Imagine, if you will, a grand and bustling marketplace where the S&P 500 struts about like a pompous turkey, flaunting its feathers of 500 carefully curated companies. This index, you see, is the crème de la crème of the U.S. stock market, handpicked by a committee of stern-faced assessors who ensure only the finest names grace its roster. Yet, even this illustrious flock has its limitations.

Since its inception in 1957, the S&P 500 has delivered a respectable compound annual return of 10.5%, dividends included. It’s a steady old bird, reliable as a grandfather clock. Warren Buffett, that sage of Omaha, often advises everyday investors to hitch their wagons to this index. But for the bold and the young, those with fire in their bellies and time on their side, there might be juicier berries to pluck from the market’s bramble.

Enter the Vanguard Growth ETF (VUG) and the Vanguard Mega Cap Growth ETF (MGK), two high-flying funds that have consistently outpaced the S&P 500. These are not your ordinary investments; they are the sprinters in a marathon, the daredevils in a circus act. 🎪

1. The Vanguard Growth ETF

The Vanguard Growth ETF, or VUG as it’s fondly called, is a sly creature that tracks the CRSP US Large Cap Growth Index. This index, a beast of its own, snares the top 85% of the market capitalization from the CRSP US Total Market Index, which houses a staggering 3,537 companies. But here’s the twist: VUG holds just 165 stocks. That’s right, a mere handful of companies hoard 85% of the market’s treasure, while the rest scramble for crumbs.

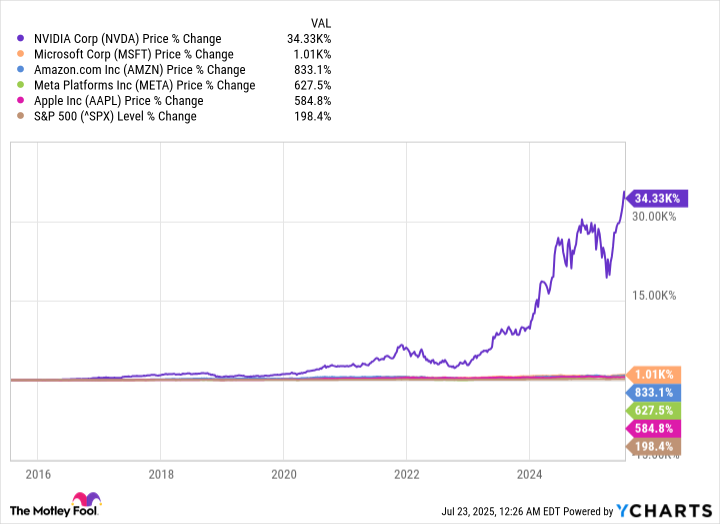

This ETF is a concentrated cocktail, with its top five holdings—Microsoft, Nvidia, Apple, Amazon, and Meta Platforms—accounting for nearly half its portfolio. Over the past decade, these tech titans have delivered a median return of 833%, propelling VUG to a compound annual return of 16.2%, leaving the S&P 500’s 12.8% in the dust.

| Stock | Vanguard Growth ETF Portfolio Weighting |

|---|---|

| 1. Microsoft | 11.76% |

| 2. Nvidia | 11.63% |

| 3. Apple | 9.71% |

| 4. Amazon | 6.53% |

| 5. Meta Platforms | 4.57% |

Since its birth in 2004, VUG has grown at a compound annual rate of 11.8%, outpacing the S&P 500’s 10.1%. That 1.7 percentage point difference might seem trifling, but over two decades, it’s the difference between a cozy cottage and a grand manor.

| Starting Balance (2004) | Compound Annual Return | Current Balance (2025) |

|---|---|---|

| $50,000 | 11.8% (Vanguard ETF) | $520,292 |

| $50,000 | 10.1% (S&P 500) | $377,140 |

2. The Vanguard Mega Cap Growth ETF

Next up is the Vanguard Mega Cap Growth ETF, or MGK, a beast that tracks the CRSP US Mega Cap Growth Index. This index captures the top 70% of the market capitalization from the CRSP US Total Market Index, resulting in a portfolio of just 69 stocks. Concentration, thy name is MGK!

Its top five holdings—Microsoft, Nvidia, Apple, Amazon, and Broadcom—account for a whopping 50.3% of its portfolio. Since its inception in 2007, MGK has delivered a compound annual return of 13.4%, leaving the S&P 500’s 10.2% in its wake. Over the past decade, it has grown at a blistering annual rate of 17%.

| Stock | Vanguard Mega Cap ETF Portfolio Weighting |

|---|---|

| 1. Microsoft | 13.49% |

| 2. Nvidia | 13.34% |

| 3. Apple | 11.14% |

| 4. Amazon | 7.52% |

| 5. Broadcom | 4.81% |

| Starting Balance (2007) | Compound Annual Return | Current Balance (2025) |

|---|---|---|

| $50,000 | 13.4% (Vanguard ETF) | $480,844 |

| $50,000 | 10.2% (S&P 500) | $287,235 |

A few things to keep in mind

These ETFs are heavyweights in the technology sector, with tech making up 60.4% of VUG and 63.9% of MGK. While this concentration has led to stellar returns, it also leaves investors exposed to significant risks. A steep correction in tech stocks could see these ETFs underperform the S&P 500 for a time. Moreover, if emerging technologies like AI fail to meet expectations, these ETFs could face prolonged weakness.

Investors should thus consider these ETFs as part of a diversified portfolio, alongside other funds and individual stocks. This approach could yield superior returns while providing insulation against potential setbacks in high-growth sectors like AI. And remember, dear reader, in the grand bazaar of the market, it’s wise to keep a few cards up your sleeve. 🃏

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-07-26 12:55