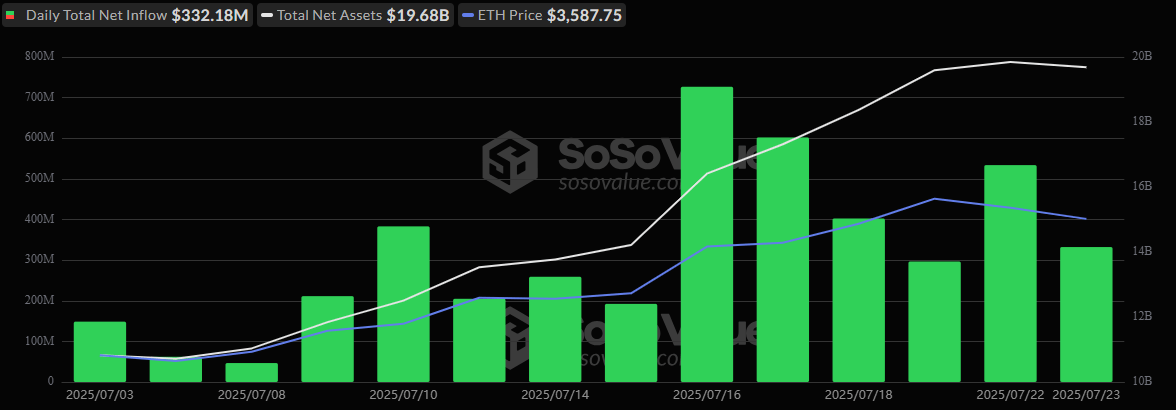

The grand ballet of Ethereum exchange-traded funds pirouettes gracefully into the spotlight, serenading the audience with a majestic inflow of $332 million, stitching together a magnificent 14-day tapestry of triumph, whilst the forlorn bitcoin ETFs waddle offstage, burdened by a sorrowful $86 million outflow.

The Crypto Chronicles: Bitcoin’s Fade and Ether’s Radiance

Ether ETFs have become the darlings of the financial soirée, embracing the limelight for a sumptuous 14th day, amassing a staggering $332.18 million, while our beleaguered friends, the bitcoin ETFs, wallow in the self-pity of their third consecutive day of outgoing funds, totaling $85.96 million. The drama unfolds!

In this whimsical arena, Blackrock’s ETHA waltzes away with a princely $324.63 million, leaving only crumbs for its smaller competitors—Vaneck’s ETHV ($3.95 million) and Fidelity’s FETH ($3.59 million). Astonishingly, no ether ETF experienced an outflow, a veritable standing ovation for investor confidence! Trading volumes soared to a dizzying $1.59 billion, puffing ether ETF net assets up to $19.68 billion like a magician’s assistant in a classic illusion.

Meanwhile, the echoes of bitcoin’s misery reverberate as Fidelity’s FBTC dons the villain’s mask, spearheading the exodus with a staggering $227.24 million outflow, accompanied by the pitiful sighs of Ark 21Shares’ ARKB at $9.84 million and Bitwise’s BITB with its meager $1.93 million departure.

Yet all is not lost! Two valiant inflows offer a glimmer of hope: Blackrock’s IBIT breaks its two-day silence with a triumphant $142.56 million, while Grayscale’s Bitcoin Mini Trust attempts to sing a soft lullaby with $10.49 million. Alas, these tender gestures cannot lift the bitcoin ETFs back into the light. Total trading activity nonetheless dazzles at $3.12 billion, with net assets wallowing at $153.25 billion.

As ETH ETFs continue to choreograph a captivating performance and BTC ETFs languish in their melancholic exit for three days, are we, dear readers, observing a seismic shift in ETF allegiance? The theater of the market may soon unravel the answer.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-07-24 16:57