The token has moved past the upper Bollinger Band, a move that usually screams “overbought” (aka “uh-oh”), but hey, maybe it’s just getting warmed up. With rising volume and open interest to back up this breakout, UNI is sitting near a range that could make or break its future—kind of like deciding whether to finish the entire pizza or save a slice for later. Spoiler alert: It’s probably going to finish the pizza.

UNI Strengthens Above $8.40 as Volume Confirms Breakout

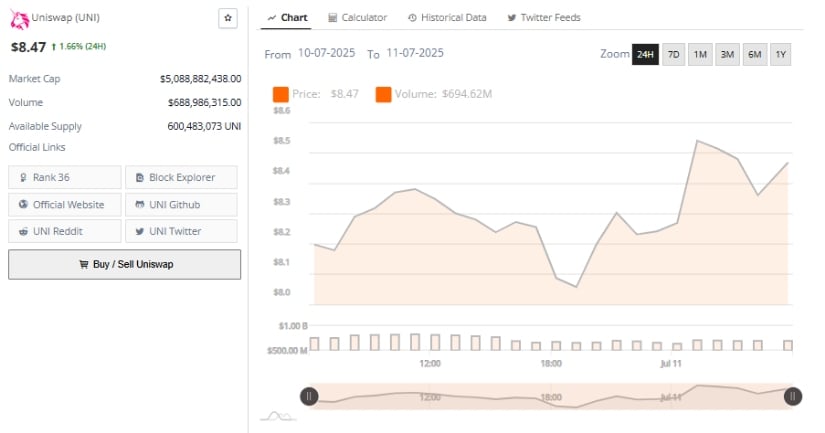

The 24-hour chart for UNI/USDT from BraveNewCoin shows a 1.66% gain, with the price currently chilling at $8.47. After starting the day near $8.20, the token took a little detour below $8.00 but quickly found its groove and decided to go upward. It’s like that time you thought you were done with dessert but then saw the last piece of cake.

The token briefly peaked at $8.55, reflecting strong buying interest and a little market swagger. The rebound from the afternoon lows is like the market flexing its muscles—showing it’s got short-term support levels in check.

Volume shot up to $688.98 million, with UNI making its way back into the $8.40 zone. This increase in volume is like a solid handshake—validating that this price jump isn’t just a fluke. With a market cap of $5.08 billion, Uniswap is now ranked #36 among digital assets. That’s not too shabby for a digital coin!

The volume-to-market-cap ratio is climbing, signaling that more people are paying attention. For the bullish trend to stick around, UNI needs to keep above the $8.30–$8.40 zone, like a tightrope walker trying not to fall. The higher the interest, the better. No pressure.

MACD and Bollinger Band Break Signal Short-Term Momentum

The daily chart for UNI/USDT from TradingView shows the token trading at $8.44, slightly above the upper Bollinger Band at $8.427. This breakout follows a long period of playing it cool between $6.90 and $8.00 and marks the highest price we’ve seen in recent weeks. It’s like a teenager finally hitting their growth spurt—everyone’s noticing.

With the Bollinger Bands now expanded, it’s clear that volatility is here to stay. The mid-band, also known as the 20-day simple moving average, sits at $7.291, acting like a reliable safety net if things go south. But, for now, it’s all about upward momentum.

The MACD indicator is looking pretty bullish, with the MACD line at 0.332, comfortably above the signal line at 0.196. The histogram is also green, suggesting that momentum is on the up and up. If it keeps going, UNI might just head toward the $9.10–$9.50 resistance zone. But let’s not get too cocky. A fall below $8.20 could spell a short-term dip, and no one likes a dip. Except for maybe in nacho cheese.

One-Hour Chart Shows Rising Open Interest Amid Uptrend

The one-hour UNI/USDT chart shows that the bullish trend started back on July 6, taking UNI from below $7.00 to a local high near $8.60. The chart is showing a series of higher highs and higher lows, like a solid playlist of feel-good hits. But now, the price is consolidating around $8.45–$8.60—kind of like deciding whether to keep dancing or call it a night. It’s that moment of hesitation before the next big move.

Open Interest (OI) has risen above 6.1 million contracts, signaling that new money is jumping in on the action. Even though OI dipped slightly since July 9, it’s still higher than earlier in the month. If UNI can hold above $8.20 with OI staying steady or rising, we might just see $9.00 in the near future. If both price and OI start to dip, however, we might be looking at the digital equivalent of a slow dance to the end of the night.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-07-11 21:43