Author: Denis Avetisyan

Researchers have developed a novel framework that intelligently explores and refines investment strategies by mapping relationships between factors and optimizing their evolution.

AlphaPROBE leverages directed acyclic graphs and Bayesian optimization to improve alpha factor discovery in quantitative finance.

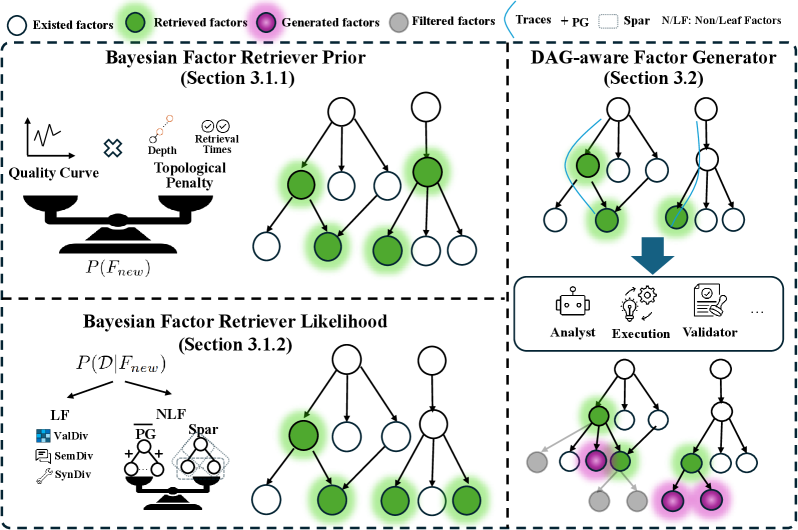

Existing automated alpha factor discovery methods often treat factors in isolation or as fragmented chains, hindering the exploration of complex relationships and limiting overall performance. To address this, we introduce AlphaPROBE-Alpha Mining via Principled Retrieval and On-graph biased evolution-a novel framework that reframes alpha mining as strategic navigation of a Directed Acyclic Graph (DAG), leveraging Bayesian optimization to identify and evolve high-potential factors. Our experiments demonstrate that modeling the interconnectedness of factors significantly enhances predictive accuracy, return stability, and training efficiency across major Chinese stock market datasets. Does this DAG-centric approach represent a fundamental shift towards more robust and efficient automated alpha discovery in quantitative finance?

The Illusion of Alpha: Why Traditional Methods Fail

Conventional approaches to discovering alpha – the excess return of an investment – frequently involve meticulously combing through vast datasets and subjecting numerous potential predictive relationships to rigorous statistical testing. However, this exhaustive search methodology often proves inadequate in capturing the nuanced and often subtle connections that genuinely drive market behavior. These traditional methods, while comprehensive in scope, can inadvertently overlook weak signals obscured by noise or complex interactions, particularly within the intricate dynamics of modern financial markets. The reliance on statistical significance as the primary filter frequently leads to a prioritization of easily detectable, yet ultimately superficial, patterns, while truly predictive relationships – those exhibiting more delicate or conditional effects – remain hidden, limiting the potential for robust and sustainable investment strategies.

The inherent complexity of financial markets presents a significant challenge to traditional alpha factor discovery techniques. These methods, often reliant on identifying correlations within historical data, can be easily misled by spurious relationships – patterns that appear predictive but lack genuine explanatory power. Consequently, a common pitfall is overfitting, where a model learns the noise within the training data rather than the underlying signal. While a model may perform exceptionally well on past data, its predictive ability diminishes considerably when applied to new, unseen market conditions. This results in a discrepancy between backtested performance and actual, real-world returns, highlighting the limitations of purely statistical approaches and the need for more robust and generalizable strategies.

The investment landscape is increasingly saturated with alpha factors, creating a challenging environment where simply identifying any predictive signal is no longer sufficient. A shift towards more strategic and efficient discovery methods is now paramount, as the sheer volume of factors diminishes the likelihood of uncovering truly novel insights. Researchers are compelled to move beyond exhaustive searches, focusing instead on approaches that prioritize signal clarity and robustness. This necessitates incorporating techniques like dimensionality reduction, regularization, and a deeper understanding of factor interactions to distinguish genuine predictive power from spurious correlations. Ultimately, success hinges on a move from quantity to quality, demanding a more discerning approach to factor selection and implementation in order to navigate the complexities of modern financial markets.

AlphaPROBE: Mapping the Factor Space

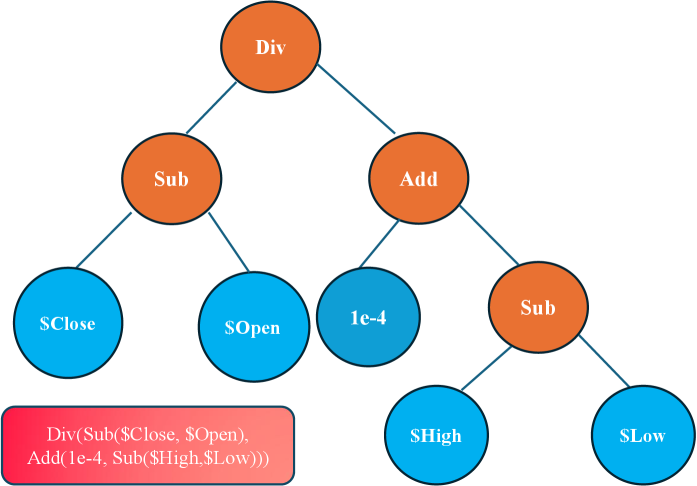

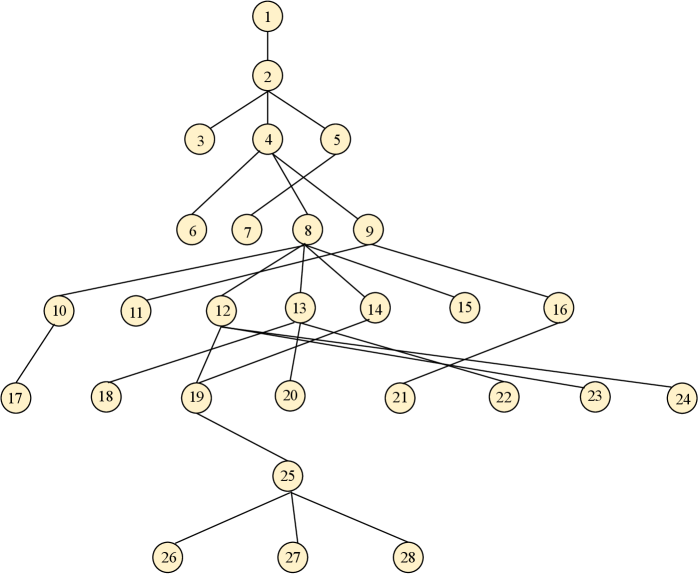

AlphaPROBE models the alpha mining process as a traversal of a Directed Acyclic Graph (DAG) where nodes represent potential investment factors. This graph structure explicitly defines relationships between factors, enabling a systematic exploration of the factor space. The DAG is constructed such that edges indicate potential dependencies or combinations between factors; for example, an edge might point from a broad market indicator to a more specific sector-based factor. By representing these relationships graphically, AlphaPROBE facilitates a more organized and efficient search for high-performing factors compared to traditional, less structured approaches. The acyclic nature of the graph prevents infinite loops during the factor generation and evaluation process, ensuring computational feasibility.

The Bayesian Factor Retriever component within AlphaPROBE utilizes a probabilistic model to prioritize potential parent factors during factor expansion. This approach avoids exhaustive searches by assigning a probability score to each candidate factor based on its predicted contribution to performance, as determined by historical data and feature correlations. Factors exceeding a defined threshold are then selected for further evaluation, significantly reducing the computational complexity of the factor discovery process. The retriever dynamically adjusts its selection criteria based on observed performance, allowing it to adapt to changing data distributions and focus on the most promising areas of the factor space.

The Factor Generator within AlphaPROBE constructs novel factors by systematically combining existing factors, a process directly informed by the structure of the underlying Directed Acyclic Graph (DAG) and predicted performance metrics. This combination isn’t random; the DAG dictates permissible connections and dependencies between factors, ensuring generated factors represent logically coherent relationships. Furthermore, the Generator prioritizes combinations predicted to yield high-performing factors – as determined by the Bayesian Factor Retriever – effectively focusing computational resources on the most promising areas of the factor space. This guided combination process allows for efficient exploration of potential factor interactions and the creation of complex factors beyond those initially present in the dataset.

Quantifying Factor Quality: Beyond Simple Statistics

The AlphaPROBE framework employs a Directed Acyclic Graph (DAG)-aware factor generator leveraging Large Language Models (LLMs) for the synthesis of novel investment factors. This LLM-based approach moves beyond traditional statistical methods by identifying and exploiting complex, non-linear relationships within financial data. The DAG structure ensures that factor dependencies are explicitly modeled, preventing circular logic and promoting interpretability. By processing extensive datasets, the LLM identifies potential factors, which are then evaluated based on their predictive power and statistical significance, ultimately generating factors intended to capture more nuanced market signals than conventional methods.

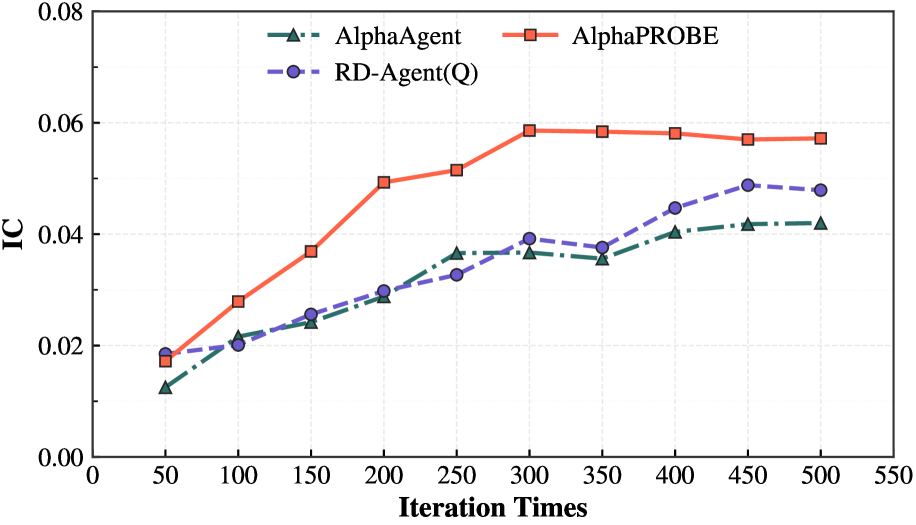

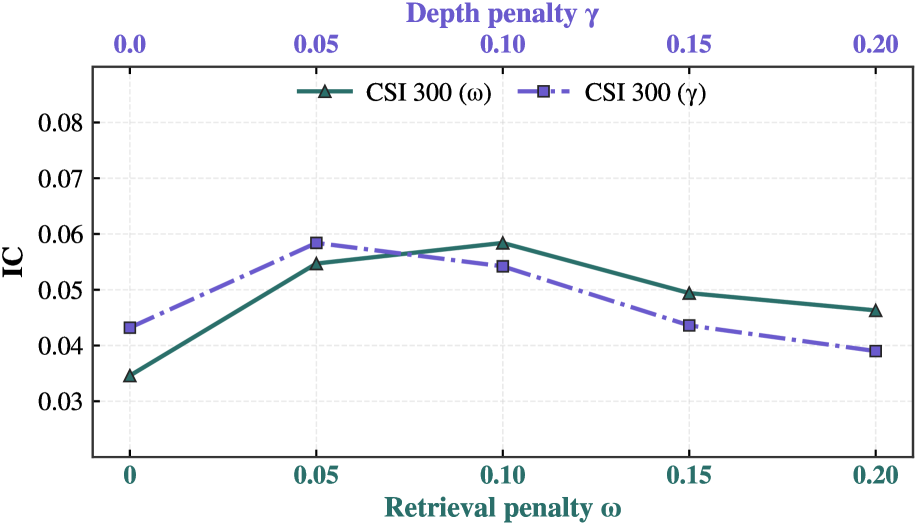

Factor quality within the AlphaPROBE framework is quantitatively assessed using the Information Coefficient (IC) and Information Ratio (ICIR). The IC measures the linear relationship between a factor’s returns and asset returns, with higher values indicating stronger predictive power; values are typically calculated on a portfolio-weighted basis. ICIR, calculated as the average IC divided by the standard deviation of the IC over time, provides a risk-adjusted measure of a factor’s performance. Statistical significance is then determined to validate that observed IC and ICIR values are not due to random chance, ensuring the generated factors demonstrate consistent and reliable predictive capabilities across the tested datasets.

The factor selection process within the framework emphasizes both performance improvement and portfolio diversification. Factor “Gain” is quantitatively measured as the incremental improvement in predictive power achieved by a newly generated factor compared to its constituent parent factors; a higher Gain indicates a demonstrable increase in alpha generation. Simultaneously, the framework minimizes the correlation between generated factors, calculated using Pearson’s correlation coefficient, to reduce redundancy and promote a more diversified investment strategy. This dual prioritization of Gain and low Correlation aims to maximize portfolio efficiency by identifying factors that contribute unique, statistically significant predictive signals.

Robustness of the factor generation framework was validated through performance evaluation across three prominent Chinese stock market indices: the CSI 300, CSI 500, and CSI 1000. Testing on these diverse datasets, representing varying market capitalizations and sector compositions, consistently demonstrated improved performance metrics compared to baseline methods. Specifically, the framework’s generated factors exhibited statistically significant gains in Information Coefficient (IC) and Information Ratio (ICIR) across all three indices, indicating consistent and reliable performance irrespective of market segment. This cross-index validation confirms the generalizability and practical applicability of the factor generation approach within the Chinese equity market.

Performance evaluation of AlphaPROBE demonstrates a statistically significant improvement in Information Coefficient over Information Ratio (ICIR) when benchmarked against established baseline methodologies across three distinct Chinese stock market indices. Specifically, the CSI 300, CSI 500, and CSI 1000 datasets all exhibited a higher average ICIR for factors generated by AlphaPROBE, indicating a superior risk-adjusted return compared to traditional factor construction techniques. These results consistently validate the framework’s ability to identify and exploit predictive signals within the Chinese equity market, providing evidence of improved alpha generation capabilities.

Beyond Backtests: Managing Risk and Building Resilient Portfolios

Backtesting reveals a consistent performance advantage for factors generated by AlphaPROBE when contrasted with traditional methods. This superiority is quantitatively demonstrated through the Sharpe Ratio

Comprehensive risk analysis reveals the framework’s strength in preserving capital during adverse market conditions. Utilizing Maximum Drawdown (MDD) as a key metric, evaluations consistently demonstrate a lower potential for peak-to-trough decline compared to conventional investment strategies. This indicates a heightened ability to navigate market volatility and limit losses, providing investors with greater confidence in the framework’s resilience. The reduced MDD isn’t merely a statistical observation; it translates to a more stable investment experience and improved long-term returns by minimizing the severity of potential downturns. This focus on downside protection is integral to the framework’s design, fostering a balance between opportunity and capital preservation.

A robust portfolio hinges not simply on identifying profitable factors, but on the breadth and independence of those factors themselves. This framework excels by generating a diverse set of signals, deliberately avoiding the common pitfalls of highly correlated strategies. This diversification isn’t merely about spreading risk; it actively enhances consistency by ensuring the portfolio isn’t overly reliant on any single market condition or predictive edge. The resulting portfolios demonstrate a marked ability to maintain performance across varying economic cycles, as the independent factors compensate for each other’s weaknesses and amplify collective strengths – ultimately leading to a smoother equity curve and more reliable long-term returns.

The pursuit of automated alpha discovery, as detailed in this framework, feels predictably ambitious. It’s easy to envision the elegance of a Directed Acyclic Graph guiding factor evolution with Bayesian optimization, but production data rarely cooperates with elegant theories. As Vinton Cerf observed, “Any sufficiently advanced technology is indistinguishable from magic.” This pursuit of ‘magic’ in quantitative finance, however, will inevitably reveal its underlying mechanics – and likely, a substantial amount of technical debt. The system might initially highlight promising factors, but the real test lies in sustained performance when market conditions inevitably shift. One can anticipate the need for constant recalibration and refinement, a continuous cycle of optimization rather than a singular breakthrough.

What’s Next?

The pursuit of automated alpha discovery, as exemplified by AlphaPROBE, inevitably bumps against the limitations of data itself. Principled retrieval and graph-based evolution offer a veneer of sophistication, but the underlying signals remain stubbornly historical. It’s a comforting illusion that relationships identified on past data will reliably predict future market behavior. The inevitable drift – the slow realization that every edge case not captured in backtesting will materialize – is merely delayed, not avoided.

Future iterations will undoubtedly focus on more complex graph structures, attempting to encode increasingly subtle relationships between factors. Bayesian optimization will be layered with other optimization techniques, each promising marginal gains. But the core problem persists: markets are adaptive systems, and any automated strategy, however elegantly constructed, becomes a target for exploitation. The ‘innovation’ will become the new normal, and then, inevitably, a liability.

One suspects the next breakthrough won’t be in the algorithm itself, but in the tooling to rapidly rebuild them. AlphaPROBE, and its successors, will likely be less about discovering the perfect factor, and more about minimizing the cost of replacing the broken ones. Everything new is just the old thing with worse docs, after all.

Original article: https://arxiv.org/pdf/2602.11917.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-02-13 08:18