Right. So, everyone’s terribly excited about AI, aren’t they? It’s the new avocado toast, apparently. And Upstart, this lending company, is supposedly at the forefront. Honestly, I’m always suspicious when something is described as ‘at the forefront.’ It usually means it’s about to fall off a cliff. But I’ve been looking at the numbers, and… well, it’s complicated. Like most things.

For years, banks have relied on this FICO score thing. It’s like a credit personality test, deciding if you’re worthy of a loan. Very judgmental. Upstart thinks it’s a bit… simplistic. Which is putting it mildly. They’ve built this algorithm, this digital brain, that looks at 2,500 data points. Two. Thousand. Five. Honestly, it sounds exhausting just thinking about it. It’s supposed to be better at figuring out if someone will actually pay you back. Which, let’s face it, is the whole point of lending.

The stock has had a bit of a wobble, down 62% in the last year. Everyone’s panicking about an AI bubble. Which, okay, fair point. Bubbles are annoying. But Upstart is actually making a profit, which is… unusual in this world of tech hype. It’s one of the few companies that’s not just burning through cash and promising jam tomorrow. It’s actually delivering jam today. Small jam, admittedly, but still.

Units of Hope Invested: 1. Hours Spent Staring at Stock Charts: 8. Number of Times I’ve Considered Just Putting the Money Under the Mattress: 15. But, I’m predicting a double in the stock price by the end of 2026. It feels… optimistic. But the numbers suggest it’s not entirely delusional.

AI: The Future of Lending (Probably)

Apparently, 91% of Upstart’s applications are now handled by the algorithm, with no human intervention. No humans! It’s terrifying and efficient all at once. The algorithm does the grunt work, approves loans instantly. Humans take days, or weeks. It’s like comparing a Formula One car to a horse and cart. Though, I do miss the charm of a good old-fashioned loan officer. They usually had biscuits.

They originated 455,788 loans last quarter, up 86% year on year. That’s a lot of loans. Mostly unsecured personal loans, but their car and home equity segments are growing. Fivefold! It’s like they’re multiplying. Though, I suspect that’s just a figure of speech. The loans are performing well, and they’re constantly improving the algorithm. It’s a virtuous cycle, apparently. Which is nice.

The chairman, Dave Girouard, reckons AI will replace all human credit assessment within a decade. A decade! It feels… ambitious. But there’s $25 trillion worth of loans originated globally every year, generating $1 trillion in fees. That’s a lot of money. And Upstart wants a piece of it. Naturally.

2025: A Good Year (Relatively)

They made $1.043 billion in revenue last year, which is more than they expected. A win! It was up 64% from the previous year, which is… impressive. And they only increased their operating expenses by 23%. Which means they’re actually making money, not just spending it. A rare thing in the tech world.

They made $53.6 million in net income. Which is a huge improvement from the loss they made the year before. And their adjusted earnings before interest, tax, depreciation, and amortization surged by 2,074%. Two thousand and seventy-four percent! It’s almost unbelievable. I’m starting to suspect they’ve made a deal with a very efficient algorithm.

So, Should You Buy?

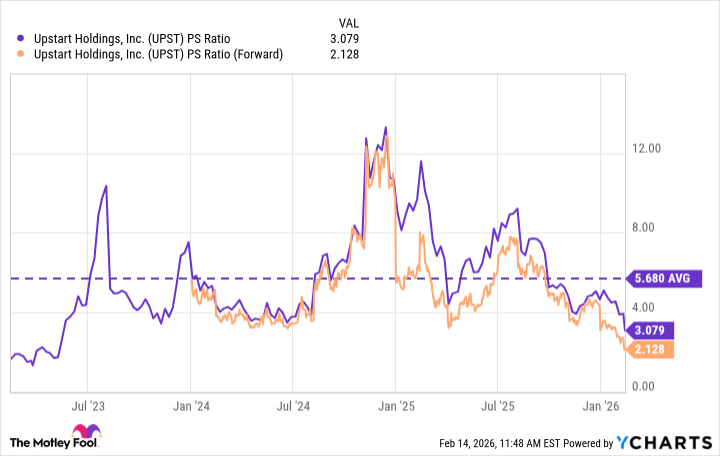

The stock is trading at a price-to-sales ratio of 3.1, which is a discount to its three-year average of 5.7. Which means it’s potentially undervalued. And if you look at its future potential revenue, it’s even cheaper. Wall Street expects $1.4 billion in revenue next year, which puts its forward price-to-sales ratio at just 2.1. Two point one! It’s practically giving itself away.

To trade in line with its three-year average, the stock would have to soar by 171%. It feels… unlikely. But it could fall way short and still double. It was trading at $61.36 as recently as September. Which means a double isn’t entirely unrealistic.

Current Stock Price: $30.68. Target Price (If Everything Goes Right): $61.36. Probability of Success: 50/50 (Let’s be honest). I’d encourage you to think long-term, because if AI really does replace all human credit assessment, Upstart could do even better. But, of course, that’s a big ‘if’. And I’m a cautious optimist. Mostly cautious.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-02-18 01:26