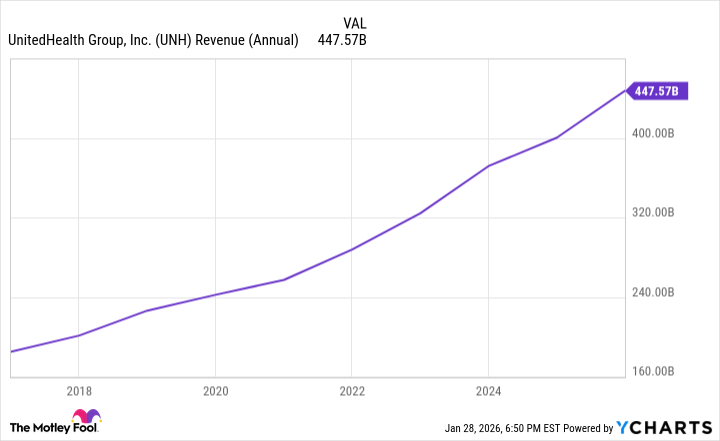

It has come to pass, gentle investors, that the esteemed UnitedHealth Group (UNH 2.43%), a colossus in the realm of healthcare, finds itself in a most peculiar predicament. A succession of misfortunes, a shifting landscape of commerce, and a lamentable decline in its share price – a fall of over 46% in the past twelve months, as the market clocks did reveal on the thirtieth of January – all conspire to paint a portrait of… well, let us call it a theatrical inconvenience.

And now, as if summoned by a mischievous sprite, arrives further disquiet. The Centers for Medicare & Medicaid Services (CMS), those arbiters of fiscal prudence, propose a meager increase – a paltry 0.09% – in payments to private insurers for the year 2027. One might almost suspect a jest, were the implications not so serious.

The market, ever sensitive to such matters, reacted with a swiftness that would impress even the most nimble comedian. A decline of roughly 20% in a single day, on the twenty-seventh of January, served as a most emphatic pronouncement of displeasure. But let us set aside the vagaries of market sentiment and consider the true effect upon UnitedHealth’s coffers.

Of Medicare and Matters Monetary

Medicare, that venerable institution providing succor to the aged and infirm, operates through four distinct parts, denoted A through D. The aforementioned proposal from CMS concerns Part C – Medicare Advantage – a realm where private insurers, such as our UnitedHealth, ply their trade.

These companies receive a fixed monthly stipend for each enrolled member. And, given that UnitedHealth reigns supreme as the largest provider of Medicare Advantage – boasting over 8.4 million customers as of late 2025 – a substantial portion of these funds naturally finds its way into their treasury. A most comfortable arrangement, one might observe.

Indeed, some 38% of UnitedHealth’s revenue in 2025 stemmed from its Medicare and retirement segment – a grand total of $171.3 billion. This represents a robust 23% increase from the previous year, eclipsing their overall revenue growth of a mere 16%. A most favorable wind, filling their sails, one might say.

Should this proposed 0.09% increase become immutable, one can anticipate a significant impediment to UnitedHealth’s continued prosperity. A most unfortunate turn of events, to be sure.

The final decree will not be rendered until the sixth of April, but rest assured that UnitedHealth will deploy its considerable influence – its legions of lobbyists, its persuasive rhetoric – in a most determined effort to alter the outcome. A spectacle worthy of the grandest stage, perhaps.

A Silver Lining, However Slight

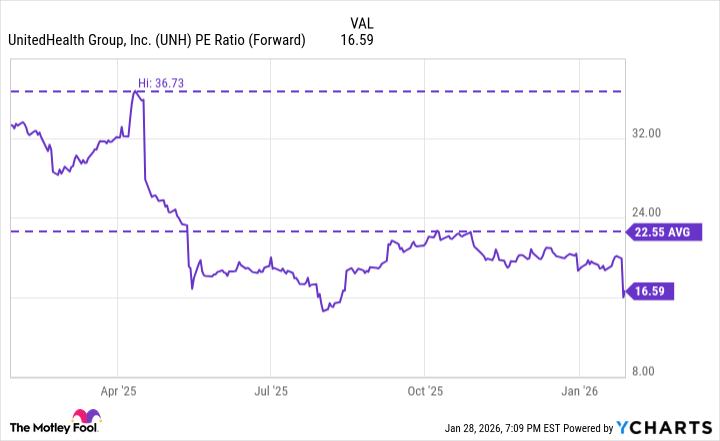

Yet, even in the midst of this discomfiture, a glimmer of hope appears. The recent plunge in UnitedHealth’s share price has rendered its valuation somewhat more… attractive. A bargain, one might almost venture to suggest.

As of the twenty-eighth of January, UnitedHealth traded at approximately 16.6 times its projected earnings, a figure below its yearly average and some 3.5 points lower than just days before, on the twenty-third. A most curious circumstance.

While a low valuation alone does not guarantee success, the market’s reaction appears… excessive. UnitedHealth undoubtedly faces certain challenges, but it remains one of the nation’s most essential enterprises. For those with the patience of Job, and a long-term perspective, this may present a most opportune moment for entry. Though, as any seasoned investor knows, one must always be wary of appearances. For in the realm of finance, as in life, things are seldom what they seem.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- 9 Video Games That Reshaped Our Moral Lens

2026-02-04 22:53