As a researcher who has closely followed the evolution of cryptocurrency regulations, I find it refreshing to see the U.S. Treasury Department reconsider its approach and withdraw the 2020 proposal on KYC requirements for non-custodial wallets. My journey in this field began with a simple curiosity about blockchain technology, and over time, I’ve come to appreciate the unique challenges it presents to traditional regulatory frameworks.

According to an article by Nikhilesh De for CoinDesk, the U.S. Treasury Department has officially abandoned a plan from 2020 which aimed to enforce know-your-customer (KYC) rules on non-custodial cryptocurrency wallets. This decision, made on August 19, brings an end to a prolonged discussion that started in the final days of the Trump administration.

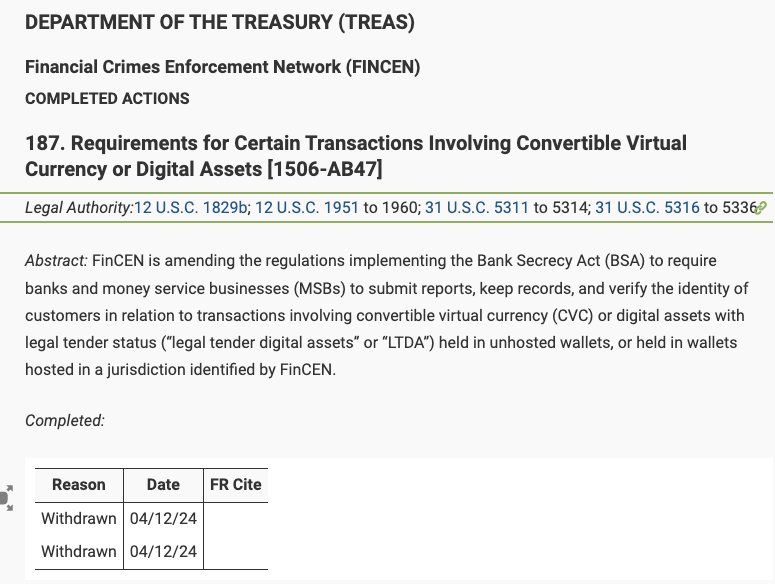

In December 2020, a new regulation was proposed by the Financial Crimes Enforcement Network (FinCEN), under Treasury Secretary Steven Mnuchin, which aimed to apply Know Your Customer (KYC) rules to personal, self-managed cryptocurrency wallets. This proposal sparked immediate and widespread criticism from the U.S. crypto industry, who argued that the rule was both technically impractical and overly vague. (Source: CoinDesk)

According to CoinDesk’s report, a multitude of comments poured in concerning the proposed regulation. These comments came from influential figures across the industry, legislators, and legal advisors. They underscored that non-custodial digital wallets do not store personal data, which can make adhering to KYC regulations challenging, if not entirely impractical. The proposal faced criticism as it seemed to contradict the inherently decentralized characteristics of blockchain technology.

According to CoinDesk, the shift to the Biden administration in January 2021 noticeably slowed down the proposal’s progress. An extended review period led to its gradual dismissal, eventually resulting in its formal withdrawal this month.

Michael Mosier, a previous head at FinCEN, shared with CoinDesk that pulling back this rule signifies an increasing understanding within the government about the importance of adjusting regulatory methods to suit contemporary technologies instead of sticking with old-fashioned systems.

As a crypto investor, I’m keeping an eye on the ongoing discussions about the Travel Rule proposal from 2020. If implemented, this rule would ask financial institutions to disclose personal information for transactions exceeding $250, which is much lower than the current threshold of $3,000. The final decision on this matter is still up in the air.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-08-24 20:02