Palantir Technologies (PLTR), the mischievous wizard of the financial realm, has cast a spell that has bewitched Wall Street into dazzled awe. It struts and frets its hour upon the S&P 500 stage, boasting a remarkable 550% ascent over the past twelve months. A hearty chuckle or two, perhaps, for none stand close to its magical feats of financial prowess.

This incredible transformation owes itself, my dear reader, to the bewitching enchantment of artificial intelligence (AI) that has swirled through the market and entangled the minds of the industrious and the greedy alike.

On the fourth day of August, Palantir unveiled its second-quarter earnings, merrily catapulting its stock price by 4.5% in after-hours trading, like a balloon loosed from a joyous child’s hand. Gather ’round, for here come the grandest tidings from this tale!

The Commercial Train Is Gaining Steam

Once upon a time in the realm of software, Palantir’s magical tools were reserved for the mighty government sorcerers, such as those from the CIA and the Department of Defense. Yet, with the unveiling of its fanciful Artificial Intelligence Platform (AIP), this playful jester has turned its sights to the busy marketplace!

In the second quarter, the U.S. commercial revenue surged up to $306 million, a stunning 93% growth compared to the whirs and whirs of last year, while its U.S. government charms grinned at a more modest but impressive 53% increase, totaling $426 million. Can you hear the cash registers chime? Why, it helped the company don its first crown of a billion-dollar quarter!

Closing Deals With Gusto!

Palantir is no ordinary shopkeeper trying to peddle quaint wares; it is a grand architect of institutional tools, weaving deals that would make the imagined gentries of yore blush with envy. As fellow investors, one must peer closely at the delightful deals being conjured up!

Here’s a taste of the magic pulled from the air in Q2 2024 through to Q2 2025:

| Deal Value | Q2 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| At least $1 million | 96 | 139 | 157 |

| At least $5 million | 33 | 51 | 66 |

| At least $10 million | 27 | 31 | 42 |

Burrow into those numbers, and you’ll find that U.S. commercial deals worth at least $1 million have doubled, while those weighing in at $5 million have sprung and leapt fivefold, as if propelled by a particularly irksome spring. The art of closing such deals is paramount-just as one doesn’t simply bake a cake with plain ingredients, so too are Palantir’s tools entwined within the fabric of these organizations!

Margins Wonderfully Glisten

Let us dwell for a moment on the tantalizing delights of operating income, shall we? In Q2, Palantir’s adjusted operating income ballooned to a staggering $464 million, an increase from the $254 million observed in the previous year’s second-quarter frolics. Adjusted operating income, mind you, often omits the pesky tolls of peculiar expenses like those ghastly one-time charges and stock-based compensations that haunt the sensible investor.

What makes this surge all the more splendid is the fact that Palantir is simultaneously sprinkling investments around to nurture AIP and its other operations fruitful. Consider the margins-it’s a pleasing sight:

- Q2 2025: 46%

- Q1 2025: 44%

- Q4 2024: 45%

- Q3 2024: 38%

- Q2 2024: 37%

A Cautionary Tale of High Valuation

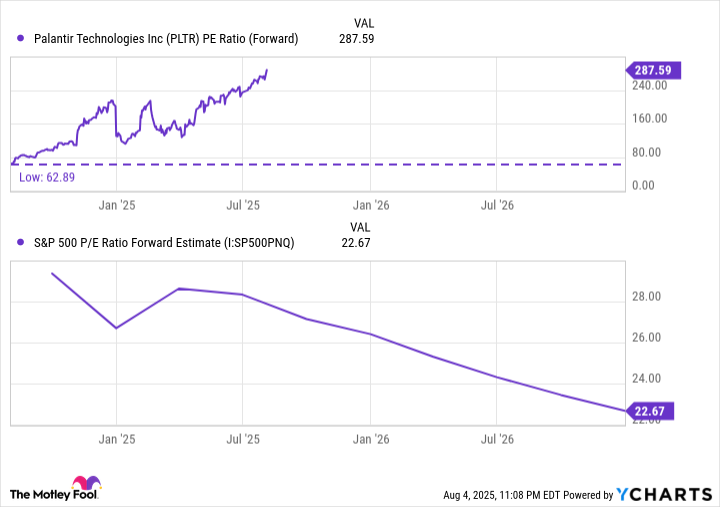

Yet, dear investors, beware! For while Palantir’s stock price has soared to dizzying heights like a particularly brave kite on a blustery day, it now claims a stratospheric valuation-287 times its forward earnings, to be precise. Such numbers may fill one with awe, but also unleash a little tickle of caution. There’s a fine line between robust growth and an overindulgent fantasy.

While this surge may infer that particular attention be paid toward the stock, it’s a truth universally acknowledged that even noble companies that once merrily fluttered with lofty valuations have stumbled mightily into the abyss. The road ahead is filled with bright caution signs-even the most fantastical charades can flicker and fade.

In conclusion, we find ourselves at a crossroad, juggling potential promises and pitfalls, but eager hearts always know where to tread carefully. Remember, the world of investing is a grand tapestry, each thread woven with hopes and dreams-take heed, but also take flight! 🌈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-06 09:55