The old adage “patience is a virtue” is particularly pertinent in the realm of investing. One might imagine the stock market as a grand drawing room where the most rewarding seats are reserved for those who resist the temptation to fidget. UnitedHealth Group (UNH), a titan of health insurance now weathering a tempest of regulatory scrutiny and earnings disappointments, may yet prove to be the sort of stock where patience, coupled with a dash of sangfroid, unlocks considerable fortune.

Though its share price has plummeted like a poorly timed soufflé, the company’s foundational strengths remain intact. Let us, with the air of a man who has just sipped a particularly fine sherry, dissect why this healthcare colossus might yet be a bargain for the discerning investor.

A Fortress of Competitive Advantage

UnitedHealth, as the preeminent U.S. health insurer, has constructed a moat so formidable it would make a medieval castle blush. Its dual-engine model-UnitedHealthcare and Optum-creates an ecosystem so interwoven with the American healthcare landscape that rivals might as well attempt to unweave a tapestry with a butter knife. This is not merely a moat; it is a labyrinth.

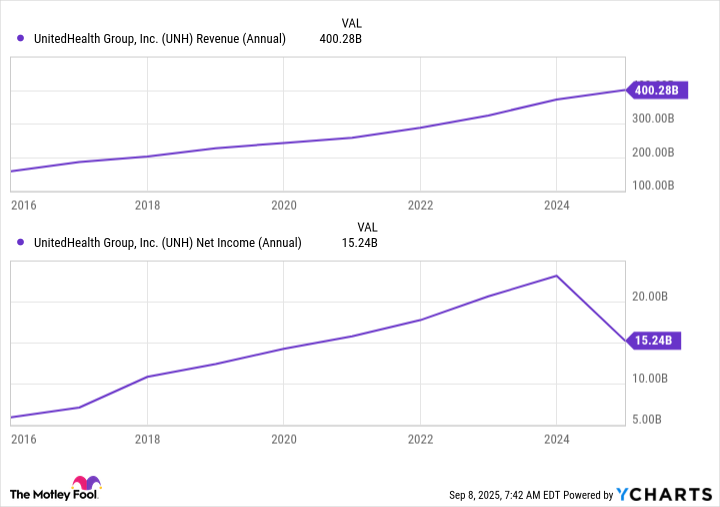

The company’s historical performance, with its steady revenue and net income growth, is as reliable as the changing of the seasons. Yet, as the poet (or perhaps a particularly astute actuary) might say, even the most stately yachts occasionally encounter squalls.

Indeed, the Justice Department’s probe into Medicare Advantage practices is but a pebble in the pond of UnitedHealth’s long-term narrative. The company, ever the gentleman, assures us it is “complying with all requests”-a phrase that, in corporate parlance, suggests a blend of legal prudence and bureaucratic charm. One might even argue that its decade-long civil challenge, which concluded with no evidence of wrongdoing, is less a scar than a badge of honor.

As for the recent earnings shortfall? Ah, the cost of healthcare has risen like a well-timed metaphor, and UnitedHealth’s medical care ratio now threatens to outpace even the most stringent Affordable Care Act requirements. A delicate balancing act, to be sure, but one that the company is addressing with the poise of a seasoned ballroom dancer.

A Recovery Strategy Worthy of a Nobleman

it has been a rather dreary interlude. From a high in April, the share price has fallen by nearly 50%, leaving it trading at a forward P/E of 19-a figure that, in the company’s long-term context, resembles a particularly generous sale at Harrods.

This is not to suggest that recovery will be swift. The market, that fickle mistress, may demand a few more quarters of proof before bestowing its favor. But for the patient investor, the current valuation is as compelling as a rare wine left to age in a perfectly temperature-controlled cellar.

In conclusion, UnitedHealth’s challenges are tiresome but not terminal, and its valuation is as attractive as a well-tailored suit. For those with the patience of a man waiting for a slow train to arrive, the rewards could be substantial. 🕰️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-09 10:12