As a seasoned crypto investor who has navigated through countless market fluctuations and witnessed the rise and fall of various industries, I must say Tuesday, November 12, 2024, was yet another day that tested our mettle. While the U.S. stocks took a downturn, it’s essential to remember that every bearish phase paves the way for a bullish comeback.

On Tuesday, November 12, 2024, U.S. stocks experienced a retreat, as all significant market indexes ended the day with losses. However, there were some positive developments in the technology sector that stood out.

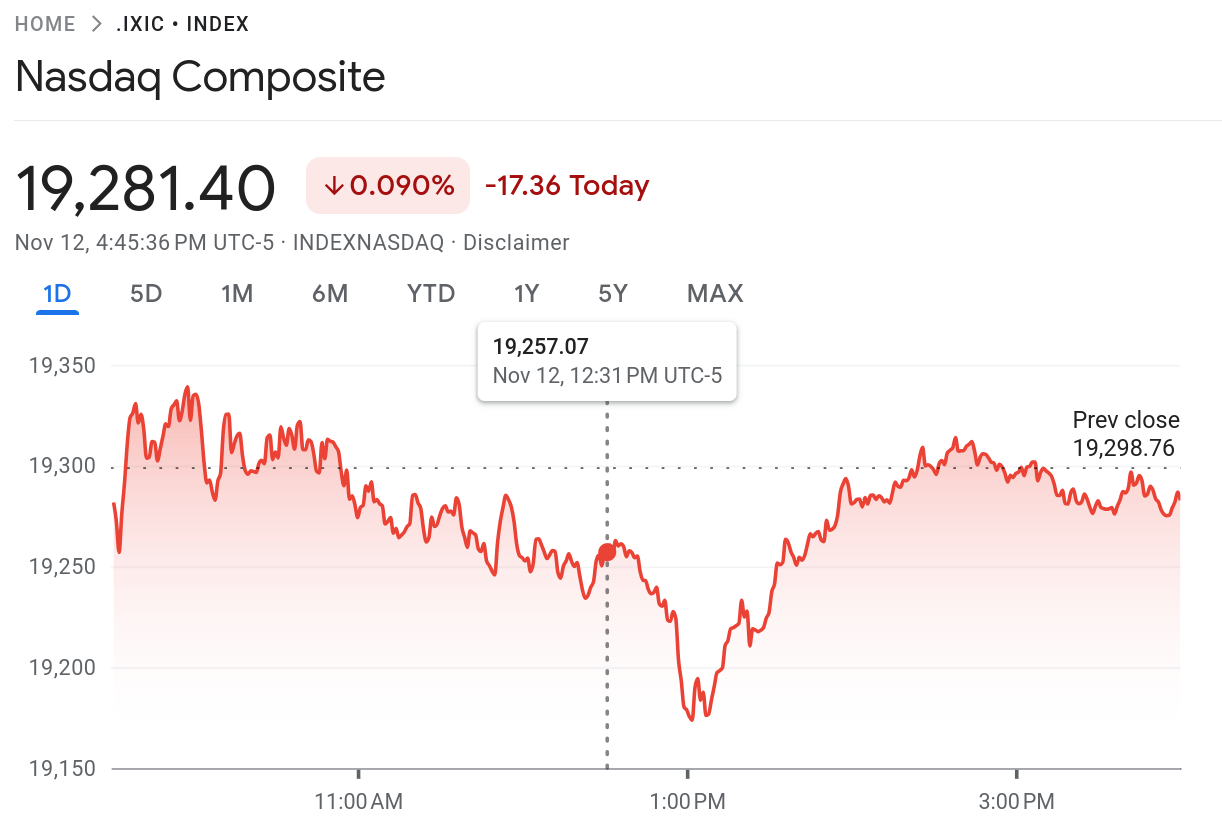

In a downward trend, the Dow Jones Industrial Average experienced the most significant drop, losing 382.15 points, equating to 0.86%. Its closing value was 43,910.98. Conversely, the S&P 500 decreased by 17.36 points, or 0.29%, ending at 5,983.99. The Nasdaq Composite, characterized as tech-heavy, demonstrated more strength, declining only 17.36 points, representing a minor 0.09% decrease, with its final value being 19,281.40.

On the Nasdaq, Amgen Inc. experienced the largest drop among individual stocks, decreasing by 7.14% to $298.84. Super Micro Computer Inc. also saw a significant decline at 6.59%, and Tesla Inc. dropped 6.15% to reach $328.49. The semiconductor sector exhibited notable weakness, with Micron Technology, Microchip Technology, and Intel all reporting losses exceeding 3%.

Nevertheless, some sectors within the market experienced positive growth, notably software and tech companies. Dexcom Inc. was a standout performer, increasing by 5.73% to reach $74.34, while Zscaler Inc. surged by 4.76%. Adobe Inc. also had an impressive day, growing by 4.35% to end at $526.42. Tech giants such as NVIDIA and Netflix demonstrated strength, with growth of 2.09% and 1.75% respectively.

During the majority of the trading period, the market exhibited a persistent decline, except for a fleeting attempt at recovery in the early part of the afternoon which didn’t last. Interestingly, the VIX, often referred to as the gauge of fear on Wall Street, decreased by 1.74%, settling at 14.71. This implies that despite the day’s drops, volatility remained relatively low.

During the majority of the trading day, there was a continuous decline in the market. However, around midday, there was an effort at recovery which unfortunately didn’t last.

Today’s market activities were cautious due to several significant economic indicators and Federal Reserve talks lined up for the rest of this week. Market participants will pay special attention to the Consumer Price Index report on Wednesday, where economists predict a 2.6% yearly increase for October. This would be the first monthly rise since March 2024 after six straight months of decreases. The Core CPI, which disregards fluctuating food and energy prices, is anticipated to reach 3.3%.

On Thursday, the ongoing discussion about inflation continues as the Producer Price Index is anticipated to reveal a 2.3% yearly increase, higher than September’s 1.8% growth. Investors will be analyzing remarks from various Federal Reserve officials throughout the week, culminating in Fed Chair Jerome Powell’s talk on the economic outlook at an event in Dallas during the afternoon. The week concludes with the publication of import and export price data on Friday, offering additional perspectives on inflation patterns.

In simpler terms, the Russell 2000 Index, which represents smaller companies, performed worse than the general market and dropped by 1.87%, ending at 2,389.42. This suggests that there’s more stress affecting these smaller businesses compared to larger ones in the market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-11-13 01:03