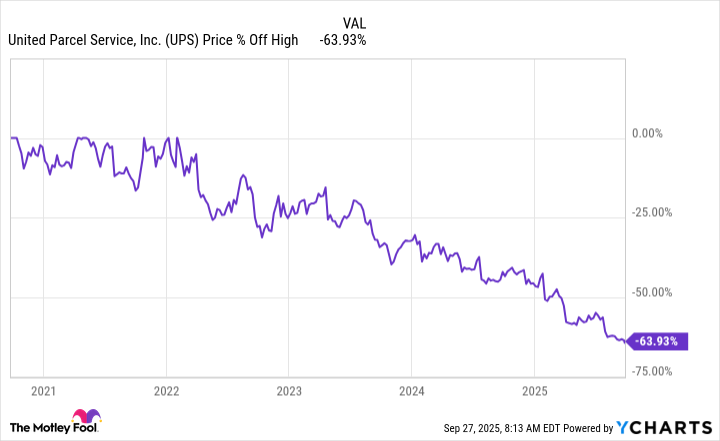

Let me be clear: United Parcel Service (UPS) is the canary in the coal mine for Wall Street’s tendency to extrapolate chaos into eternity. When the pandemic hit, UPS’s stock went from “recession-proof” to “oh no, not again” faster than you could say “social distancing.” And let’s not forget the masterstroke of management: a corporate overhaul that turned the stock into a piñata for investors. But here’s the kicker-this is the kind of mess that value investors love. The blood in the streets is just fertilizer for tomorrow’s bloom. 🚚

What went wrong during the pandemic?

When the world hit pause, UPS thought it was in the “pause to win” phase. Everyone was stuck at home, so they spent money on Amazon (AMZN) like it was their new therapist. UPS became the delivery boy for the apocalypse. But here’s the rub: trees don’t grow to the sky, and neither do margins when you’re shipping every household’s emergency toilet paper stash. Wall Street, in its infinite wisdom, priced in a future where UPS would be the eternal Amazon concierge. Then reality hit like a truck to the ribs. The stock plummeted. Management, in a moment of sheer panic, decided to play Russian Roulette with its balance sheet. And we’re still picking up the pieces. 🎯

UPS’ changes are painful in the short term

Let’s talk about the “overhaul” that’s making shareholders weep into their coffee. UPS renegotiated union contracts because, apparently, “sustainable margins” is a thing that exists now. The cost inflation? A bloodbath. But hey, at least they’re not relying on delivery drivers with pitchforks. They also axed “less desirable” businesses-read: selling divisions to buy time. And let’s not forget the tech investments. Because nothing says “long-term vision” like spending billions on robots while laying off the people who once loved your job. It’s a masterpiece of short-term pain for long-term gain. But here’s the thing: if you’re a value investor, you’re already calculating how many skeletons are buried in the cost-cutting graveyard. 💀

The latest twist? UPS is ditching Amazon’s less profitable packages. You’re thinking, “Is this the same company that delivered your Amazon Prime orders?” Yes. And now it’s trying to be the “I only date for money” version of itself. The dividend yield is a siren song at 7.8%, but let’s not mistake desperation for generosity. This is a bait and switch: high yield now, potential dividend cut later. It’s the financial equivalent of a one-night stand with a trust fund. 💸

Is it always darkest before the dawn?

UPS’s financials look like a horror movie: revenue down, margins squeezed, payout ratio flirting with 100%. But here’s the plot twist: in Q2 2025, profit per package rose 5.5%. That’s not a typo. That’s management whispering, “We’re not dead yet.” They’re trimming the fat, focusing on the profitable bits, and hoping the phoenix metaphor works for logistics. It’s a slow burn, sure, but value investors thrive in slow burns. We’re the ones who see the smoke and think, “Ah, there it is.” 🌅

So, should you buy? Well, if you like being wrong about the timing of a comeback and then being right about it, UPS is your oyster. Just don’t expect a fairy tale. This is a slow, painful rebirth. But if you’re the kind of investor who thinks 7.8% yield is a gift from the gods and a 5.5% profit uptick is a wink from the universe, then by all means-jump in. Just don’t say I didn’t warn you. 🦅

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-09-29 11:54