Author: Denis Avetisyan

A new framework combines the power of artificial intelligence and linguistic structure to automatically discover and refine investment strategies.

This paper introduces AlphaCFG, a system leveraging context-free grammars, Tree-LSTMs, and reinforcement learning for interpretable alpha factor discovery in quantitative finance.

Discovering consistently profitable quantitative trading strategies remains a challenge, often hindered by exhaustive searches over vast, unstructured spaces of potential factors. This paper, ‘Alpha Discovery via Grammar-Guided Learning and Search’, introduces AlphaCFG, a novel framework that leverages context-free grammars and reinforcement learning to systematically explore and refine syntactically valid and financially interpretable alpha factors. Experimental results demonstrate that AlphaCFG outperforms state-of-the-art methods in both search efficiency and trading profitability across Chinese and U.S. stock markets. Could this grammar-guided approach unlock a new era of symbolic factor discovery and refinement, extending beyond trading to broader areas of quantitative finance such as asset pricing and portfolio construction?

The Inevitable Decay of Traditional Models

Conventional statistical techniques, such as linear regression and correlation analysis, frequently fall short when applied to the intricacies of financial markets. These methods operate under the assumption of straightforward, proportional relationships between variables-a premise rarely met in reality. Financial data is inherently noisy and often exhibits non-linear patterns – meaning relationships aren’t consistently direct or predictable. Factors that appear weakly correlated under traditional analysis can, in fact, possess a strong, yet obscured, influence when viewed through the lens of complex interactions. This limitation often leads to the overlooking of potentially profitable alpha factors, as these techniques struggle to capture the subtle, conditional relationships that drive market movements. Consequently, reliance on these conventional approaches may result in incomplete models and missed investment opportunities, particularly in dynamic and evolving markets.

While machine learning algorithms demonstrate considerable predictive power in identifying potential alpha factors, their inherent complexity often presents a significant challenge to practical implementation. These models, frequently operating as ‘black boxes’, can achieve high accuracy without revealing why a particular factor is predictive, or the underlying relationships driving its success. This lack of transparency hinders both investor trust and the crucial process of model refinement; without understanding the causal mechanisms, it becomes difficult to assess a factor’s robustness across different market conditions or to confidently adjust strategies based on evolving data. Consequently, the potential benefits of these powerful algorithms are often tempered by the need for explainability, pushing researchers to develop techniques that can illuminate the inner workings of these complex systems and bridge the gap between prediction and understanding.

A truly resilient investment strategy demands more than simply identifying predictive signals – known as alpha factors – but also a comprehensive understanding of why those signals work. Traditional approaches often treat factor discovery and interpretation as separate steps, leading to brittle strategies vulnerable to changing market dynamics. A systematic methodology, however, integrates these processes, employing techniques that not only uncover potential alpha but also rigorously assess the underlying economic rationale and potential limitations. This holistic approach allows for continuous refinement, increased confidence in predictive power, and ultimately, a more robust and adaptable investment framework capable of navigating complex and evolving financial landscapes. Such rigor moves beyond statistical correlation toward causal inference, bolstering long-term performance and mitigating the risks associated with relying on opaque or poorly understood factors.

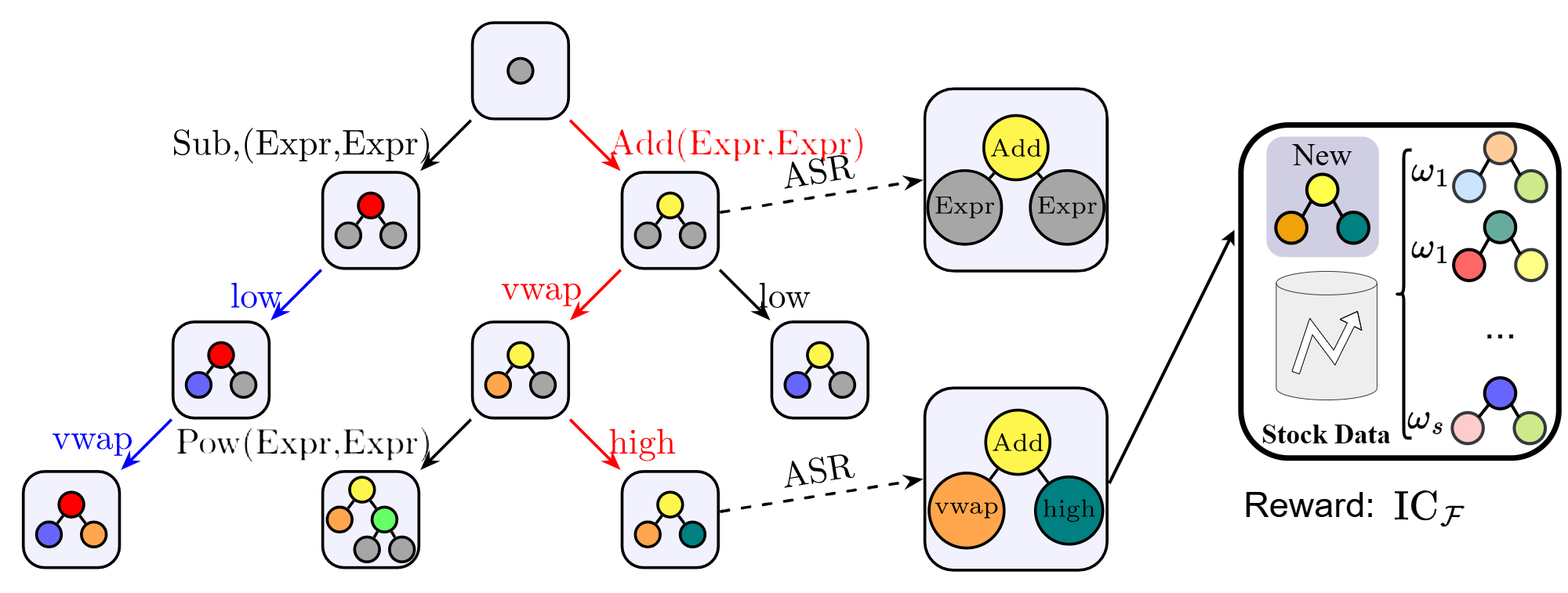

Structuring Alpha: A Grammar of Financial Logic

The representation of alpha factors as expressions within a formal grammar, specifically a Context-Free Grammar (CFG), provides a standardized and machine-readable structure for their logical composition. A CFG defines a set of rules specifying how symbols can be combined to create valid factor expressions; these expressions are built from terminal symbols representing data inputs (e.g., price, volume) and non-terminal symbols representing operators or intermediate calculations. This grammatical structure allows for the unambiguous parsing and interpretation of each factor’s logic, facilitating automated analysis, modification, and generation of new factors. By explicitly defining the syntax of alpha factors, we move beyond informal, string-based representations and enable rigorous computational manipulation and validation of investment strategies.

Reverse Polish Notation (RPN), also known as postfix notation, facilitates efficient parsing and evaluation of alpha factor expressions by eliminating the need for parentheses and operator precedence rules. In RPN, operators follow their operands, allowing for direct evaluation using a stack-based algorithm. This process involves pushing operands onto the stack and, upon encountering an operator, popping the necessary operands, performing the operation, and pushing the result back onto the stack. The final result remains as the sole element on the stack. This approach reduces computational complexity compared to traditional infix notation parsing, as it avoids the need for a parse tree and simplifies the evaluation process, particularly beneficial when dealing with a large number of factors and frequent backtesting scenarios. a \cdot b + c in infix becomes a b \cdot c + in RPN.

The application of a formal linguistic framework to alpha factor discovery facilitates a systematic and exhaustive search of the potential factor space, contrasting with traditional, ad hoc methods. By defining alpha factors within a constrained grammar, the framework allows for the generation of all valid factor expressions, rather than relying on intuition or manual construction. This approach enables quantitative evaluation of factor validity and performance across the entire solution space, mitigating the risk of overlooking potentially profitable strategies. Furthermore, the structured representation allows for automated optimization and simplification of factors, improving efficiency and reducing overfitting. The ability to algorithmically explore and refine factors represents a shift from subjective model building to an objective, data-driven process.

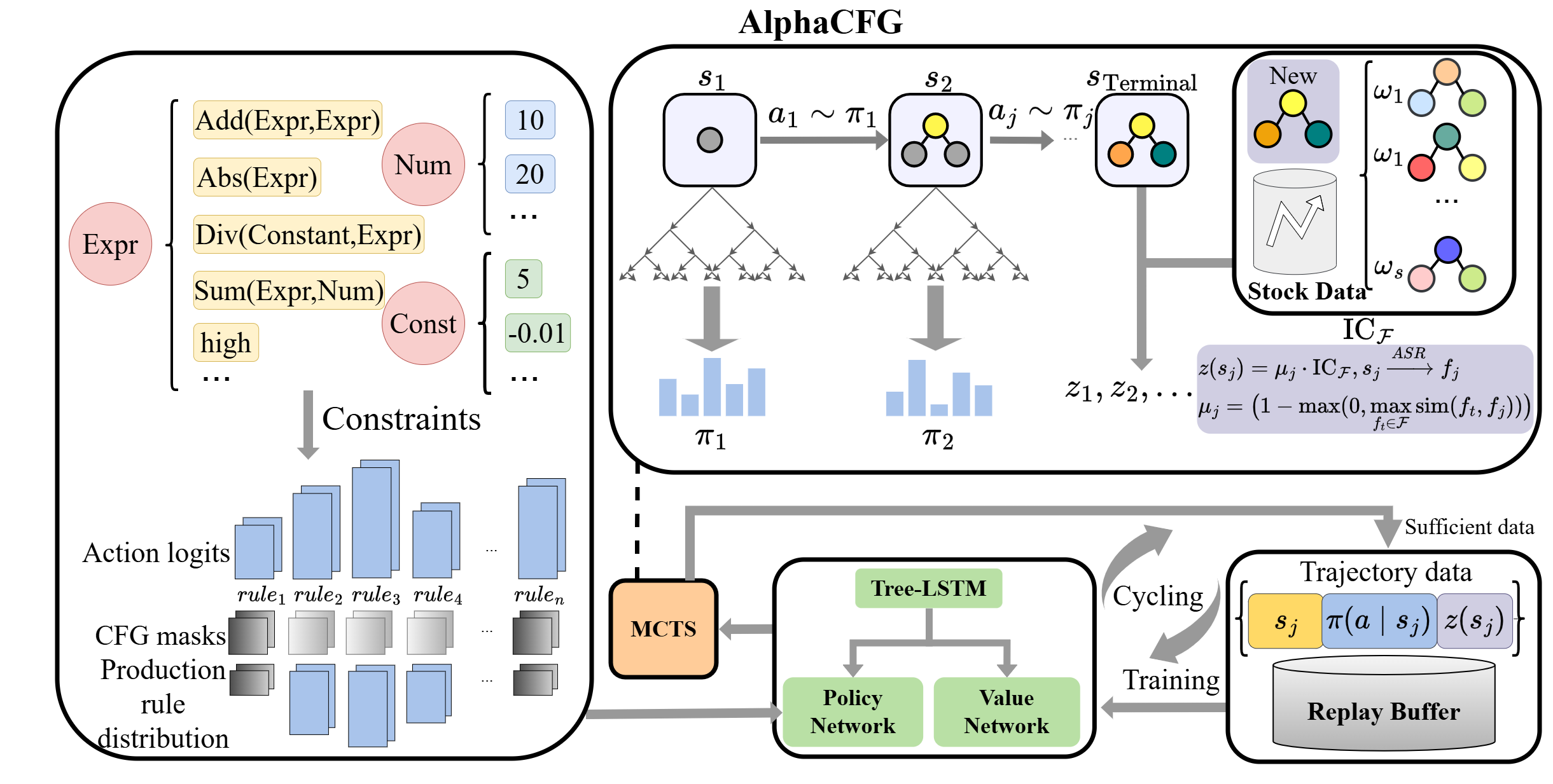

AlphaCFG: A Systematic Approach to Factor Discovery

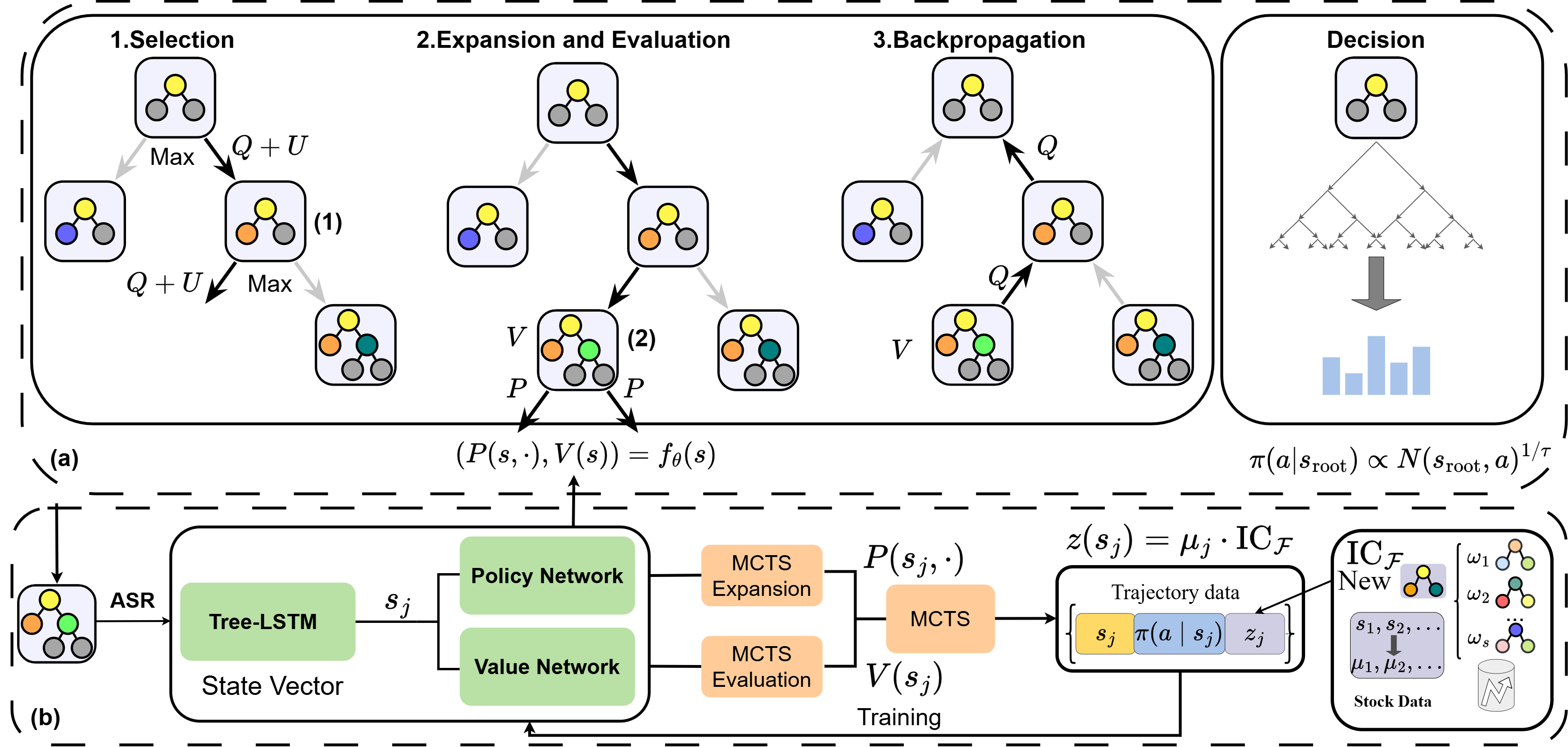

AlphaCFG leverages a context-free grammar (CFG) to define the allowable structure and components of alpha factors, enabling the systematic generation of potential trading signals. This grammar is integrated with Monte Carlo Tree Search (MCTS), a machine learning technique used to explore the vast space of possible alpha factor expressions. MCTS guides the search process, prioritizing the evaluation of more promising factor structures based on observed performance metrics. The CFG ensures that generated factors are syntactically valid and interpretable, facilitating analysis and understanding of the underlying trading logic. This approach automates the traditionally manual process of alpha factor discovery, allowing for the efficient creation of potentially profitable trading strategies.

TreeLSTM models are utilized within AlphaCFG to address the challenges of processing and encoding the tree-structured expressions that represent alpha factors. Traditional recurrent neural networks (RNNs) struggle with non-linear data and variable-length inputs; TreeLSTMs overcome these limitations by recursively composing vector representations of tree nodes. This allows the model to capture hierarchical relationships within the alpha factor expressions, effectively representing the complex interactions between financial variables. The input to the TreeLSTM is a parse tree of the alpha factor expression, and the model learns to represent each node as a vector embedding, capturing its semantic meaning within the overall factor calculation. This structured encoding facilitates the discovery of more interpretable and predictive alpha factors compared to methods that treat factors as unstructured data.

The predictive power of alpha factors discovered by AlphaCFG is quantitatively assessed using the Information Coefficient (IC). Evaluations across both the CSI 300 and S&P 500 datasets demonstrate that AlphaCFG achieves IC values ranging from 0.05 to 0.08. This performance consistently exceeds that of benchmark models, including Reverse Polish Notation (RPN), AlphaGen, and AlphaQCM, when subjected to the same evaluation criteria. The IC metric quantifies the correlation between predicted and actual returns, with higher values indicating greater predictive accuracy; AlphaCFG’s results suggest a statistically significant improvement in identifying factors with strong forecasting capabilities.

AlphaCFG distinguishes itself by integrating both symbolic and numerical computation within a single framework for alpha factor discovery. Traditional approaches rely either on data-driven methods, which can produce opaque and difficult-to-interpret factors, or on manually defined, rule-based systems that lack adaptability. AlphaCFG overcomes these limitations by leveraging a formal grammar to represent alpha factors symbolically, while simultaneously employing machine learning for efficient search and optimization. Backtesting simulations demonstrate the effectiveness of this combined approach, consistently achieving Sharpe Ratios between 0.6 and 0.8, indicating a favorable risk-adjusted return profile.

Diversifying the Toolkit: Complementary Learning Models

Numerous machine learning models supplement AlphaCFG in the prediction of alpha factors. Gradient boosting methods, specifically XGBoost and LightGBM, are frequently employed due to their efficiency and predictive power. Recurrent Neural Networks (RNNs), including Long Short-Term Memory (LSTM) and Attentive LSTM (ALSTM) networks, are utilized to capture temporal dependencies within financial time series data. Furthermore, Temporal Convolutional Networks (TCNs) provide an alternative approach to modeling sequential data, offering advantages in parallelization and long-range dependency capture. These models are actively researched and deployed in quantitative finance for generating predictive signals.

AlphaGen and AlphaQCM represent factor mining approaches that leverage reinforcement learning (RL) to identify profitable trading strategies. These techniques frame the factor discovery process as a Markov Decision Process, where an RL agent iteratively learns to construct and evaluate potential alpha factors. The agent receives rewards based on the performance of these factors, encouraging the development of strategies that maximize returns and minimize risk. Specifically, AlphaGen employs a generative approach, creating factors from a predefined set of building blocks, while AlphaQCM focuses on learning optimal combinations of existing factors through a quality-based learning process. Both methods automate the typically manual process of factor construction and selection, enabling the discovery of novel and potentially high-performing alpha signals.

Symbolic regression, implemented through the GPlearn library, offers an automated approach to constructing alpha factor formulas. Unlike traditional methods requiring manual specification, GPlearn employs genetic programming to evolve mathematical expressions that best fit the provided data. This process generates equations comprising basic arithmetic operations and functions, resulting in directly interpretable factors. The resulting formulas, while potentially more complex than those derived through manual feature engineering, provide transparency into the relationships driving predictive power, allowing for greater understanding and validation of the factor’s behavior. The output is a mathematical function f(x) = a + bx + cx^2 where the coefficients a, b, and c are determined through the evolutionary process.

The integration of diverse machine learning models – including XGBoost, LightGBM, LSTM, ALSTM, and TCN – within a factor discovery framework leverages their complementary strengths to improve predictive performance. While various models can be employed, AlphaCFG has demonstrated a risk profile characterized by a Maximum Drawdown of 10-15% in comparative analyses. This indicates a potentially lower peak-to-trough decline during a specified period than observed with several baseline factor prediction methods, suggesting improved capital preservation characteristics when utilized within a broader quantitative strategy.

Towards Intelligent Systems: A Future of Adaptive Finance

The convergence of natural language processing and quantitative finance heralds a new era for investment strategies. AlphaCFG, a linguistic learning approach, doesn’t simply analyze numerical data; it dissects the language surrounding financial instruments – news articles, analyst reports, and even social media – to extract nuanced insights often missed by traditional models. By combining this qualitative understanding with the predictive power of established quantitative techniques, systems can move beyond identifying what is happening in the market to understanding why, potentially uncovering hidden drivers and anticipating future trends. This synergistic approach promises more robust and adaptable investment systems, capable of navigating complex market dynamics with a level of sophistication previously unattainable, and represents a significant leap towards truly intelligent automation in finance.

The increasing complexity of automated investment strategies necessitates a concurrent focus on explainable AI (XAI). While powerful predictive models may generate profitable signals, their opacity hinders adoption by portfolio managers and regulators who require understanding of the underlying rationale. Further research into XAI techniques – methods that illuminate the decision-making processes of these ‘black box’ algorithms – is therefore crucial for fostering trust and enabling effective human oversight. This isn’t simply about transparency; it’s about accountability and the ability to identify and correct potential biases or errors in the system. Successfully integrating XAI will allow human experts to validate automated insights, refine investment strategies, and ultimately, build more robust and reliable intelligent investment systems.

The methodologies underpinning AlphaCFG extend beyond simple stock ranking, presenting considerable opportunities to refine broader financial forecasting models. Current research indicates a strong potential for adapting these techniques to accurately predict market volatility, a critical component of options pricing and portfolio optimization. Furthermore, the automated factor discovery inherent in this approach promises to enhance risk management strategies by identifying previously unseen correlations and potential vulnerabilities within complex financial instruments. Successfully applying these learnings could lead to more robust and adaptive systems capable of navigating increasingly turbulent market conditions, ultimately improving the precision and efficacy of financial modeling across multiple disciplines.

The future of quantitative finance is poised for transformation through interpretable and automated factor discovery, moving beyond traditional, manually-defined investment strategies. Recent advancements, such as the AlphaCFG model, exemplify this shift by autonomously identifying predictive signals directly from financial text. Crucially, this approach isn’t simply about automation; it’s about transparency. AlphaCFG’s ability to articulate the reasoning behind its investment decisions – a key feature of explainable AI – builds trust and allows for effective human oversight. Empirical results demonstrate a tangible benefit, with AlphaCFG achieving an improved Rank ICIR of 0.06-0.08 compared to several established baseline methods, suggesting that this new paradigm has the potential to deliver demonstrably superior investment performance while simultaneously enhancing understanding of market dynamics.

The pursuit of Alpha Discovery, as detailed within this framework, echoes a fundamental truth about all systems. While AlphaCFG aims to unearth consistently high-performing factors, it acknowledges the inherent instability within complex financial markets. This mirrors the observation that ‘there is no permanence in this world, only change.’ Just as latency is an unavoidable tax on every request within a system, market conditions inevitably shift, demanding constant adaptation. The framework’s reliance on context-free grammars and Tree-LSTMs isn’t about achieving absolute stability, but rather building a system that ages gracefully, capable of interpreting and responding to the ceaseless flow of change. The very search for interpretable factors implies an acceptance of impermanence – an effort to understand the why behind performance, knowing that even the most robust signal will eventually decay.

What Lies Ahead?

The framework detailed herein, while demonstrating a capacity for automated factor discovery, merely marks a point on the timeline of quantitative research. The system’s chronicle-the logging of grammar derivations and reinforcement learning iterations-reveals not perfection, but a particular configuration of search. The inherent limitations of any context-free grammar lie in its inability to fully capture the nuanced complexities of market dynamics; the grammar is, after all, a simplification, a reduction of infinite possibility to a finite set of rules. Future iterations must grapple with this fundamental constraint, perhaps by exploring probabilistic or context-sensitive grammars-though each expansion of expressive power brings a corresponding increase in computational burden.

Furthermore, the current approach, focused on interpretability, trades off some degree of predictive power. The question is not whether this is a flaw, but whether graceful degradation is preferable to brittle complexity. Deployment, as a moment on the timeline, exposes the model to the unforgiving pressures of real-world data, where unforeseen regimes shift and previously reliable signals decay. The true measure of success will not be initial performance, but the system’s capacity to adapt, to refine its grammar, and to log its own obsolescence.

Ultimately, the pursuit of automated alpha discovery is a study in entropy. The market, a chaotic system, continuously generates new patterns and discards old ones. The challenge for future research lies not in finding the ultimate factor, but in building systems that can gracefully navigate this perpetual state of flux-systems that acknowledge their own impermanence and learn to evolve alongside the market itself.

Original article: https://arxiv.org/pdf/2601.22119.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-30 09:02