Now, UPS, that great brown beast of a company, has been rattling its money box and announced something rather curious. They’re predicting a pile of cash – $6.5 billion, to be precise – by 2026. A sum large enough to keep the dividend-gobblers happy, those investors who simply must have their little trickle of income. It’s a rather reassuring thought, if you’re the sort who likes a predictable penny. But let’s not get carried away; this isn’t a chocolate factory, and there’s a bit of trickery afoot.

UPS Shocks the Market (Or Attempts To)

The surprise isn’t just the number, you see. It’s how they’ve conjured this wealth. Three main ingredients, all a bit… suspicious, if you ask me. Like a potion brewed by a particularly greedy goblin.

First, they claim to be squeezing out cost savings. A grand total of $3 billion in 2026, on top of the $3.5 billion they pinched in 2025. Perfectly respectable, you might think. Except, of course, they’re shrinking, shedding bits of themselves like a snake shedding skin. And a good portion of these savings come from delivering fewer parcels for that enormous, ever-hungry Amazon. It’s like claiming you’ve become richer by simply… doing less.

They’re offloading workers, you see. Nearly 80,000 souls in the next two years! And shuttering buildings like a wicked giant closing shop. A rather grim spectacle, even for a seasoned investor like myself. They claim it’s efficiency, but it feels a bit like… dismantling the clock to save on winding.

A third of the 2025 cuts were “structural” they say. Meaning they’ve actually removed parts of the machine. These cuts, along with the 2026 ones, will supposedly start trickling into the cash flow later on. We’ll see about that. I’ve seen more promises than a politician at election time.

One-Off Property Sales Are Boosting Cash Flow

Then there’s the business of selling off bits and bobs – buildings, land, all sorts of paraphernalia. They’ve already pocketed $700 million from these disposals in 2025. It’s like a child selling their toys to buy sweets. A temporary sugar rush, but hardly a sustainable business model.

They don’t quite tell you how much more they plan to sell off in 2026. A clever omission, wouldn’t you say? If you strip out that $700 million from 2025, the actual cash flow dwindles to a rather paltry $4.7 billion. Not nearly enough to cover that hefty $5.4 billion dividend. A rather precarious situation, if you ask me.

Reducing Capital Spending Improves Cash Flow

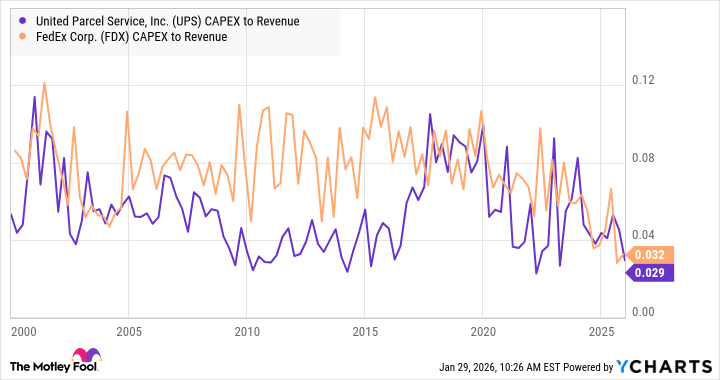

And finally, they’re tightening the purse strings on capital expenditures. Down from $3.7 billion in 2025 to a mere $3 billion in 2026. They claim it’s because they’re making the network more efficient. That’s what they say. But it feels suspiciously like they’re simply… neglecting the machinery. Like a farmer who refuses to mend his fences. It might save money in the short term, but it’s a recipe for disaster in the long run.

They’ve even decided to lease 18 new Boeing 767 aircraft rather than buying them outright. A bit like renting a horse instead of owning one. It might be cheaper now, but you don’t actually own anything.

What It Means to Investors

For those who simply crave a steady stream of income, UPS will do nicely. Management seems determined to keep that dividend flowing, and that’s all some investors care about. But for those who seek actual growth? Well, that’s another matter entirely.

This reliance on selling assets and cutting capital expenditures isn’t sustainable. Once they’ve squeezed every last penny out of these tricks, they’ll need to find a way to actually grow revenue. And that, my friends, is a far more difficult task. Especially when the economic winds are blowing in a rather unpredictable direction. And let’s not even mention what 3M is saying about the industrial sector… a rather gloomy forecast, indeed.

So, there you have it. $6.5 billion in free cash flow in 2026 is a decent starting point, but it’s hardly a guarantee of long-term prosperity. It’s a good stock for income-seekers, but not for those who crave a bit of genuine, sustainable growth. A peculiar potion, indeed. And like all potions, it’s best to approach it with a healthy dose of skepticism.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-02-02 23:13