Ah, the illustrious Strategy, once cloaked in the mundane garb of MicroStrategy, has pirouetted into the market with its dazzling Strike Preferred Stock (STRK), a veritable phoenix rising from the ashes of financial ennui.

In a mere fortnight, STRK has waltzed its way to the pinnacle of performance, becoming the most liquid perpetual security among its US-listed brethren since the dawn of 2022. Who knew finance could be so… thrilling?

Strategy’s STRK Trading Volume Hits Seven Times the Average as Demand Surges

On the fateful day of February 15, the ever-enthusiastic Michael Saylor, the founder of this financial marvel, regaled us with tales of STRK’s meteoric ascent.

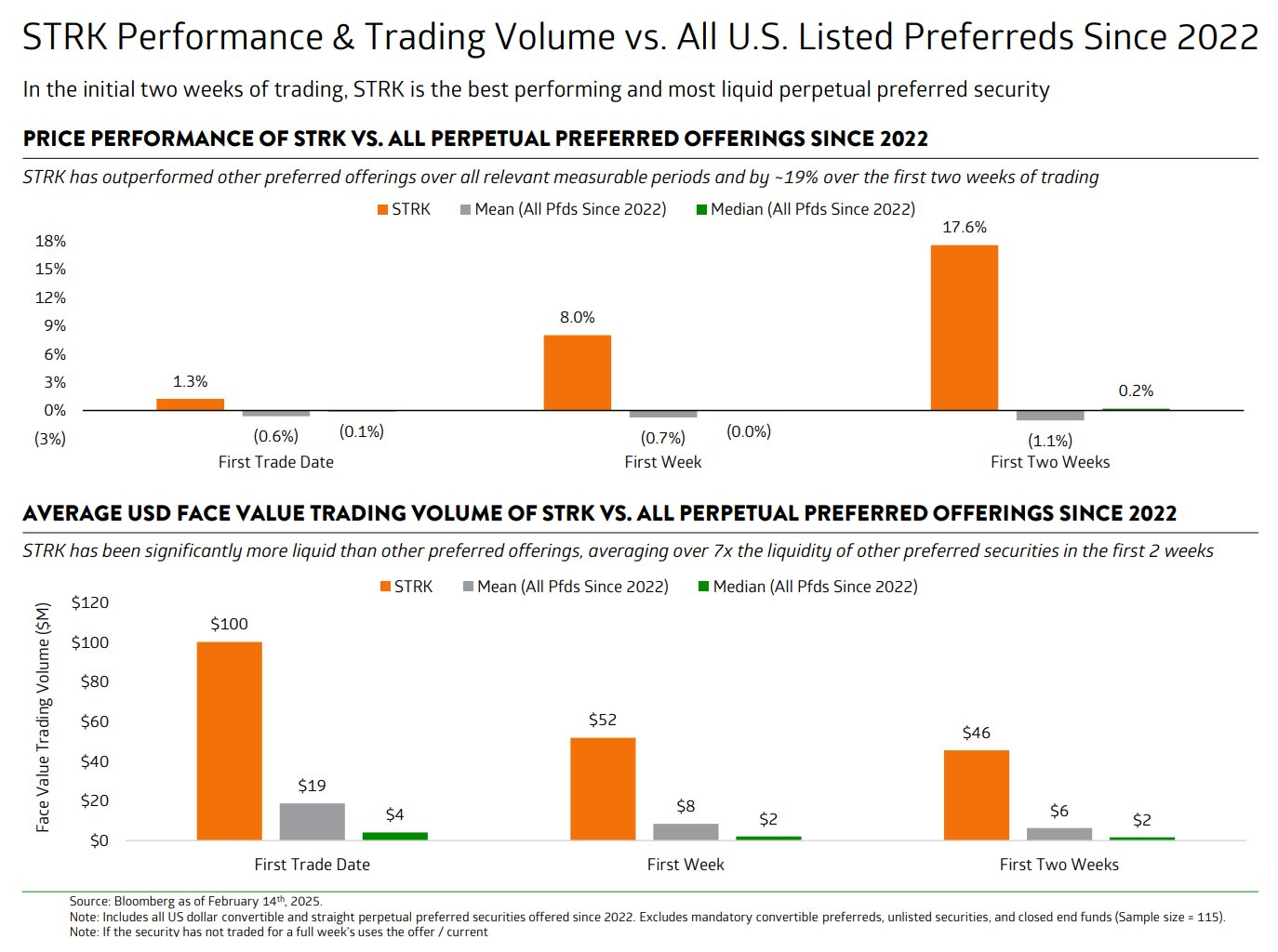

“Strategy’s first IPO in over a quarter-century has achieved record-breaking performance in its initial two weeks. Among the 115 US-listed preferreds birthed since 2022, $STRK reigns supreme in price performance, boasting a staggering 19% above the average, and in trading volume, it’s a whopping 7x the average,” Strategy proclaimed on X, as if it were a modern-day bard.

Data, that fickle mistress, reveals that the stock gained a modest 1.3% on its inaugural day and a robust 8% in its first week. By the end of the second week, it had soared to a dizzying 17.6%, leaving its competitors gasping in its wake, approximately 19% behind.

Meanwhile, STRK has showcased liquidity that would make even the most seasoned fishmonger envious, averaging seven times the trading volume of its peers. Yet, in a twist worthy of a Shakespearean drama, it initially soared to $100 on launch day, only to plummet to $52 within a week, finally settling at a rather pedestrian $48 after two weeks. Oh, the irony!

Strategy unveiled STRK on January 27, with the noble intent of raising capital for Bitcoin acquisitions. The firm triumphantly announced that the offering exceeded all expectations, securing a staggering $563.4 million—nearly triple the anticipated amount, a testament to the fervent demand of investors. Who knew they had such a taste for the dramatic?

Michael Saylor and Nayib Bukele Discuss Bitcoin

As if the plot couldn’t thicken further, STRK’s robust market performance coincided with a tête-à-tête between two of Bitcoin’s most ardent supporters—Michael Saylor and President Nayib Bukele—who convened at the presidential palace of El Salvador, no less!

On February 14, Saylor divulged that their discourse revolved around the grand ambition of expanding Bitcoin’s global dominion, with El Salvador poised to take center stage in this theatrical endeavor.

“Bukele and I had a splendid discussion about the myriad opportunities for El Salvador to capitalize on and hasten global Bitcoin adoption,” Saylor tweeted, as if he were penning the next great American novel.

Meanwhile, the crypto community buzzed with speculation about a potential relocation of Strategy’s headquarters to El Salvador, following in the footsteps of Tether. Oh, the audacity!

However, this scenario seems as likely as a snowstorm in July, given Strategy’s steadfast presence in the US, where regulatory developments are finally showing signs of improvement. A round of applause, please!

Under Bukele’s astute leadership, the nation has ascended to the ranks of the largest sovereign Bitcoin holders, while Strategy proudly maintains its title as the biggest corporate investor in BTC. A match made in financial heaven!

According to the illustrious Bitcoin Treasuries, Strategy boasts a staggering 478,740 BTC, while El Salvador’s national reserve holds a mere 6,079 BTC. The numbers speak for themselves, don’t they?

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-02-16 18:47