In the infinite library of financial markets, the S&P 500 index (SNPINDEX: ^GSPC) offers a mere whisper of a dividend yield—1.2%, a pittance in the grand scheme. The average healthcare stock extends a slightly more generous 1.8%, yet these figures pale in comparison to the yields one might find in the labyrinthine corridors of healthcare real estate. Here lie three entities—LTC Properties (LTC), Omega Healthcare Investors (OHI), and Universal Health Realty Trust (UHT)—whose dividends shimmer like ancient treasures, beckoning the intrepid investor.

The Mirror of the Pandemic

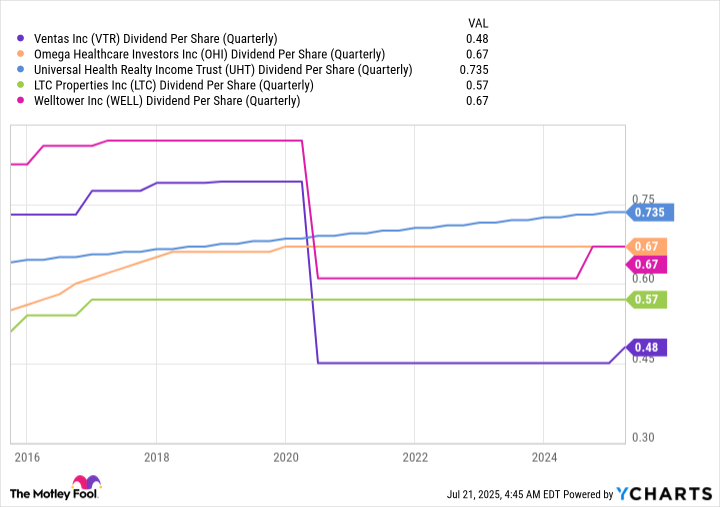

When the COVID-19 pandemic descended upon the world, it cast a shadow over nursing homes and senior housing properties, a reflection of mortality itself. The virus, a malevolent librarian, rearranged the lives of the elderly, reducing occupancy rates and accelerating deaths. Amid this chaos, some healthcare real estate investment trusts (REITs)—Ventas (NYSE: VTR) and Welltower (NYSE: WELL)—chose to lower their dividends, as though bowing to the inevitable.

Yet, two REITs stood unwavering, their dividends untouched: LTC Properties and Omega Healthcare Investors. These entities navigated the labyrinth of tenant relationships, severing ties with troubled operators and embracing new ones. LTC Properties, in particular, ventured into the realm of senior housing operating assets (SHOP), a bold move akin to entering a new wing of the financial library. The result? Dividends flowed as steadily as ink from a scholar’s pen.

The Recursive Dividend

For some investors, mere survival through the pandemic is insufficient; they seek growth, a recursive narrative of increasing returns. Enter Universal Health Realty Trust (UHT), a REIT that has, like a meticulous archivist, raised its dividend annually for 40 consecutive years. Its yield, a staggering 7.1%, is a testament to its enduring appeal. Unlike its peers, UHT focuses on medical office properties, though its largest tenant, Universal Health Services (UHS), is also its manager—a relationship as complex and layered as a Borgesian tale.

Its dividend growth, averaging 1.5% annually, is modest but steadfast, a quiet assurance amidst the cacophony of markets. For those who seek not grandeur but reliability, UHT remains a beacon.

The Library of Aging

In the end, the dividend investor’s greatest fear is a cessation of payments—a blank page where once there was a story. LTC Properties and Omega avoided this fate, navigating the brutal winds of the pandemic with grace. Today, they stand poised to benefit from the aging population, a demographic shift as inexorable as the march of time. With $500, one might acquire around 13 shares of either, or a blend of both. As for Universal Health Realty Trust, $500 yields approximately 12 shares—a modest investment in a tale of enduring dividends.

In the labyrinth of income-generating investments, these REITs are not merely stocks; they are volumes in the infinite library of finance, offering yields that whisper promises of stability and growth. 📜

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-07-28 05:56