United Parcel Service (UPS), that colossus of brown-clad ambition, will unveil its third-quarter earnings on October 18. By then, the world may already know what the numbers will confirm: a company teetering on the precipice of its own hubris. Its stock, bruised by time and circumstance, and its long-term prospects-well, let us not feign optimism where only arithmetic resides.

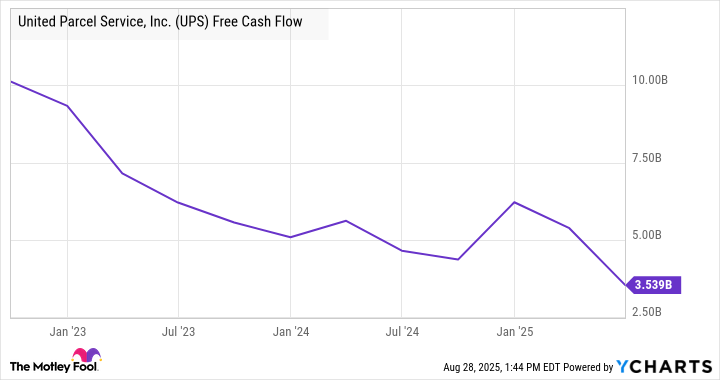

UPS’s earnings report will likely be a dirge, not a dirge for the company, but for the credulity of those who still cling to its dividend like a life raft in a sea of fiscal folly. A 7.6% yield is no mere statistic; it is the market’s verdict, cold and unyielding-a verdict that the dividend, like Icarus’s wings, is crafted from unsustainable wax. And yet, management persists in its delusions of grandeur. CEO Carol Tome, with the solemnity of a priest at a state funeral, declared the dividend “rock solid,” as though UPS’s free cash flow were the Nile, inexhaustible and eternal. But the Nile does not drown its banks; it nourishes them. UPS’s $5.5 billion payout in 2025, paired with $1 billion in buybacks, is a flood that drowns the roots of its own future.

The company’s balance sheet, that “investment-grade” relic, is a parchment scroll in a digital age-prized for its age, not its utility. Free cash flow, that lifeblood of enterprise, is insufficient to cover the combined $6.5 billion siphoned to shareholders. One might call this capital-allocation malpractice; Solzhenitsyn might call it a symptom of a deeper rot.

Worse still: management, in a move as brave as it is evasive, declined to offer full-year guidance. They cited “uncertainty,” but the truth is grimmer. In Q2, their SMB market volume-ostensibly the engine of their next-era ambition-faltered, a casualty of “tariff tides” that even Tome admits her customers cannot navigate. Small businesses, those fragile vessels of economic hope, are left to founder while UPS’s executives parse spreadsheets in air-conditioned boardrooms. It is the age-old tragedy: the ossified structures of power blind to the relentless tide of economic gravity.

What awaits on October 18? Volatility, certainly. But let us not delude ourselves into thinking this is a mere stock price’s dance. If the dividend is slashed, as it must be, UPS will become a cautionary tale-less a “compelling stock to monitor” and more a parable of short-term greed. Should the numbers defy expectations, the market’s fickle mercy may lift the shares, but such mercy is fleeting. The company’s true crossroads lies not in earnings per se, but in the collision of hubris and humility. One suspects the latter will prevail.

🦅

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-08-31 14:52