As a seasoned analyst with over two decades of experience navigating market fluctuations, I find the recent UBS warning about a potential 15% decline in the S&P 500 within the next two months to be a cause for concern. Having witnessed several market cycles and crashes, I can attest that such bearish outlooks should never be taken lightly.

Yesterday on his YouTube channel “Meet Kevin,” finance expert Kevin Paffrath shared a cautionary statement from UBS regarding a potential 15% decrease in the S&P 500 within the next two months. This prediction, based on insights by Rebecca Cheong, a leading strategist for U.S. equity derivatives at UBS, highlights market internals being at their lowest in six years. Paffrath delved into the reasons behind this pessimistic forecast and offered advice on strategies investors could use to navigate the anticipated market turbulence.

Based on a report from Seeking Alpha, UBS analyst Rebecca Cheong stated via email on Tuesday that the current market situation has significantly worsened, making the S&P 500 potentially more susceptible to adverse effects than it has been in quite some time.

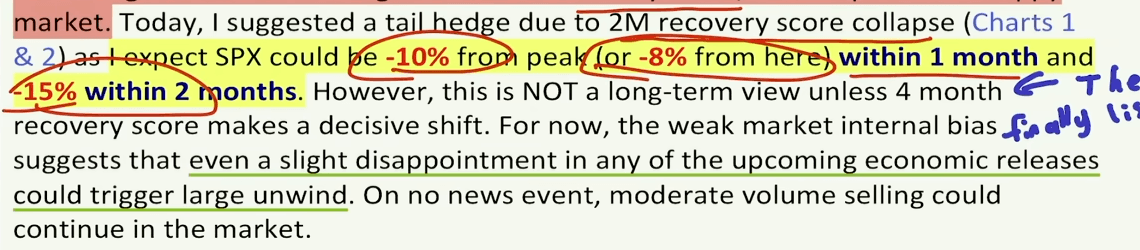

Cheong stated:

For the next two months, I’m adopting a strategic bearish stance. I anticipate that the S&P 500 might decrease by about 10% from its current peak within one month, and further drop by approximately 15% over the following month.

I’ve noticed that the internal market conditions have deteriorated to their worst state this year, which could potentially signal a significant drop in value for my crypto investments.

Cheong cautioned that a minor letdown in the forthcoming economic figures might ignite a massive reversal. She added, “In the absence of new information, substantial selling could persist within the market.

The report emphasizes that the market’s internal bias is so fragile that both external shocks and the absence of positive news could lead to significant declines in the S&P 500.

Given the expected market drop, Cheong focused on selecting particular tools to protect against a falling market: (or) Aware of the upcoming market downturn, Cheong pinpointed certain tools for safeguarding investments: (or) In view of the predicted decline, Cheong chose specific measures for shielding assets from a falling market.

- iShares Russell 2000 ETF (IWM): Chosen due to its clean short/hedge positioning after a recent short squeeze.

- Financial Select Sector SPDR ETF (XLF): Option premiums are screened as cheap, sitting in the bottom 25th percentile versus the past five years.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG): Also identified for its inexpensive option premiums, making it a suitable hedge.

Kevin mirrored the worries expressed by UBS, highlighting the vulnerable condition of the S&P 500. He delved into the details of the UBS report, focusing on these key aspects:

- Intraday Recovery Scores at Six-Year Low: The market’s ability to rebound after sell-offs has significantly diminished, increasing vulnerability to downward movements.

- Investor Sentiment Shifting: There’s a noticeable change in investor behavior, with many opting to sell the dip instead of buying it. This shift could exacerbate market declines.

- Upcoming Economic Indicators: Paffrath highlighted the importance of upcoming economic data releases, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), which could influence the market’s direction significantly.

- Political Events as Catalysts: He noted that political events, including debates and elections, could introduce additional volatility to the market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-09-11 12:16