In the grand theater of decentralized exchanges, Uniswap finds itself in a tragicomedy, grappling with the weight of its own ambitions. The price, like a stubborn mule, refuses to rise above the $10 threshold, despite the fervent prayers of its loyal followers.

What a spectacle it is! The broader market, a tempestuous sea, and the tepid reception of the V4 upgrade have conspired to keep Uniswap shackled in its current state of stagnation. Doubts swirl like autumn leaves, questioning whether this once-mighty exchange can ever break free from its self-imposed prison.

Uniswap’s V4: A Distant Echo of Enthusiasm

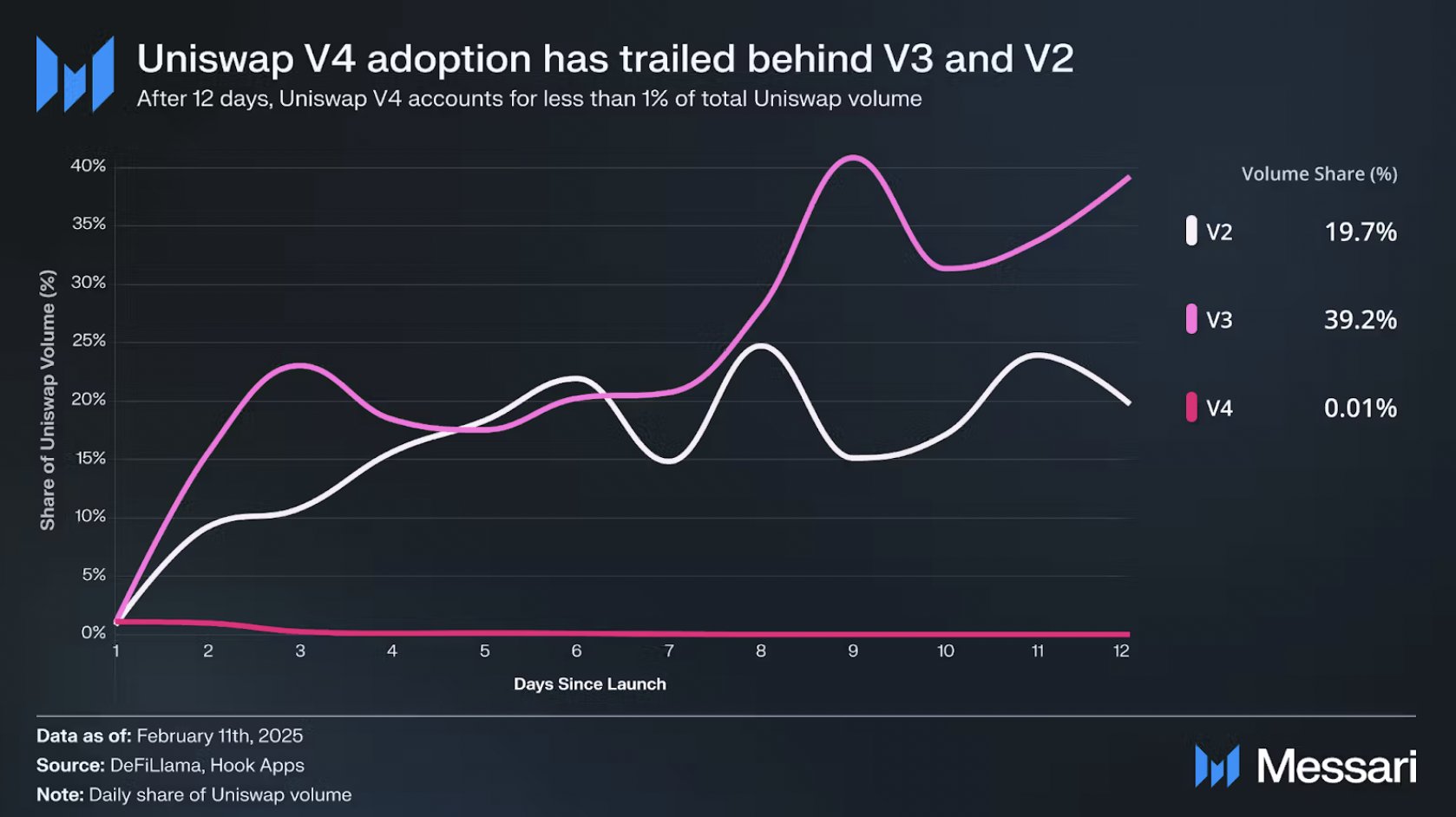

The launch of V4, heralded as a new dawn, has instead been met with a collective yawn from the community. With a mere 0.01% of the volume share, V4 is like a forgotten child, overshadowed by its older siblings, V3 and V2, who galloped to 40% and 20% market share in just 12 days. Oh, the irony! 🎭

As users cling to the familiar embrace of V3, skepticism festers like an uninvited guest at a dinner party. The excitement is palpable—if only in its absence—casting a shadow over the token price that seems to be in a perpetual state of decline.

From a technical standpoint, Uniswap’s price action resembles a slumbering giant, as the Relative Strength Index (RSI) languishes below the neutral mark. A flicker of bullish momentum appears, yet it remains trapped beneath the 50.0 threshold, like a bird longing to soar but tethered by invisible strings.

Until the RSI breaks free and rises above 50.0, Uniswap’s path to recovery seems as elusive as a mirage in the desert. The broader market cues, too, have turned their backs, leaving the altcoin ensnared below the $10 barrier, while the slow adoption of V4 only deepens the quagmire.

UNI‘s Struggle: A Comedy of Errors

At present, Uniswap’s price hovers at $9.65, a mere whisper away from the $10.06 resistance level, which it has been unable to breach since the month began. The lack of bullish market cues, coupled with the sluggish uptake of V4, suggests that the price will remain trapped in a range, like a hamster on a wheel. 🐹

If these bearish trends persist, UNI may find itself consolidating between $10.06 and $8.76, delaying any hope of recovery and exposing it to further losses. Should the price slip below $8.76, it could tumble to $8.23, deepening the wounds of its investors.

Yet, should Uniswap manage to ignite a spark of interest in V4, it could shatter the $10.06 barrier and transform it into a bastion of support. This would allow UNI to ascend, targeting $11.96 and perhaps dispelling the current bearish gloom. The fate of this recovery hinges on the successful embrace of the V4 upgrade, which could rekindle the flames of investor confidence in the token’s future. 🔥

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-19 15:18