boost development within the cryptocurrency sector, or could it potentially undermine Bitcoin’s core principles of decentralization?

The proposal for the reserve, introduced by US Senator Cynthia Lummis, suggests that the Treasury and the Federal Reserve acquire 200,000 Bitcoins annually over five years, totaling one million BTC, approximately 5% of the total global supply.

According to Bill Qian, Chairman of Cypher Capital, speaking to BeInCrypto, a plan that reserves Bitcoins could significantly alter the perception of Bitcoin. Instead of being viewed as a speculative asset, it would be considered a tactical financial tool.

This change indicates an acknowledgement of Bitcoin’s future value, encouraging institutional investors to reassess their investments. In just two weeks, proposals for a Bitcoin reserve setup in Russia and Vancouver emerged, hinting that such action might spread worldwide, becoming a global movement.

For Qian, the effects go beyond just investment tactics. He contends that institutional investors and cryptocurrency companies might see this as confirmation of Bitcoin’s long-term worth. This could trigger a surge of financial resources being directed towards Bitcoin as institutions prepare to capitalize on its digital gold qualities.

Making Bitcoin a more accepted form of payment in business transactions might be facilitated by this move, potentially making it more mainstream. Bill Hughes, the Head of Global Regulatory Matters at Consensys, posits that legitimizing Bitcoin as a reserve asset could gradually lead to increased corporate acceptance.

According to Hughes’ statement in his BeInCrypto interview, if the U.S. Federal Government considers Bitcoin reliable enough to include it on their balance sheet, then it should be acceptable for any American company. This could potentially lead to corporate transactions that involve Bitcoin as payment, especially for high-value transactions.

Could This Trigger a Global Crypto Arms Race?

Establishing a U.S. Bitcoin reserve might carry significant geopolitical repercussions, possibly igniting a worldwide scramble for cryptocurrency assets. According to Ji Kim, Head of Legal and Policy at the Innovation Crypto Council, such a move can be seen as a tactical maneuver.

As a researcher, I’ve come to firmly believe that digital assets, particularly Bitcoin, are becoming more crucial in various markets. I strongly advocate for the recognition of digital assets as a strategic asset class by our government, much like gold, oil, and other physical assets have been valued for centuries. This conviction was expressed during my recent conversation with BeInCrypto.

In contrast to the U.S.’s potential creation of a Bitcoin reserve, developing countries are currently utilizing cryptocurrencies as a means to diminish their dependence on the U.S. dollar. Countries like El Salvador have been actively buying Bitcoin since they declared it legal tender in 2021.

The recent increase in Bitcoin’s worth has been applauded by Salvadoran President Nayib Bukele, who has earlier suggested that embracing Bitcoin might help Salvadorans save up to $400 million each year on remittance charges. While others worry that such measures could lead to international disputes, Kim holds a contrasting view.

He mentioned that this action won’t create disagreements or disputes. As the US takes the front seat in establishing suitable regulations for digital assets, acknowledging their validity could foster a more connected global community, providing people with increased independence and control.

In the sphere of power and dominance, America’s Bitcoin reserves could potentially balance out China’s rising impact by introducing their state-supported digital currency equivalent to the digital yuan. For instance, if China accepts digital yuan payments for settlements within its Belt and Road Initiative projects, it showcases Beijing’s opportunity to contest the US dollar’s supremacy in international trade deals. This underscores China’s ambition of undermining the US dollar’s prevalence in global commerce.

If the U.S. wants to maintain its dominance in financial matters, it needs to take action promptly. By embracing Bitcoin, not only can the U.S. protect itself from inflation, but it also demonstrates a dedication to innovation – a crucial aspect when considering China’s growing aspirations in digital currency development, as stated by Qian.

While some experts believe that establishing a U.S. Bitcoin reserve could counteract the political advantage of the digital yuan, others voice concerns that this might not entirely be the case. Unlike Bitcoin, which operates in a decentralized manner, the digital yuan benefits from state-backed assurances and smooth compatibility with China’s domestic systems as well as its trade networks.

Risks and Criticisms of a Bitcoin Reserve

The Bitcoin savings strategy might hold some advantages, but it’s important to be aware of its risks. One significant risk is the high volatility in Bitcoin’s value, which could potentially pose problems for taxpayers’ investments. However, economist Hughes downplays this issue, suggesting that at present, Bitcoin’s relatively small size means it has a limited influence on the overall economy.

As an analyst, I’m pointing out that for Bitcoin to have a significant influence on the U.S. economy, its use and total market capitalization must escalate substantially. To put it into perspective, even if the U.S. government were to invest a massive amount of capital into a Bitcoin reserve, the impact would be minimal.

Another concern is whether state involvement in Bitcoin could damage its decentralized ethos. Hughes dismisses this idea, stressing that government ownership does not equate to control.

He stated that the main function of this network is to enable everyone, whether individuals or institutions like governments, to possess and trade an asset. If the U.S. government were to own Bitcoin, it could lead to a wider acceptance of Bitcoin as a form of value storage.

The US Bitcoin reserve plan could pave the way for more crypto-friendly regulation, as Hughes points out.

The discussion about a Bitcoin reserve coincides with announcements that the U.S. is fully embracing blockchain software development. While one event doesn’t necessarily cause the other, they support and strengthen each other,” he summed up.

Advancing US Crypto Mining Infrastructure

Furthermore, should countries such as China or Russia speed up their cryptocurrency endeavors, it might result in heightened competition in sectors like mining and digital framework development.

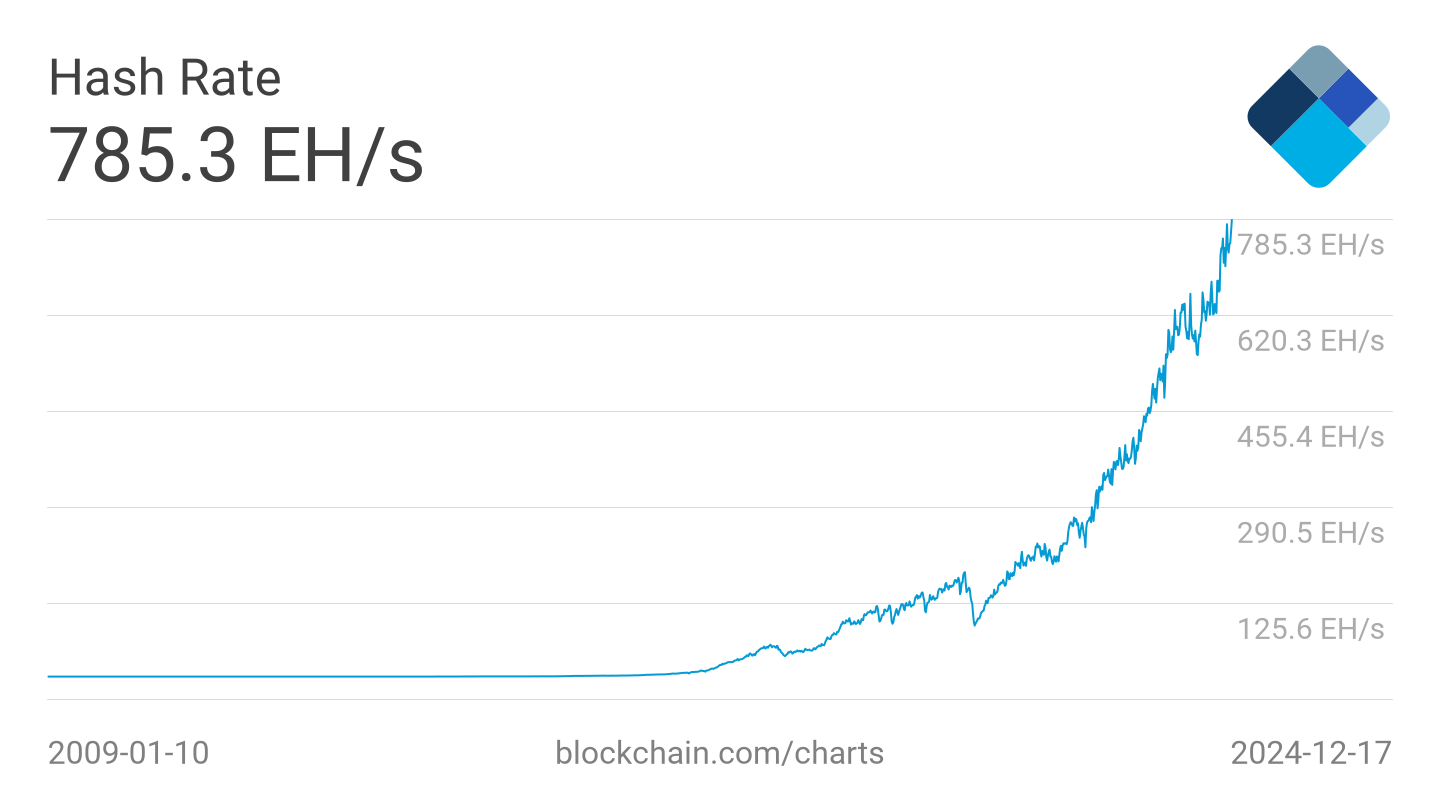

As an analyst, based on my recent review of JP Morgan’s comprehensive guide titled “Bitcoin Mining: An Investor’s Guide to Bitcoin Mining and HPC,” I’ve discovered that a staggering 29% of the entire Bitcoin network is controlled by 14 publicly listed Bitcoin miners operating within the United States. Notably, this significant growth in computing power (hashrate) can be largely attributed to these US-based Bitcoin mining operations, particularly the public mining companies. Remarkably, states like Texas have taken the lead, harnessing their abundant renewable energy resources to fuel these mining activities.

Currently, the computational power maintaining the Bitcoin network is close to record levels, consistently averaging approximately 785.3 quintillion (or 785,300,000,000,000,000) hashes every second.

The research suggests that the increase in hashrate isn’t solely due to advancements within the U.S. mining industry; it’s also linked to substantial activity in other prominent mining areas, notably Russia and China. By December, Russia even imposed a ban on crypto mining across Ukraine and Siberia because of worries about their local power supplies.

“Mining operations could see accelerated developments in renewable energy integration and hardware efficiency to meet growing demand. Similarly, storage solutions would evolve to address heightened focus on security and custodianship for large-scale institutional holdings,” Qian said.

Hughes, on the other hand, presents a moderated perspective. He posits that the market’s reaction to heightened demand for Bitcoin, rather than government intervention, is likely to stimulate innovation in this field.

“The increase in hashrate and advancements in energy efficiency could mitigate concerns about Bitcoin mining’s environmental footprint, aligning it with broader public policy goals,” he said.

Nonetheless, for crypto enthusiasts, the proposal of a Bitcoin reserve represents a vision for the US to lead in digital finance, nourishing the ecosystem through sound policy. The US could catalyze a wave of adoption, reshaping the future of global finance.

The course of action taken by the Trump administration and the worldwide reaction will decide if this strategy ignites a worldwide competition for cryptocurrency development, or establishes a model for cautious assimilation.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- ATH PREDICTION. ATH cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-18 17:31