Centrus Energy (LEU +13.97%) has established itself as a notable entity within the U.S. uranium enrichment and nuclear fuel supply sector.

The company generates revenue through the provision of uranium fuel and contractual engagements, notably exemplified by its recent demonstration of high-assay, low-enriched uranium (HALEU) for the Department of Energy (DOE).

This might seem unremarkable at first glance; however, it is essential to acknowledge the shifting landscape wherein the U.S. aims to diminish its dependence on Russian nuclear fuel. Centrus has transitioned from a largely unnoticed player to a pivotal contributor in the nuclear supply chain.

For those still skeptical, consider this: Centrus’s stock experienced a remarkable ascent of over 218% year-to-date (as of this writing). In mid-October, it achieved a fivefold increase before succumbing to the general downturn affecting nuclear equities.

For those intrigued, here are two critical insights to consider regarding Centrus Energy.

1. Strategic Importance to the U.S. Government

Centrus possesses a significant competitive advantage due to its unique position as one of the few U.S.-owned, publicly traded uranium enrichers. Moreover, it holds the distinction of being the inaugural U.S. company licensed to produce HALEU, a crucial nuclear fuel anticipated to be utilized by numerous next-generation reactors.

This detail bears substantial weight. Historically, the global enrichment capacity has been concentrated within a select few nations, with Russia holding a dominant position. Should advanced reactors become integral to the U.S. energy portfolio-particularly as reliable electricity sources for burgeoning data centers-establishing a robust HALEU supply chain will be paramount.

The DOE recognizes this necessity and is collaborating closely with Centrus to bolster its HALEU production capabilities. Simply put, the government is financially backing Centrus to execute a HALEU production demonstration in Piketon, Ohio, with expectations to deliver HALEU to the DOE. Notably, Centrus has already reached a significant milestone under this agreement, delivering 900 kilograms of HALEU, and the DOE has extended its contract for an additional 900 kilograms by 2026.

2. Financial Resilience Amidst Volatility

Centrus stands apart in the sector as a profitable entity, contrasting sharply with other speculative nuclear stocks, such as Oklo and Nano Nuclear Energy.

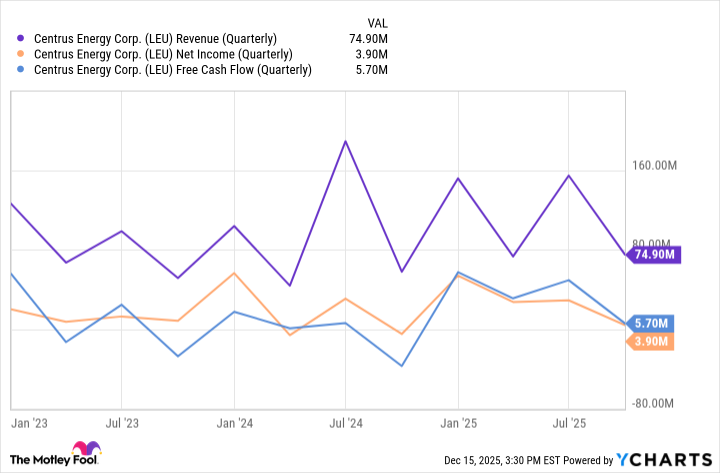

In the third quarter of 2025, Centrus reported approximately $4 million in net income on revenues nearing $75 million. This figure marks a decline from its second quarter, which recorded net income of around $29 million on revenue of approximately $155 million. It is imperative to note that Centrus’s contracts do not yield consistent quarter-to-quarter revenue, resulting in earnings that fluctuate based on delivery pricing.

Furthermore, Centrus boasts a robust balance sheet. Following the successful raising of approximately $805 million via a convertible note offering in August, the company concluded its third quarter with roughly $1.6 billion in unrestricted cash. This financial position provides substantial flexibility for a firm of its size, particularly as it prepares to expand its enrichment facility in Piketon, Ohio.

However, it is crucial to acknowledge potential downsides; those same notes may convert into new shares, consequently diluting existing shareholder equity.

Investment Considerations for Centrus

Centrus presents a compelling opportunity for patient investors willing to navigate volatility while harboring a belief in a long-term resurgence of nuclear energy. However, it should not be perceived as a stable or secure investment. For those seeking greater predictability, a nuclear energy exchange-traded fund (ETF) may constitute a more suitable alternative.

🔍

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

2025-12-20 17:02